Batteries

Korea’s battery trio cornered by Chinese rivals’ overseas advance

Chinese firms’ growing dominance is eroding Korean players’ price competitiveness and their market shares

By Apr 04, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

China’s leading battery makers are actively advancing into overseas markets with plans to build manufacturing factories close to their clients, setting off alarm bells for South Korean rivals.

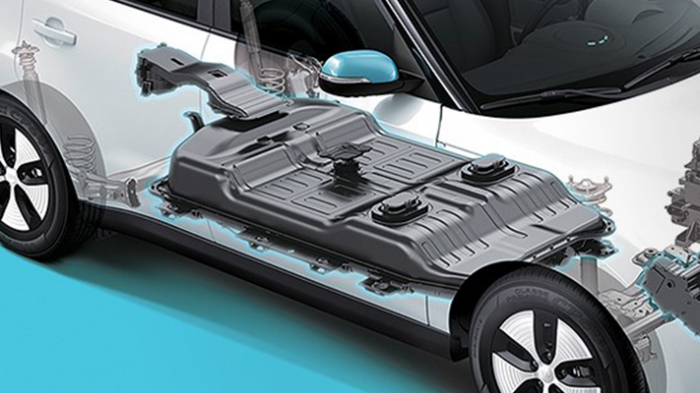

Korea’s Big Three – LG Energy Solution Ltd., SK On Co. and Samsung SDI Co. – are also cornered by the increasing adoption worldwide of lithium iron phosphate (LFP) batteries, which are lower in energy density but cheaper to make compared to other types such as nickel-cobalt-manganese (NCM) batteries. LFP batteries are also more stable, meaning less vulnerable to fire.

Chinese battery makers are mainly producing LFP batterie as such a type is becoming a global standard for entry-level electric vehicles, while Korean battery players focus on NCM batteries with higher energy density and so more profitable.

With the rising battery raw material prices, however, Korea’s NCM products are rapidly losing price competitiveness versus China’s LFP batteries.

SLIDING MARKET SHARE

According to market tracker SNE Research, China’s Contemporary Amperex Technology Co. Ltd. (CATL), the world’s top battery maker, saw its market share rise to 34.4% in the first two months of the year, from 27.5% in the same period a year earlier.

Korea’s LG Energy, the world’s second-largest battery maker, reported that its market share dropped to 13.8% from 20.7% over the same period.

LG is closely followed by China’s BYD, which said its market share rose significantly to 11.9% from 6.9%.

SK On’s market share increased to 6.5% from 5.4%, but its ranking fell by one notch to fifth, while Samsung SDI’s share fell to 3.8% from 6% to rank seventh.

The Korean battery makers’ weakening global presence coincides with automakers’ increasing adoption of LFP batteries in their new EVs, particularly in the low-end models.

In October of last year, Tesla Inc., the world’s top EV maker, said it is installing LFP batteries in all of its standard-range EVs. Other global automakers followed suit with Volkswagen AG and Daimler AG announcing that they will use LFP cells for their entry-level EVs from 2023 and 2024, respectively.

LFP batteries are about 20% lower than NCM batteries in costs and their price fluctuations are less volatile, prompting electric vehicle makers to favor LFP batteries for cheap models.

In addition to rising raw material prices such as lithium and nickel, Korean battery companies are also under pressure as carmakers are still suffering from an automotive chip shortage, which slows car production.

According to market researcher FnGuide, LG Energy Solution is forecast to post 161.1 billion won ($132 million) in first-quarter operating profit, down sharply from 341.2 billion in the year-earlier period.

SK On, spun off from SK Innovation Co., is expected to post an operating loss in the 100 billion won range, while Samsung SDI’s operating profit is projected to more than double to 288.4 billion won.

CHINA BENT ON NEW FACTORIES OVERSEAS

In recent months, Chinese companies are announcing plans to build battery factories in countries where their major clients operate car manufacturing facilities to cut logistics costs and better meet customer requirements.

China’s Eve Energy Co., which counts a number of major European auto manufacturers such as Daimler, BMW and Jaguar Land Rover among its clients, said last week it plans to construct an EV battery factory in Hungary to make cylindrical batteries.

Eve Energy is one of the battery makers that clinched a deal worth a combined 8 billion euros from BMW last year.

No timeline for the construction of the battery plant is announced, but once completed, Eve will compete with Korea’s Samsung SDI and SK On, which already operate battery facilities in Hungary.

Gotion High-Tech Co., Volkswagen’s Chinese battery partner, last year acquired Robert Bosch’s plant in Germany to build its overseas battery manufacturing facility. Gotion also plans to build a plant in North America.

Industry leader CATL has said it will complete the construction of its German battery plant by the end of this year to secure an annual production capacity of 100 gigawatt hours (GWh) by 2025.

It is also building a $5 billion 80 GWh battery plant in North America.

NEW TECHNOLOGY

China is fostering the LFP battery industry, providing subsidies to its battery makers for technology development and raw material procurement.

CATL said last week that the third-generation cell-to-pack technology it recently developed produces more power than the latest Tesla battery technology.

Cell-to-pack refers to the direct integration of cells into a battery pack, without the modules used in most current pack designs. CATL said its new cell-to-pack battery, known internally as the Qilin Battery, can deliver 13% more power than the 4680-format cells Tesla is shifting to.

Write to Hyung-kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in Canada

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in CanadaMar 24, 2022 (Gmt+09:00)

4 Min read -

BatteriesLG Energy considers billion-dollar battery plant in Arizona

BatteriesLG Energy considers billion-dollar battery plant in ArizonaMar 22, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG, SK, Samsung unveil next-generation battery roadmaps at InterBattery

BatteriesLG, SK, Samsung unveil next-generation battery roadmaps at InterBatteryMar 17, 2022 (Gmt+09:00)

3 Min read -

-

EV BatteriesTesla’s shift to LFP cells to shake global battery industry

EV BatteriesTesla’s shift to LFP cells to shake global battery industryOct 22, 2021 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN