War in Ukraine

Ukraine crisis haunts global stocks; oil prices surge

Few expect stocks to rebound in near term as rising oil prices will further accelerate inflation

By Feb 22, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Global stock markets tumbled and oil prices hit their highest levels since 2014 on Tuesday as Russian President Vladimir Putin ordered troops into breakaway regions of eastern Ukraine, increasing the risk of war. The news also heightened tensions between the US and Russia, the world’s top two military powerhouses.

Stock markets are expected to stay under pressure for the time being even without full-fledged military conflict as crude prices jumped to near the $100 a barrel level, boosting inflationary pressure, analysts said.

ASIA, EUROPE BRUISED

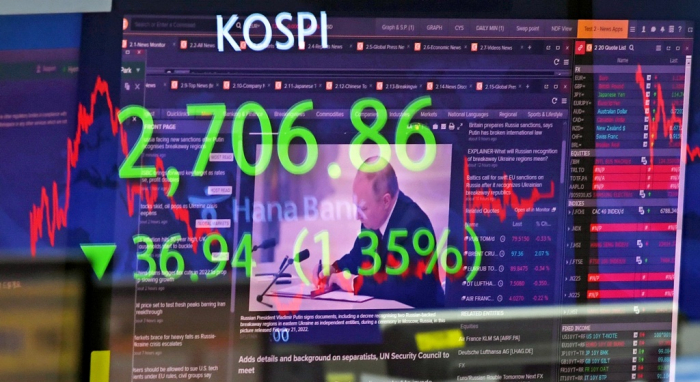

South Korea’s main Kospi fell 1.35% to close at 2,706.79 after touching a one-week low of 2,690.09 with its market capitalization losing 29 trillion won ($24.3 billion). The junior Kosdaq declined by 1.83%.

Most large caps lost ground with Samsung Electronics Co. and LG Energy Solution Ltd. down 1.08% and 2.87%, respectively. SK Hynix Inc. skidded 1.15%.

Other Asian stock markets slid too. Hong Kong’s Hang Seng index tumbled 2.82%, while Japan’s Nikkei index and China’s benchmark Shanghai Composite Index declined 1.71% and 0.96 %, respectively.

European shares, especially Russian stocks, tumbled overnight. Russia’s MOEX equity index nosedived 10.5%, the largest loss since 2014 when the country seized Crimea from Ukraine. The Stoxx Europe 600 index fell 1.3%. The German DAX 30 index and the French CAC 40 index tumbled 2.07% and 2.04%, respectively.

The Russian ruble tanked 3% to its weakest point since November 2021 while Ukraine’s hryvnia currency softened 1%.

US markets were closed on Monday to mark the Presidents’ Day holiday there. But stock futures reflected increasing geopolitical tensions in Eastern Europe. S&P 500 futures lost 1.4% and Nasdaq futures fell 1.9% the previous day.

NO REBOUND IN NEAR TERM

Global stock markets are likely to remain under pressure from growing tensions between Russia and the US despite the low risk of military conflict between those two countries, analysts said.

“Markets are expected to become more volatile in the near term, given potential military conflicts between Russia and the West in Ukraine,” said Kim Young-hwan, a market strategist at NH Investment & Securities in Seoul. “But an actual conflict between Russia and the US, the world’s top military powerhouses, will be extremely unlikely since global markets will panic on any clash.”

Some hoped the war risk impact might be brief if the tensions are resolved in the short term. In March 2014, when Russia invaded and subsequently annexed the Crimean Peninsula from Ukraine, the Kospi lost just 3% in two weeks and the S&P 500 Index fell only 2% in a week.

Concerns over inflation are expected to deepen, however, since Russia, a key raw material exporter, is at the center of the latest crisis, analysts said.

Russia is the world’s top supplier of natural gas and wheat, as well as the No. 3 oil producer. Brent crude, the global benchmark, surged to as high as $99.50 per barrel, the highest since September 2014, according to media reports.

“The deeper and wider the conflict gets, the longer worries about inflation last,” said Jung Yong-taek, research head at IBK Investment & Securities. “Markets do not move only on the Ukraine crisis, so they are unlikely to significantly rebound even after the issue is resolved.”

Write to Jae-Won Park, Ji-Hyun Lee and Hyeong-Gyo Seo at wonderful@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyKorea Inc. revises business plans as rising oil prices hit economy

EconomyKorea Inc. revises business plans as rising oil prices hit economyFeb 21, 2022 (Gmt+09:00)

6 Min read -

Comment 0

LOG IN