Korean chipmakers

Samsung, SK Hynix scramble for talent amid a lack government support

The two are aiming to foster high-quality semiconductor manpower at SNU, KoreaŌĆÖs top university, in their race to stay ahead

By May 06, 2022 (Gmt+09:00)

6

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

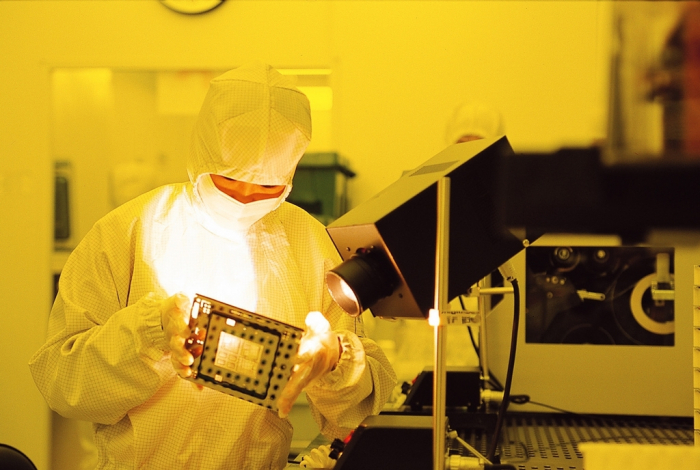

Samsung Electronics Co. and SK Hynix Inc., the worldŌĆÖs top memory chipmakers, are scrambling for semiconductor manpower in South Korea as the government is seen to provide insufficient support despite a high-quality labor force shortage amid the global war to dominate the industry.┬Ā

The South Korean tech giants are competing to set up a temporary department to train their own advanced manpower at Seoul National University (SNU), the countryŌĆÖs top college, according to local semiconductor industry sources.

Samsung has asked the alma mater of Hwang Chang-gyu, a legend within South KoreaŌĆÖs semiconductor industry, to establish the department for 80 students next year. Hwang played a key role in developing Samsung into the worldŌĆÖs No. 1 memory chip maker as the companyŌĆÖs president from 2004 to 2008.

The company pledged to hire graduates from the department while providing scholarships and aid, including tuition and living expenses.

SK Hynix, the worldŌĆÖs No. 2 memory chip producer, also reportedly requested SNU to jointly run such a program, which is usually operated for five years under an exclusive contract between a university and a company.

This comes as the local semiconductor industry suffers from a lack of skilled manpower without sufficient support from the government when global competitors are boosting their muscle backed by aid from their governments and more.┬Ā

The industry including chipmakers and labs needs about 1,500 new professionals every year, but the sector gets only some 650 fresh graduates from semiconductor-related departments at local universities, according to the Ministry of Trade, Industry and Energy.

ŌĆ£The government has only paid lip service to fostering manpower in the semiconductor sector. So, companies had no choice but to make their own efforts,ŌĆØ said a senior executive in the industry.

CUT-THROAT COMPETITION AROUND THE WORLD

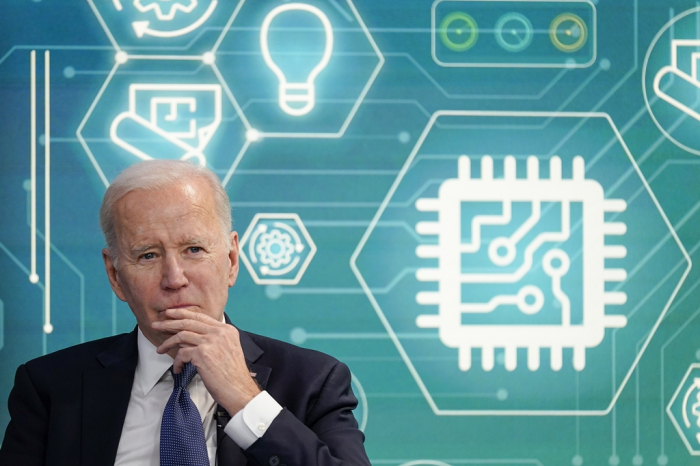

Countries around the world have committed to pouring tens of billions of dollars into nurturing their own semiconductor industries.

The US has announced a plan to invest $52 billion in enhancing the sectorŌĆÖs competitiveness by spending $13.7 billion on talent development including scholarships for students majoring in related studies, according to media reports.

Europe aims to produce 20% of semiconductors for the global market by 2030 based on cooperation between top colleges and companies in the region.

China is rushing to establish semiconductor-related programs at universities and research centers to deal with US sanctions against the mainlandŌĆÖs chipmakers. China is expected to suffer a shortage of more than 600,000 professionals in the semiconductor and related industries this year. The country may absorb high-quality talent from South Korea and Taiwan, its neighboring semiconductor powerhouses, if it fails to fill the gap.

Taiwan, home to the worldŌĆÖs top foundry maker Taiwan Semiconductor Manufacturing Co. (TSMC), is trying to protect and nurture manpower for the semiconductor sector, its core strategic industry, under the leadership of President Tsai Ing-wen. It is working on a program to train talented people from other countries, which do not have the semiconductor industry, in Taiwan to develop the sectorŌĆÖs experts.

On the other hand, South Korea has continued to ban universities in Seoul and surrounding areas from increasing the number of students in semiconductor-related departments.

Colleges in the Seoul Metropolitan Area are prohibited from raising the number of students for any major as they are classified as ŌĆ£facilities of population concentration,ŌĆØ according to the law. The countryŌĆÖs semiconductor industry has been asking the government to relax the rule only for the sector to foster high-quality talent.

The outgoing President Moon Jae-in administration, however, refused the request as it was against the policy of balanced development of the country. That stoked complaints that the government did not care about the industry when competitors bolstered the foundation of the sector by securing semiconductor manpower as a key task.

The incoming government included a review of the issue of the number of students for semiconductor-related majors in its key tasks, but the industry is urging to allow the increase as soon as possible.

ŌĆ£We may lose the semiconductor powerhouse status unless the government comes up with measures to foster and secure a talented labor force,ŌĆØ said an industry source.

TEMPORARY MEASURES

South KoreaŌĆÖs semiconductor industries took steps to ease the manpower shortage that is expected to deteriorate on increasing global capital expenditures (capex).

Samsung and SK Hynix aim to develop and obtain about 1,160 professionals in five years by operating temporary departments at leading universities in South Korea, according to industry sources. About 400 high-quality talent from the planned program at SNU are expected to provide short-term relief to ease the manpower shortage, according to the sources.

ŌĆ£Students at the temporary semiconductor department will build expertise through curriculums and field projects, in which companies participate,ŌĆØ said one of the sources. ŌĆ£In four to five years, many of them will secure the competitiveness to work in the field immediately after graduation.ŌĆØ

Samsung and SK Hynix currently operate such courses at seven local leading universities. Samsung fostered semiconductor manpower at Sungkyunkwan University and Yonsei University in Seoul, as well as Korea Advanced Institute of Science and Technology (KAIST) and Pohang University of Science and Technology (POSTECH). SK Hynix has similar programs at Korea University, Sogang University and Hanyang University.

But they are not enough to deal with the sectorŌĆÖs manpower shortage in the longer term. Samsung and SK Hynix are persuading SNU professors and students to set up a program to train professionals. Samsung last year made an unofficial proposal to the school for the temporary department, but it was refused as professors and students said the school should be an academic place, not a training place for technical professionals.

MANPOWER SHORTAGE WORSENING

The semiconductor industryŌĆÖs manpower shortage is expected to deteriorate further as major players such as Samsung, Intel Corp. and TSMC are ramping up their production facilities.

The sector in the US is estimated to need up to 90,000 more high-quality talent by 2025, given the industryŌĆÖs current capex expansions.

Samsung and SK Hynix are on the same track. Samsung is scheduled to complete its third plant in Pyeongtaek, about 70 kilometers south of Seoul, in which it invested some 30 trillion won ($24 billion), in the second half. The company is also set to break ground for a $17 billion chipmaking plant in Taylor, Texas, in the first half.

SK Hynix aims to build a semiconductor complex in South Korea with an investment of 120 trillion won this year.

Write to Ji-Eun Jeong at jeong@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

The KED ViewCan Samsung Electronics ever catch up to foundry leader TSMC?

The KED ViewCan Samsung Electronics ever catch up to foundry leader TSMC?May 03, 2022 (Gmt+09:00)

4 Min read -

Samsung GroupJay Y. Lee absence raises risks for Samsung chip biz

Samsung GroupJay Y. Lee absence raises risks for Samsung chip bizApr 24, 2022 (Gmt+09:00)

6 Min read -

Korean chipmakersSamsungŌĆÖs $17 billion new chip plant in Taylor aims to rein in TSMC

Korean chipmakersSamsungŌĆÖs $17 billion new chip plant in Taylor aims to rein in TSMCNov 24, 2021 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix-led $101 bn Korean chip project delayed again

Korean chipmakersSK Hynix-led $101 bn Korean chip project delayed againSep 22, 2021 (Gmt+09:00)

6 Min read

Comment 0

LOG IN