Logistics

Mesh to raise up to $253 mn to become logistics unicorn

The fast-growing startup aims to be valued at $843.2 mn despite having been in the red for years

By Jan 13, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

By selling the new shares, Mesh aims to become a unicorn with more than 1 trillion won in corporate value. The startup was valued at around 550 billion won last June, when it attracted a 27 billion won investment from KB Investment.

The largest shareholder of Mesh is the Korean online portal titan Naver Corp., owning a 20.7% stake. Korean retail giant GS Retail Co., Mesh’s Chief Executive Yoo Jung-beom and Hyundai Motor Co. hold 19.5%, 16.6% and 9.9% stakes, respectively, in the South Korean logistics company.

CEO Yoo and other founders’ holdings will remain around 26% as the company has increased its corporate value by rights offerings. In the first half of 2021, Mesh raised 100 billion won through a rights offering from GS Retail, apparel exporter Hansae Co., online bookstore Yes 24 Co., state-run Korea Development Bank, KB Investment Co. and others.

Mesh’s annual sales soared from 500 million won in 2015 to 5.2 billion won in 2016. The fast-growing company’s sales jumped to 30.1 billion won in 2017, 73.2 billion won in 2018, 161.4 billion won in 2019 and 256.5 billion won in 2020. However, the company has suffered operating losses -- 14 billion won in 2018, 12.2 billion won in 2019 and 17.8 billion won in 2020. It remained in the red last year despite growing demand for logistics services during the pandemic.

Through selling the new shares, Mesh will build micro-fulfillment centers (MFCs), small, highly automated storage facilities to reduce cost and time to end consumers, as well as employ more information technology professionals. The company will also start a quick commerce service that receives orders and delivers a small volume of daily necessities within an hour. Mesh founded a joint venture with grocery delivery platform Oasis Corp. last year. The JV will launch quick commerce platform V Mart in the first half of this year.

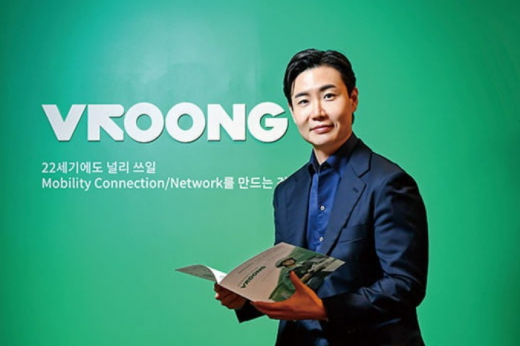

Founded in 2013, Mesh offers a fulfillment service from product storage, inventory management and shipping through its delivery app Vroong. It has 49,000 delivery drivers and operates around 440 logistics bases across Korea. The company is one of the top last-mile delivery service providers in Korea alongside Barogo, Logiall and Manna Plus.

Write to Si-eun Park at seeker@hankyung.com

Jihyun Kim edited this article.

More to Read

-

-

[Exclusive] Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment center

[Exclusive] Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment centerJul 05, 2021 (Gmt+09:00)

4 Min read -

StartupsKorean last-mile delivery apps’ valuations out of sync with demand surge

StartupsKorean last-mile delivery apps’ valuations out of sync with demand surgeSep 10, 2020 (Gmt+09:00)

4 Min read

Comment 0

LOG IN