Economy

South Korea's working young teeter on brink of debt disaster

Loan growth rate for those in their 20s and 30s far outpaced that of other age groups at banks and non-banking institutions

By Feb 21, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

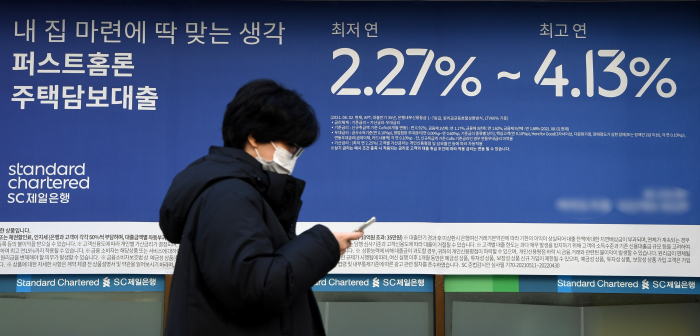

As the liquidity party is coming to an end, rising interest rates and falling asset values are highlighting concerns about household debt taken on by younger South Koreans, which could pose a systematic risk to the broader economy.

Last December, a 32-year-old office worker identified only by his family name Choi overdrew his checking account by 9 million won ($7,550) to buy on cryptocurrency dips, after the Bitcoin price slid to the $50,000 level from $69,000.

But contrary to his expectations, the Bitcoin price declined further to the $40,000 level and his investments in digital coins such as Chainlink and Metadium yielded a negative 41% return, wiping 9 million won from his 22 million won in cryoto investments.

"Now that banks charge higher interest rates, which are automatically transferred from my account, I am concerned if I can raise seed money," Choi told The Korea Economic Daily.

Twenty- and thirtysomethings in South Korea have aggressively taken out personal loans over the past few years to scale up leveraged investing. The millennials, who had missed out on buying homes, switched into stock and digital coin markets with a dream of making a fortune.

Their combined debt amounted to 458 trillion won ($384 billion) as of end-June 2021, taking up 27% of the country's total household debt of 1,705 trillion won over the same period. About one-third of the debts extended to the millennials, or 150 trillion won, is estimated to be owed by multiple debtors.

More worryingly, the pace of their debt growth was two to three times faster than that of other age groups.

LOANS BY BANKS, BROKERAGE COMPANIES

The balance of bank loans owed by those in their 20s and 30s leapt by 35.2% and 23.7%, respectively, over the past one and a half years. That outstripped an average 14.8% growth in banks' household loans during the same period.

The number of borrowers in their 20s and 30s at the country's 10 large brokerage companies doubled to 54,554 over the same period, driven in part by their accessibility to mobile banking and fintech platforms.

The balance of shares held by those age groups spiked 178% to 39 trillion won as of end-2021, versus 14 trillion won at end-2019. The growth rate eclipsed 108% for those in their 50s and 95% in their 60s during the same period.

In the cryptocurrency markets, those in their 20s and 30s account for 60% of users of Upbit, the country's dominant cryptocurrency exchange.

"Those aged 30 and below led household loan growth, led by a sharp increase in their borrowings from non-banking financial institutions," the Korea Institute of Finance said in a recent note.

Last year, twenty- and thirtysomethings made up their largest share of apartment buyers in history at 31.0% nationwide and 41.7% in Seoul, according to the Korea Real Estate Board.

Those age groups were also the core borrowers for jeonse loans, taken out by tenants to pay a lump-sum deposit for home rent during their contract period, instead of paying rent in installments.

Driven by the sharp rise in home prices and jeonse deposits, the amount of jeonse debt by the two age brackets have been on double-digit growth over the past few years: a 30.5% on-year growth in 2019; up 29.5% in 2020 and up 21.2% in the first half of 2021.

SPECULATIVE, SHORT-TERM TRADERS

"The average apartment price in Seoul tops 1 billion won, which even professionals cannot afford with their annual salary," said a 30-year-old accountant identified by his family name Yoon. "Investing is the only way to make my dream of buying a home come true."

After pocketing decent returns from overseas stock investments last year, a 28-year-old company employee increased his global stock investments to 70 billion won with borrowed money to diversify his portfolio into underdog stocks.

But his investments in the so-called meme stock halved in value and early this month, he ran up his overdraft by 10 million won to buy new shares.

The meme stocks refer to stocks that suddenly catch the attention of investors, based on rumors and internet message board discussions.

The Bank of Korea pointed out that mortgage loans and credit loans extended for investment purposes had driven the debt growth by those in their 20s and 30s.

"Leveraged asset purchases by the young could be vulnerable to an unexpected correction in asset prices," the central bank said in a recent research note. "Their debt burden could hold their consumption demand in check."

The millennials also are speculative, short-term investors in stocks and digital coins, with the highest turnover rate compared to other age groups. For retail investors in their 20s or below, their daily turnover was 16.9% in the domestic stock market, according to Korea Capital Market Institute. Daily turnovers refer to their average daily transaction value divided by the balance of their shareholdings.

"Those in their 20s and 30s, who recently rushed into investment markets, have hardly experienced a long-term slump or rangebound trade in real estate, stock and digital coin markets," said an investment industry source.

Escalating inflationary pressures and the Federal Reserve's quickened tightening pace are likely to start to dry up liquidity in financial markets, further raising the vulnerability of South Korea's indebted generation.

Write to Hyun-Woo Lim, Gil-Sung Yang, Kang-Ho Jang, Gwang-shik Lee and In-hyuck Lee at tardis@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Banking & FinanceKorean bank profits at record-high as borrowers struggle under debt

Banking & FinanceKorean bank profits at record-high as borrowers struggle under debtFeb 10, 2022 (Gmt+09:00)

3 Min read -

EconomyKorea private debt growth at record high of $98 bn in Q2

EconomyKorea private debt growth at record high of $98 bn in Q2Oct 12, 2021 (Gmt+09:00)

1 Min read -

Personal debtA generation indebted: Young Koreans struggle under record loans in Q1

Personal debtA generation indebted: Young Koreans struggle under record loans in Q1Jul 06, 2021 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN