Mergers & Acquisitions

Korea PE firms to buy FCCL maker NexFlex at $463 mn

SkyLake, NexFlex’s top shareholder, is set to exit with a profit estimated at some six times its initial investment

By Sep 02, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

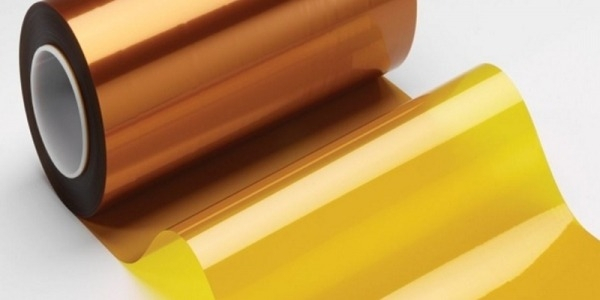

South Korean private equity firms are set to take over NexFlex Co., the country’s largest manufacturer of flexible copper-clad laminates (FCCLs) used for smartphones, for about $463 million.

SkyLake Equity Partners, NexFlex’s top shareholder headquartered in Seoul, recently signed a memorandum of understanding to sell a 100% stake in the company to a consortium of Well to Sea Investment Co. and Woori Private Equity Asset Management Co., according to investment banking sources on Friday.

They plan to ink a stock purchase agreement (SPA) next month for the deal, which was known to be at some 630 billion won ($462.6 million). Local independent advisory firm KR & Partners handled the transaction.

NexFlex is the country’s top producer of FCCLs used for flexible printed circuit boards (FPCBs), a key component for information technology devices such as smartphones by sales.

NexFlex earnings have significantly improved since SkyLake launched the company after taking over the FCCL unit of SK Innovation Co. in 2018. The FCCL maker’s operating profit surged to 45.8 billion won last year from a mere 1 billion won in 2019 with sales more than doubling to 154.7 billion won from 68.2 billion won.

SUCCESSFUL EXIT

The consortium of Well to Sea was understood to buy the company as the FCCL industry has great potential. FCCL demand for 5G mobile communication is growing while the FCCL market for existing smartphones remains strong. NexFlex predicts earnings in 2022 to nearly double from last year.

Seoul-based Well to Sea, founded in September 2014, stood out with major takeovers of management rights in domestic companies such as Aju Capital – currently Woori Financial Capital – and HSD Engine. Woori Private Equity, a subsidiary of Woori Financial Group, has been actively making investments, including recent acquisitions of three stone companies.

The consortium reportedly has almost completed fundraising for NexFlex.

Initially, JC Growth Investment (JCGI), South Korean private equity fund JC Partner Co.’s subsidiary, had been a candidate for NexFlex. But JCGI failed to secure the money for the deal.

SkyLake is set to exit from NexFlex with a huge profit in about four years as it spent about 100 billion won to buy the FCCL unit from SK Innovation.

SkyLake is currently setting up a blind fund of some 1 trillion won with a target of completion by year-end for investments in 2023.

Write to Chae-Yeon Kim at why29@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansionApr 30, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to Bunge

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to BungeApr 29, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 million

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 millionApr 28, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bank

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bankApr 24, 2025 (Gmt+09:00)

-

Comment 0

LOG IN