Shareholder activism

Activist fund nominates director candidates for KT&G

Flashlight Capital says in a shareholder letter that new perspectives are urgently needed in KT&G’s boardroom

By Jan 19, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

A Singapore-based activist fund has stepped up pressure on the world’s fifth-largest tobacco maker KT&G Corp. to reform governance and boost shareholder returns, nominating two high-profile outside director candidates.

Flashlight Capital Partners Pte. (FCP), led by former Carlyle Group Korean head Lee Sanghyun, sent its second shareholder letter to KT&G on Wednesday, outlining new proposals, ahead of a March general meeting.

FCP has just a 1% stake in the South Korean tobacco company with a market capitalization of 12.6 trillion won ($10 billion).

Describing itself as “a significant long-term shareholder of KT&G,” it has recommended Cha Suk Yong, an ex-CEO and chairman of LG H&H Co. and Hwang Ou Jin, an ex-CEO of Prudential Life Insurance’s Korean arm as new directors for the eight-member board.

Currently, KT&G's board of directors is composed of two internal members and six outside directors.

Also, it repeated proposals that KT&G spin off its wholly-owned Korea Ginseng Corp. and buy back treasury shares, as well as introduce quarterly dividends.

The Wednesday letter was submitted after KT&G announced an investor relations meeting on Jan. 26.

But it is the first time for an activist fund to nominate external director candidates for a domestic company.

ABSENCE OF CONTROLLING SHAREHOLDER

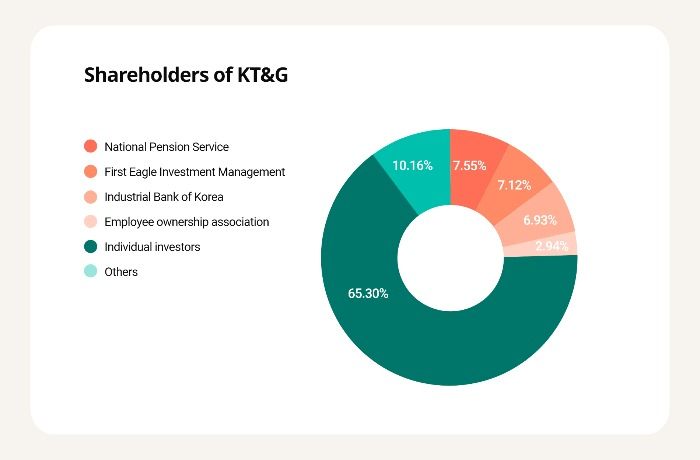

Particularly, FCP’s campaigns against KT&G were triggered by the absence of a controlling shareholder, said industry officials. About half of its outstanding shares are owned by foreign public funds.

Still, it is doubtful whether the FCP-led shareholder campaigns will shake up KT&G’s governance structure.

Its top shareholder National Pension Service (NPS) has stayed on the sidelines and tight-lipped about FCP’s proposals amid criticism that the pension scheme might increase its clout over listed companies.

The NPS holds a 7.44% stake in KT&G.

Two other institutional investors -- First Eagle Investment Management and the Industrial Bank of Korea -- hold more than a 5% stake in KT&C.

At a Jan. 26 IR meeting, KT&G is set to release dramatic shareholder-friendly measures and new growth strategies, said a KT&G official.

Under the leadership of CEO and Chairman Baek Bok-In, sales at KT&G increased to 5.2 trillion won in 2021, compared to 4.5 trillion won in 2016.

MILESTONE FOR SHAREHOLDER ACTIVISM

Industry observers said the FCP-led campaigns could become a milestone for shareholder activism for listed companies in the country.

“Lee Sanghyun has been winning over KT&G’s foreign shareholders, armed with experience built during his stints at Affinity Equity Partners and The Carlyle Group,” said an investment banking industry official.

“Given the even split between domestic and foreign shareholders of KT&G, nobody can guarantee who will be the winner if such proposals are put to a vote,” he added.

Write to Dong-Hui Park at donghuip@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Shareholder activismAnda pushes for right to copy KT&G shareholder list

Shareholder activismAnda pushes for right to copy KT&G shareholder listJan 10, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismKT&G taps top-tier law firm to defend itself against shareholder activism

Shareholder activismKT&G taps top-tier law firm to defend itself against shareholder activismNov 03, 2022 (Gmt+09:00)

2 Min read -

Shareholder activismKT&G enlists Goldman Sachs to cope with shareholder activism

Shareholder activismKT&G enlists Goldman Sachs to cope with shareholder activismNov 14, 2022 (Gmt+09:00)

1 Min read -

Shareholder activismSingapore PE firm proposes KT&G spin off ginseng biz

Shareholder activismSingapore PE firm proposes KT&G spin off ginseng bizOct 26, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN