Korean startups

Startup accelerator Klim Ventures secures $4 mn in bridge capital

Dunamu & Partners and NEXON Korea participated in the funding round

By Apr 26, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Bridge capital is temporary funding that helps a business cover its costs until it can get permanent capital from investors or lenders.

Dunamu & Partners and NEXON Korea participated in the funding round.

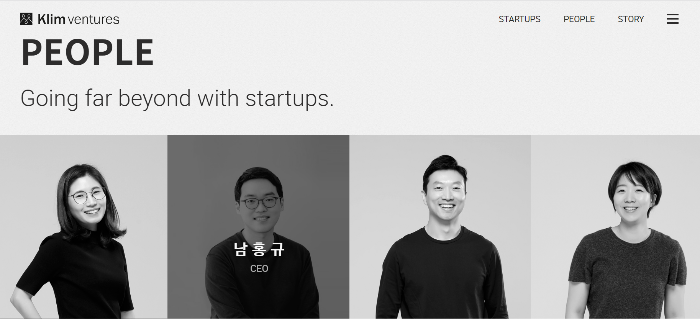

Klim Ventures' mission is to create a “healthy society.” The co-founders cut their teeth in startup and venture capital firms and founded Klim in 2020 with a focus on early stage startups.

The co-founders’ philosophy is that building trust with entrepreneurs at the early stages leads to exponential growth in the invested startups’ growth curve. In other words, they are in it for the long haul.

Klim also invests mostly with its own funding to win the trust of startup founders.

The accelerator has invested more than 30 billion won in artificial intelligence and robotics, digital healthcare and e-commerce.

It also operates Klim Park, a space dedicated to the startups it invests in, and established an ESG advisory committee to help them incorporate ESG principles into their long-term visions. On Nov. 2 last year, Klim appointed former CEO of Naver Kim Sang-hun as the chair of its ESG advisory committee, in addition to a seat on the board of directors.

Klim’s chief executive officer Nam Hong-gyu said he is excited to assist in entrepreneurs’ journeys and promised to grow as a company alongside the startups it funds.

Write to Jong Woo Kim at jongwoo@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

Venture capitalS.Korean accelerators FuturePlay and Bluepoint Partners rev up for IPOs

Venture capitalS.Korean accelerators FuturePlay and Bluepoint Partners rev up for IPOsApr 25, 2022 (Gmt+09:00)

2 Min read -

Korean startupsOnline education startup Day 1 Co. completes $28 mn Series D funding

Korean startupsOnline education startup Day 1 Co. completes $28 mn Series D fundingApr 22, 2022 (Gmt+09:00)

2 Min read -

Korean startupsTop-ranking S.Korean universities become hotbeds for promising startups

Korean startupsTop-ranking S.Korean universities become hotbeds for promising startupsApr 21, 2022 (Gmt+09:00)

3 Min read -

Venture capitalKDB resumes global venture IR event in Singapore

Venture capitalKDB resumes global venture IR event in SingaporeApr 21, 2022 (Gmt+09:00)

2 Min read -

Korean startupsFortune-telling app receives $4 mn in Altos Ventures-led Series A funding

Korean startupsFortune-telling app receives $4 mn in Altos Ventures-led Series A fundingApr 19, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN