LG Energy, LG Chem deliver record results in 2021

LG Energy swings to operating profit after three years; LG Chem vows to ramp up battery materials sales

By Feb 08, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's LG Energy Solution Ltd. and its parent company LG Chem Ltd. on Tuesday delivered their largest-ever results in 2021, as the increased adoption of electric vehicles boosted demand for automotive batteries and their materials.

LG Energy, the world's No. 2 battery producer, swung to a profit after two years of losses. Its 2021 operating profit reached its largest-ever 768.5 billion won ($641 million), with a profit margin of 4.3%.

This year, it is aiming for an 8% increase in sales to 19.2 trillion won from last year's 17.9 trillion won, which was its record annual revenue and 42% higher than the year previous.

The company, split off from LG Chem in December 2020, earmarked 6.3 trillion won for facility expansion this year, 58% more than its 2020 spending of 4 trillion won. This year's spending will include its investment in a joint venture with General Motors.

"Our sales target factored in the growing EV market, the increasing demand for cylindrical batteries and the supply chain issues surrounding the semiconductor industry," LG Energy said on Tuesday.

Cylindrical batteries are used in mini electric cars, electric buses and excavators. Last year, LG hiked its price for the battery type by double digits, in line with the growing demand.

The 2021 results reflected the costs related to the recalls of General Motor's electric cars and ESS units in the US due to overheating and fire concerns, on top of the settlement money it received from SK Innovation Co. in relation to their disputes over trade secrets.

Excluding those one-off factors, LG Energy's operating profit would have come to 917.9 billion won on sales of 16.9 trillion won, the company said.

In the fourth quarter of last year, operating profit came in at 75.7 billion won, with sales up 10.2% to 4.4 trillion won from three months before thanks to the increased shipments of the pouch and cylindrical cells.

LG CHEM

LG Chem posted a record operating profit of 5 trillion won in 2021, a 178.4% surge from a year earlier. Consolidated sales leapt 42% on-year to a record 42.7 trillion won.

The sales figures exclude revenues of LG Energy Solution, in which LG Chem holds an 81.84% stake.

"Half of our sales target for 2030, or 30 trillion won, will be generated from battery materials, eco-friendly materials and drug development," Shin told an online conference call with investors on Tuesday.

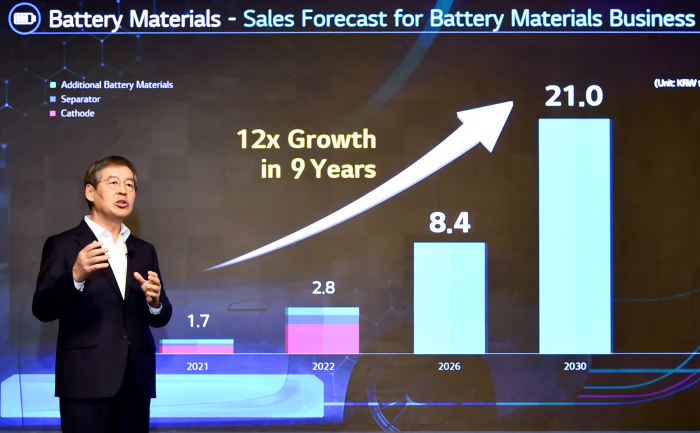

The projected number is divided into 21 trillion won from battery materials versus last year's 1.7 trillion won; 8 trillion won from eco-friendly materials versus 1.4 trillion won; and 1 trillion won from new drug development.

To reach the targets, it will pump more than 4 trillion won every year into the three business segments, including 1 trillion won in R&D. The three segments currently generate about 3 trillion won in combined sales.

To fund the investments, LG Chem will utilize the proceeds from the initial public offering of LG Energy Solution last month.

BATTERY MATERIALS

Shin said its battery materials business will produce double-digit operating profit margins down the road.

While boosting its global production capacity of cathode materials, LG Chem will also venture into the markets of battery separators and other battery ingredients such as carbon nanotubes and binders used in the anode manufacturing process.

"As LG Energy Solution grows further and secures a larger pool of clients, we'll set higher sales targets for battery materials," Shin said.

The eco-friendly materials business will deal with recycling and biodegradable and renewable energy materials, with the pharmaceutical division pivoting on anticancer and diabetes treatments and metabolic therapies for global customers.

"We'll jump into the blue ocean markets, exploring all growth options, which encompass strategic investments and mergers and acquisitions," Shin added.

Write to Il-Gyu Kim and Kyung-Min Kang at kkm1026@hankyung.com

Yeonhee Kim edited this article

-

BatteriesLG Energy to spend $1.7 bn to hike Michigan battery capacity fivefold

BatteriesLG Energy to spend $1.7 bn to hike Michigan battery capacity fivefoldFeb 07, 2022 (Gmt+09:00)

3 Min read -

EV BatteriesLG Energy, GM to build $2.6 bn battery plant in Michigan

EV BatteriesLG Energy, GM to build $2.6 bn battery plant in MichiganJan 26, 2022 (Gmt+09:00)

2 Min read -

IPOsOne in 10 Koreans rushes for LG Energy shares ahead of $8.6 billion IPO

IPOsOne in 10 Koreans rushes for LG Energy shares ahead of $8.6 billion IPOJan 19, 2022 (Gmt+09:00)

4 Min read