Economy

Korea sees record H1 trade deficit, weak consumer sentiment

Trade conditions are unlikely to improve in H2 on global recession risks, sustained supply chain disruption

By Jul 01, 2022 (Gmt+09:00)

5

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

S.Korea's LS Materials set to boost earnings ahead of IPO process

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

South Korea suffered the largest trade deficit for the first half of a year on surging energy prices and slowing exports, while consumer sentiment in AsiaŌĆÖs fourth-largest economy weakened on rampant inflation. The dismal economic picture caused expectations that the central bank may take a cautious stance on interest rate hikes.

The country reported a trade shortfall of $10.3 billion in the first half of 2022, the largest deficit for the January-June period, since 1956 when the government started compiling such data, according to the Ministry of Trade, Industry and Energy on Friday.

Imports jumped 26.2% to $360.6 billion in the first six months from a year earlier although exports rose 15.6% to $350.3 billion, the largest for a half-year period.

ŌĆ£Our trade is in a serious situation as uncertainties are growing with a series of deficits, a slowing global economy and deepening supply chain instability,ŌĆØ said Trade, Industry and Energy Minister Lee Chang-yang.

The country is unlikely to improve the trade balance as exports are expected to slow down, given the risk of an economic recession around the world and the sustained supply chain disruption, industry sources and analysts said. Exports in June rose 5.4% on-year, marking the first single-digit growth in 16 months.

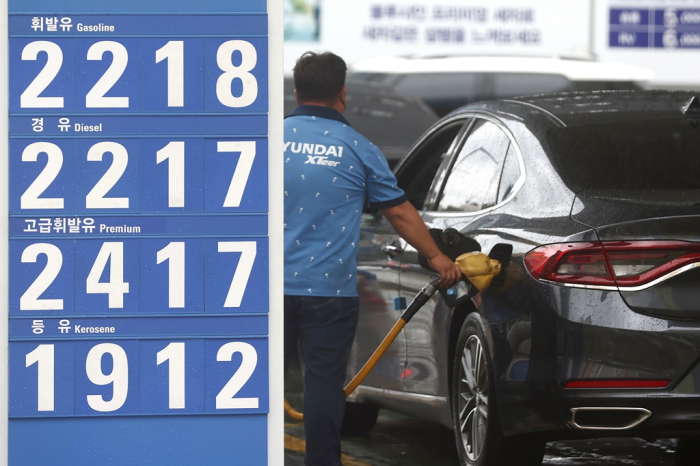

SURGING ENERGY, COMMODITY IMPORTS

RussiaŌĆÖs invasion of Ukraine, poor weather conditions and the global supply disruptions all lifted South KoreaŌĆÖs imports.

Purchases of three major energy sources ŌĆō oil, natural gas and coal ŌĆō soared 87.5% to $87.9 billion in the first half from a year earlier. Imports of non-ferrous metals and agricultural products jumped 30.2% and 19.3%, respectively, to $12.7 billion and $13.5 billion.

Such higher imports dwarfed strong exports of key products. Overseas sales of semiconductors rose 20.8% to $69 billion in the first half on-year, while shipments of petroleum products and petrochemicals surged 89.3% and 16%, respectively, to $30.4 billion and $30.1 billion.

Few expected to maintain such growth in the second half.

Exports were forecast to edge up only 0.5% in the second half, according to a recent survey of 150 companies in the countryŌĆÖs key 12 export industries including the semiconductor, automobile and petrochemical sectors by the Federation of Korean Industries (FKI), a business lobby group.

Among the poll participants, 44% of the companies predicted overseas sales to fall in the July-December period from a year earlier due to weakening export competitiveness on surging commodity prices and rising logistics costs.

Exports of electric and electronics, steel, petrochemicals and refined oil products were expected to decline by 1.1-3.8%, according to the survey.

Concerns over a global recession are also growing as major economies such as Japan, France and Italy are suffering from continuous trade deficits.

South Korea plans to help local companies improve export competitiveness as the external conditions are unlikely to improve soon.

ŌĆ£Most difficulties of exporters are external factors that are not easy to improve in the near term. Export conditions are expected to stay tough in the second half,ŌĆØ said Finance Minister Choo Kyung-ho. ŌĆ£We will try to resolve key difficulties and expand support for tasks highly requested.ŌĆØ

WEAKENING CONSUMER SENTIMENT

A potential slowdown in domestic demand is another headache. Consumer sentiment turned pessimistic about overall economic conditions in June for the first time in 16 months although their inflation expectations hit a decade high, a central bank poll showed earlier this week.

The consumer sentiment index (CSI) dropped to 96.4 in June from 102.6 in May, according to the Bank of Korea's survey of consumers released on June 29. The index fell below the 100-mark, a threshold between optimism and pessimism, for the first time since February 2021. On the other hand, consumers' inflation expectations for the next 12 months rose to 3.9% from 3.3% the previous month, hitting the highest since April 2012.

The BOK expected private consumption to lead growth, helping the economy weather slower exports. In May, the central bank upgraded its private consumption growth forecast to 3.7% from the previous 3.5%, citing a post-COVID-19 shopping spree.

But doubts grew over the optimism as surging inflation. Nominal consumption increased 2.3% in the first quarter from a year earlier, but real consumption which reflects inflation contracted by 1.4%.

ŌĆ£A recovery in consumption is expected to be delayed by a weaker purchasing power on high inflation rather than revenge shopping on improved quarantine conditions,ŌĆØ said Joo Won, a senior economist at Hyundai Research Institute, referring to a post-lockdown against COVID-19 rush to purchase luxury or durable goods. ŌĆ£Consumption is likely to weaken unless inflation stabilizes.ŌĆØ

The central bankŌĆÖs aggressive interest rate hikes are also hurting private consumption. A hike in the BOK policy rate by 25 basis points will increase borrowing costs by 161,000 won per person a year, according to the monetary authority.

The Bank of Korea may raise the base interest rate by 50 basis points for the first time at its monetary policy meeting on July 13, analysts said. But some expressed a different view.

ŌĆ£Household debt problems have become more serious during the pandemic period,ŌĆØ said Jung Yong-taek, head of research at IBK Investment & Securities Co. ŌĆ£Higher interest rates will hurt the vulnerable more, which would come as a pressure on the monetary authority.ŌĆØ

Write to So-Hyeon Kim and Mi-Hyun Jo at alpha@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBOK may take big-step rate hike on Fed's aggressive tightening

Central bankBOK may take big-step rate hike on Fed's aggressive tighteningJun 16, 2022 (Gmt+09:00)

3 Min read -

Central bankBOK steps up inflation fight with back-to-back rate hikes

Central bankBOK steps up inflation fight with back-to-back rate hikesMay 26, 2022 (Gmt+09:00)

2 Min read -

Raw materialsVolatile raw material prices put Korea on alert for procurement

Raw materialsVolatile raw material prices put Korea on alert for procurementAug 25, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN