Corporate investment

Hyosung to expand carbon fiber production for hydrogen tanks

Korea’s only high-intensity carbon fiber maker aims to control a tenth of the global market by 2028

By Mar 03, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

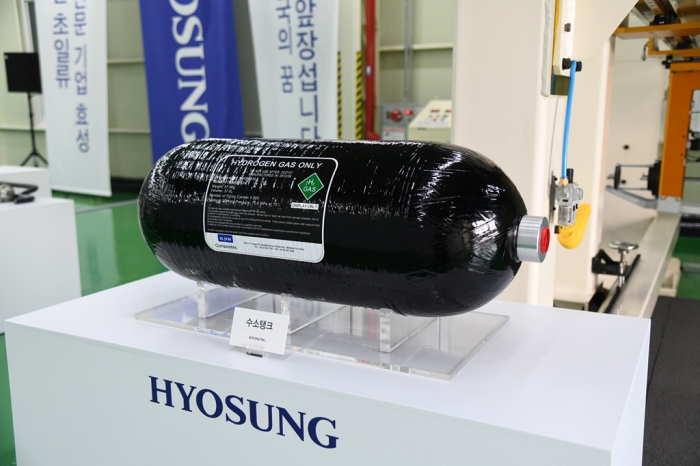

South Korea’s Hyosung Advanced Materials Corp. is expanding its carbon fiber production by adding a third line to meet the growing demand for the material used to make hydrogen tank cylinders.

The carbon fiber manufacturing unit of Hyosung Group said on Wednesday it will invest 46.9 billion won ($39 million) to expand its annual production capacity at its main plant in Jeonju by 2,500 tons to 9,000 tons.

The company already expanded its Jeonju plant capacity in 2020 and 2021.

Hyosung is the only Korean company that can produce high-intensity, high-strain carbon fiber used for industrial applications, including compressed natural gas (CNG) fuel tanks and hydrogen tanks in vehicles.

The company developed its first carbon fiber product called TANSOME in 2011 and started mass production in 2013.

Hyosung said earlier it will spend up to 1 trillion won to increase its annual carbon fiber production capacity to 24,000 tons by 2028.

Once the planned capacity expansion is completed by 2028, the company will become the world’s third-largest carbon fiber maker, controlling about a tenth of the global market, it said.

SHARES RISE

Shares of Hyosung Advanced Materials finished 4.6% higher at 510,000 won on Thursday, outperforming the broader market’s 1.6% rise. Over the past month, Hyosung has advanced 17.5% on expectations that hydrogen will become an economically viable source of alternative energy when oil prices surge.

According to stock market tracker FnGuide, the market consensus for Hyosung’s stock is 826,000 won, meaning more room for a further 62% increase from the current level.

The company’s 12-month forward price-earnings ratio (PER) is 8.5, lower than a multiple of 9.4 three months ago.

“Hydrogen-related stocks will get a boost if politicians resume discussions on revising the hydrogen promotion act following the presidential election next week,” said eBest Investment & Securities analyst Anna Lee.

Write to Jung-hwan Hwang at jung@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Hydrogen economyHyosung goes greener with $836 million green hydrogen project

Hydrogen economyHyosung goes greener with $836 million green hydrogen projectJan 24, 2022 (Gmt+09:00)

2 Min read -

Hydrogen economyShares of Hyosung, Kolon Industries fly high propelled by hydrogen

Hydrogen economyShares of Hyosung, Kolon Industries fly high propelled by hydrogenSep 24, 2021 (Gmt+09:00)

2 Min read -

Leadership & ManagementHyosung Group Chairman Cho seeks growth opportunities in US market

Leadership & ManagementHyosung Group Chairman Cho seeks growth opportunities in US marketSep 13, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN