Batteries

LG Energy surrenders No. 2 EV battery position to BYD

Tesla suspends production in Shanghai due to COVID-19 lockdowns, hurting Korean LG Energy’s battery market share, Q2 earnings

By Jul 04, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

LG Energy was the world’s third-largest battery maker in May with its market share down to 12.5% in May from 12.8% in April, according to market tracker SNE Research on Monday. BYD’s share also skidded to 12.5% from 15.9% during the period, but the Chinese producer had marginally more than LG Energy’s share in May, SNE said without details.

BYD has been outperforming LG Energy in terms of monthly market shares since April, raising its position to No. 2 from No. 3, as Tesla’s EV deliveries tumbled 18% to 254,695 units in the second quarter from the previous three months due to the output disruption in its Shanghai plant. The factory is Tesla’s largest production complex, manufacturing both the Model 3 and the Model Y.

The global EV giant is LG Energy’s top customer, accounting for 19% of the South Korean battery maker’s total sales in 2021.

LG Energy’s earnings were estimated to have weakened in the second quarter with its operating profit seen down about 20% to low-200 billion won ($184 million) in the period from the prior three months, analysts said.

“Tesla bought most of LG Energy Solution’s cylindrical batteries, which caused a shortage of those batteries in the market. But the supply line has been broken (by Tesla’s production disruption in China),” said an industry source about LG Energy’s poor performance.

The source, however, expected an improvement in the third quarter as Tesla is ramping up output in the world’s largest EV market, the source said.

Meanwhile, China’s Contemporary Amperex Technology Co. Ltd. (CATL), the world’s top battery maker, kept its throne in May, raising its market share to 33.9% from 29.6% in April.

Other major South Korean battery makers – SK On Co. and Samsung SDI Co. – ranked No. 5 and No. 6, respectively, with a market share of 6.6% and 5.1%.

Write to Hyung-Kyu Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

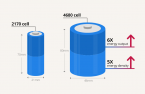

BatteriesLG Energy to invest $451 mn in mass production of Tesla’s 4680 battery cells

BatteriesLG Energy to invest $451 mn in mass production of Tesla’s 4680 battery cellsJun 13, 2022 (Gmt+09:00)

3 Min read -

EarningsLG Energy Q1 profit beats forecast on strong demand, price hikes

EarningsLG Energy Q1 profit beats forecast on strong demand, price hikesApr 07, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN