Tech, Media & Telecom

SK Telecom joins race for Korean dental scanner maker

Korea’s leading mobile carrier aims to make inroads into healthcare sector through a deal worth as much as $2.8 bn

By Sep 30, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

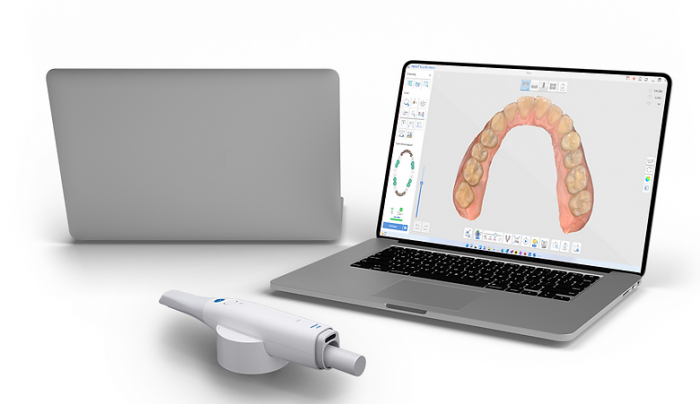

South Korea’s top mobile carrier SK Telecom Co. has joined the race to acquire Medit Corp., the world’s third-largest 3D dental scanner maker, as the telco seeks a future growth engine in the healthcare sector.

SK Telecom is proceeding with the bidding process after hiring Deutsche Bank for the deal, according to investment banking industry sources on Friday.

The Carlyle Group, a US private equity giant, has joined hands with South Korean energy-to-retail conglomerate GS Group to buy Medit, while major PE firms such as Kohlberg Kravis Roberts & Co. (KKR) and CVC Capital Partners were known to be considering bids.

SK Telecom aims to diversify its business portfolio centered on telecommunication and carve out a place in the healthcare industry, a key sector for information and communication technology through the takeover. Its business development team led by Chief Development Officer Ha Min Yong was known to work on the acquisition.

NEW GROWTH BOOSTER

The carrier has been seeking new businesses for future growth since it split into its mobile unit – SK Telecom – and investment unit SK Square Co last year. If SK Telecom buys Medit, that would mark its first major acquisition since the spin-off.

South Korea’s mid-market-focused private equity firm Unison Capital Inc., Medit’s top shareholder, has put a 100% stake in the global 3D dental clinic scanning solutions provider up for sale. Citigroup Global Markets is handling the deal.

Unison hopes to sell the company at around 4 trillion won ($2.8 billion).

Unison spent 320 billion won for its controlling stake in Medit, founded in 2000 by Korea University mechanical engineering professor Chang Minho, who has a doctorate from MIT. The founder Chang, currently the No. 2 shareholder, is not involved in the company’s management.

Medit has been growing fast as Unison has expanded its global businesses since its acquisition in 2019. Its earnings before interest, taxes, depreciation and amortization (EBITDA) nearly tripled to 103.9 billion won in 2021, from 36.7 billion won two years earlier, with sales more than doubling to 190.6 billion won from 72.2 billion won during the period.

Write to Jun-Ho Cha at chacha@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Mergers & AcquisitionsCarlyle, GS team up to buy Korean dental scanner maker

Mergers & AcquisitionsCarlyle, GS team up to buy Korean dental scanner makerAug 16, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for sale

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for saleJul 05, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN