KTB PE earns 100% return from US brand sold to P&G

P&G took over Farmacy Beauty in late 2021, a year after KTB took a 30% stake

By Jan 17, 2022 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

S.Korea's LS Materials set to boost earnings ahead of IPO process

HYBE to fire NewJeans agency CEO; Min refutes accusation

Louis Vuitton, Chanel, Dior post weak profits in Korea post-pandemic

Microsoft CEO to meet with Samsung, SK Hynix, LG, SK Telecom chiefs

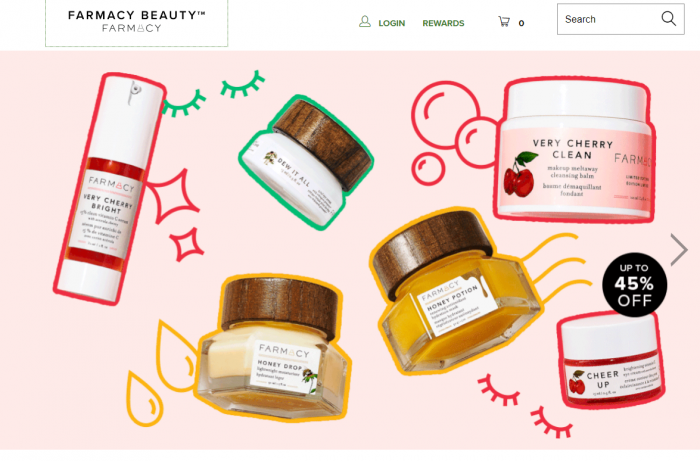

South Korea-based KTB Private Equity has earned a 100% return from Farmacy Beauty, just a year after its investment, following Procter & Gamble's (P&G) acquisition of the US skincare brand late last year.

KTB PE invested an undisclosed amount in December 2020 to take a 30% stake in the independent beauty brand, established in 2015.

The US consumer goods giant P&G took it over for $350 million, according to investment banking sources last week.

Based on the deal value, KTB PE is estimated to have pumped between 50 billion and 60 billion won ($42 million-$50 million) into Farmacy Beauty and sold its stake for around 110 billion won ($90 million), according to calculations by Market Insight, the capital markets news outlet of The Korea Economic Daily.

Dubbing itself as a "farm-to-face" brand, it has rapidly built market share both online and offline. It sells lotions, creams and cleansing products on Amazon.com and through LVMH-owned retailer Sephora.

Back in 2020, KTB PE's CEO Song Sanghyon beat global competitors to secure the investment in the fast-growing skincare startup thanks to his relationship with Farmacy's top management, the sources said.┬Ā

Farmacy Beauty's founder and CEO David Chung is believed to be an American of Korean descent.

Last year, KTB PE took full control of Sungmyung Ind. Co., a domestic wrapping paper and packaging materials producer, from the founding families of BYC Co., a leading Korean underwear brand. It also acquired MG Food Solution, a Korean seasoning sauce manufacturer in the same year. It did not provide details of both deals.

Song has since mid-2016 been leading KTB PE, an affiliated company of KTB Investment & Securities Co. and KTB Asset Management Co. He previously worked as vice president of Lehman Brothers and managing director and South Korea head of Asia-focused buyout firm Unitas Capital.

He holds an MBA from Columbia Business School and a bachelor's degree in East Asian studies from Harvard University.

Write to Jun-ho Cha at chacha@hankyung.com

Yeonhee Kim edited this article.

-

-

Venture capitalKTB Network wins jackpot from Korean delivery app sale

Venture capitalKTB Network wins jackpot from Korean delivery app saleMar 30, 2021 (Gmt+09:00)

2 Min read