IPOs

One in 10 Koreans rushes for LG Energy shares ahead of $8.6 billion IPO

Given the frenzy over all things EV, investor appetite for battery shares will continue for years, analysts say

By Jan 19, 2022 (Gmt+09:00)

4

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

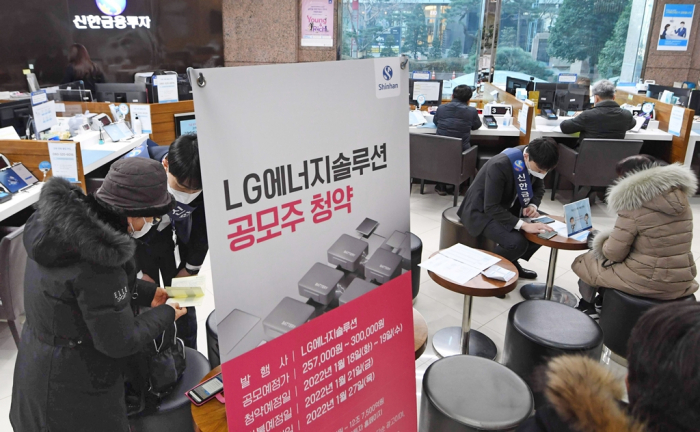

The worldŌĆÖs second-largest electric vehicle battery maker LG Energy Solution Ltd. has set a new record for initial public offering demand, with nearly one in every 10 South Koreans rushing to the brokerages handling the share sale to subscribe or submitting bids online.

LG Energy Solution has attracted a total of 114 trillion won, or $96 billion, in deposits from retail investors during the two-day public subscription, which ended on Wednesday.

That represents the highest-ever amount deposited from individual investors for an IPO on a Seoul bourse, beating the previous record set by SK IE Technology Co. nine months ago. SK IE Tech, the battery materials subsidiary of Korean battery maker SK Innovation Co., pulled in 81.9 trillion won in public subscriptions in April of 2021.

LG EnergyŌĆÖs shares were 69 times oversubscribed, with some 4.42 million people submitting bids to buy the stock. About 6% of 1,500 trillion won in short-term funds in the financial market has been mobilized for the public subscription, also posting a record amount.

Operations at some local banks were briefly paralyzed, with money withdrawals from short-term funds, called MMFs, suspended as investors transferred their money into accounts hurriedly opened at brokerages -- even set up under the names of their minor children -- to get as many LG Energy shares as possible.

Financial industry officials said some small investors wonŌĆÖt be able to secure a single share due to the overwhelming demand.

ŌĆ£The amount is astronomical. More than 100 trillion won in retail demand for a single IPO is rare even for a global share sale,ŌĆØ said an official at a foreign investment banking company.

ŌĆ£It looks like all Korean people are betting on LG Energy as if to win the lotto.ŌĆØ

KOREAŌĆÖS SECOND-MOST VALUABLE FIRM IF DEBUT IS SUCCESSFUL

The battery maker already set a record with bids worth 11,500 trillion won, or $9.65 trillion, from more than 1,700 institutional investors during the bookbuilding process last week.

Given the frenzy for all things EV across the globe, investor appetite for battery shares will continue for years to come, as battery makers strive to raise capital to finance enormous spending on facility expansion, analysts said.

LG Energy, which is offering 34 million shares via the IPO, has said it wants to sell them in a price range of 257,000 won-300,000 won apiece.

At the top of the price range, LG Energy will have an enterprise value of 70.2 trillion won, making it KoreaŌĆÖs third-most valuable company after Samsung Electronics Co. and SK Hynix Inc. The battery makerŌĆÖs parent, LG Chem Ltd., is capitalized at 46 trillion won.

Given the unprecedently strong demand, industry watchers said LG Energy will likely price its IPO at the top end when it goes public on Jan. 27, allowing the company to raise as much as 10.2 trillion won, the biggest ever IPO in Korea.

Of the total shares on offer, only 9% will likely start trading on their debut as 77% of institutional investors have agreed to a lock-up clause, promising not to sell the stock post-IPO for a certain period of time, according to sources.

Some 11 million shares were allocated for retail investors.

Following its┬Āsuccessful bookbuilding and public subscription, investors are now paying attention to how the share price will move once listed.

Market watchers say if LG Energy debuts on the Kospi market with its opening price double the offering price and reaches the daily upper limit of 30%, then it could touch 780,000 won a share, making it KoreaŌĆÖs second-most valuable company on the first trading day.

RECORD COMMISSION FEES

A total of seven local brokerages handled the subscriptions, with KB Securities Co. managing the largest volume, followed by Daishin Securities and Shinhan Investment. The three account for 91% of the bids.

KB Securities is expected to earn 19.3 billion won in commission fees from the IPO, almost a third of the total IPO commission charges it received last year. Daishin and Shinhan will likely receive 9.8 billion won each in commission fees from the LG Energy IPO.

With IPO fever running high in Korea, the securities regulator recently changed rules and adopted an equal share allocation system under which half of all shares on offer to individuals will be equally distributed among investors bidding for at least 10 shares with the other half allocated in proportion to their bid sizes.

With the IPO proceeds, LG plans to expand its production capacity and increase research and development in Korea and abroad.

Last week, LG Energy Chief Executive Kwon Young-soo vowed to overtake ChinaŌĆÖs Contemporary Amperex Technology (CATL), the EV battery market leader, within the next few years.

LG counts General Motors Co., Tesla Inc. and Volkswagen among others as its major global clients.

Write to Ye-Jin Jun at ace@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

IPOsLG Energy sets new IPO record with $9.65 trillion investor demand

IPOsLG Energy sets new IPO record with $9.65 trillion investor demandJan 12, 2022 (Gmt+09:00)

3 Min read -

IPOsLG Energy takes on CATL as it prepares for KoreaŌĆÖs largest-ever IPO

IPOsLG Energy takes on CATL as it prepares for KoreaŌĆÖs largest-ever IPOJan 10, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN