Doosan adds chip post-processing to list of growth drivers

Doosan plans to invest 1 trillion won in the semiconductor business over the next five years

By Jun 15, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

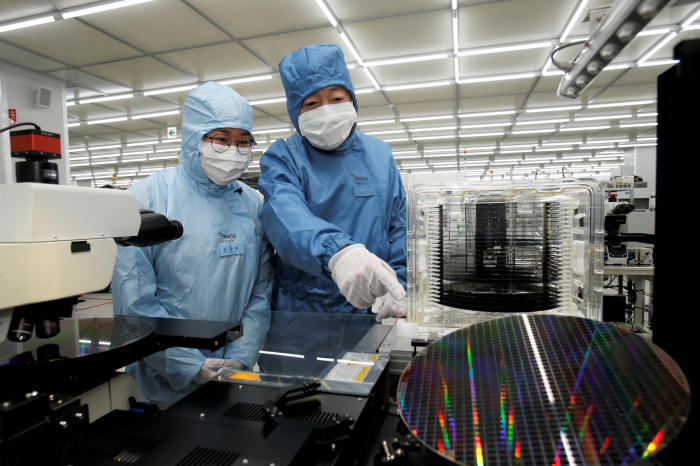

Doosan Group has added semiconductor post-processing services to its core businesses and plans to invest 1 trillion won ($774 million) in its microchip business over the next five years, the South Korean business group said on Wednesday.

Doosan ventured into the semiconductor sector after acquiring the country's largest chip testing company Tesna, now renamed as Doosan Tesna, for 460 billion won last year.

“Semiconductors will become Doosan's new growth pillar, in addition to our core businesses of energy and machinery,” Doosan Group Chairman Park Jung-won said during a visit to Doosan Tesna's plant in Anseong, 70 km south of Seoul, according to Doosan Group on Wednesday.

“We will spare no expense to nurture Doosan Tesna into the top domestic player in the system-on-a-chip (SoC) market and one of the world’s top five companies in the semiconductor testing field within five years."

Doosan Tesna performs testing of the electrical power, temperature and functions of unprocessed silicon wafers, on which circuit patterns have not yet been drawn.

In particular, it provides SoC testing services such as application processors, camera image sensors and radio frequencies, after their design and manufacturing processes are completed.

Samsung Electronics Co. and SK Hynix Inc., the world's two largest memory chipmakers, are its main clients.

The 1 trillion won investment is aimed at keeping pace with the development of sophisticated chips for use in smartphones and autonomous vehicles.

Of this amount, the group will spend 124 billion won to buy new testing equipment and additional money to build a new semiconductor testing plant by the end of 2024.

The planned spending is part of the conglomerate's five-year investment plan of 5 trillion won ($4 billion) announced last month. At the time, the group said this chunk of the spending will go toward next-generation energy sectors such as small module reactors (SMRs), gas turbines, hydrogen turbines and hydrogen fuel cells.

"No South Korean company has joined the world's top 10 list in the post-processing service market yet," said a Doosan Group official.

"To become a global post-processing service company, we are looking to advance into the (semiconductor) testing equipment and packaging market as well."

The investment is expected to help the group's sales grow by an annual average of about 20%, according to the group.

Last year, Doosan Tesna's operating profit came in at 54 billion won on sales of 207.6 billion won.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Yeonhee Kim edited this article.

-

Corporate investmentDoosan to ramp up small nuclear reactor investment

Corporate investmentDoosan to ramp up small nuclear reactor investmentMay 25, 2022 (Gmt+09:00)

2 Min read -

CompaniesDoosan Enerbility turns around with reform, new orders

CompaniesDoosan Enerbility turns around with reform, new ordersMay 06, 2022 (Gmt+09:00)

2 Min read -

Joint venturesDoosan to build Saudi Arabia's largest steel casting plant

Joint venturesDoosan to build Saudi Arabia's largest steel casting plantJan 20, 2022 (Gmt+09:00)

1 Min read