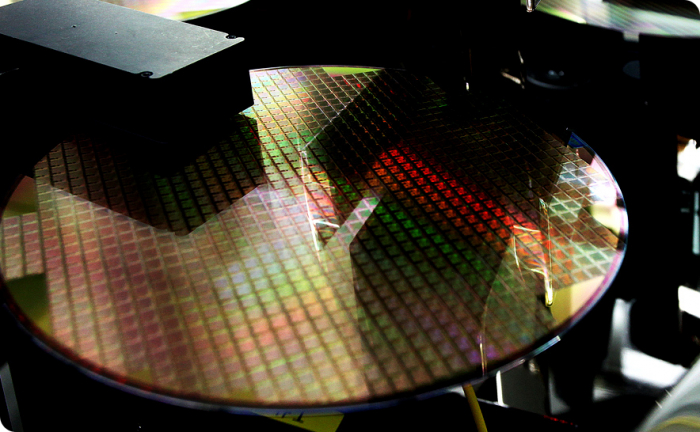

Semiconductors

Time to buy Korean chipmakers; Samsung among 2022 top picks

Automobiles, metaverse shares are also set to outperform amid tough market conditions, analysts say

By Jan 03, 2022 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

The year of the tiger will see decent stock price gains in leading chipmakers such as Samsung Electronics Co. and SK Hynix Inc. on expected hyperscale capital spending by tech companies on data centers and the metaverse, fund managers and analysts said.

Experts also expect automakers such as Hyundai Motor Co. and Kia Corp. as well as internet-related stocks, including Naver Corp., to outperform the broader market in 2022.

According to a quarterly survey of 122 fund managers based in South Korea, two-thirds of respondents said semiconductor is the most promising sector this year, citing widespread market views that the memory industryŌĆÖs downturn will be shorter and shallower.

The metaverse sector came in second with 36%, followed by automobiles and rechargeable batteries (21.3% each), games (13.1%) and bio stocks (12.3%).

The survey conducted by The Korea Economic Daily on Dec. 22-24 also showed 29.5% of pollees believe battery plays could be subject to a correction as those companies have already reflected much of their future growth potential in their current share prices.

The surveyed fund managers recommended investors fill 50% of their equity portfolio with foreign stocks, while limiting Korean stocks to 30%, citing higher chances of outperformance in advanced countries, including the US.

KoreaŌĆÖs benchmark Kospi index is forecast to move in a range of 2,900-3,200 in the first quarter, with an annual peak at 3,400 points by year-end, according to the money managers.

Key negative factors that could suppress share prices this year are inflation, the resurgence of the COVID-19 pandemic and the weakening global economic growth momentum, they said.

ŌĆ£Equities will continue to perform better than other asset classes this year, but given the unfavorable market conditions such as rising interest rates, it will become harder to pick the right ones on the stock market,ŌĆØ said Lee Chae-won, chief of Korea-based Long-term Investment For Everyone (LIFE) Asset Management.

On Monday, the first trading day of 2022 in Korea, the Kospi index was up 0.2% at 2,982.29 by midday.

GREENSHOOTS IN MEMORY

In another survey of 10 brokerage firms by The Korea Economic Daily, Samsung Electronics was chosen as the likely best performer this year among Korean stocks, followed by SK Hynix.

Shares of chipmakers in Korea and abroad outperformed in recent weeks amid increasing signs of an earlier-than-expected end to the chip industry winter.

Analysts said inventories will dwindle and corporate investment in cloud servers will increase, signaling a shorter downcycle for the memory industry.

Chipmakers will benefit from major technology companiesŌĆÖ heavy spending on metaverse, a virtual world where people can connect, as well as increasing investments in chip-guzzling data centers, they said.

Global tech companies such as Google Inc., Amazon.com, Microsoft Corp. and IBM Corp. are predicted to buy 23% more DRAM chips than their 2021 purchases, according to KB Securities. ThatŌĆÖs above SamsungŌĆÖs expected DRAM supply growth rate of 16% for this year.

Samsung and SK Hynix are the worldŌĆÖs two largest memory makers.

Daishin Securities said automakers also stand to gain from an easing supply bottleneck of automotive chips.

Meritz Securities named Kia as its top pick, saying the stock is undervalued with the carmakerŌĆÖs price-earnings ratio (PER) of 6.4.

Three of the 10 surveyed brokerages picked LG Innotek Co. as their top stock.

LG Innotek has risen 71% in the past couple of months on expectations that the auto parts maker will benefit from Apple Inc.ŌĆÖs planned launch of its first autonomous electric car in 2025.

The surveyed analysts also picked HYBE Co., the label behind boyband sensation BTS, and Naver, KoreaŌĆÖs top portal operator, as their top picks in the entertainment and internet categories, respectively.

Write to Jae-Won Park, Eun-Seo Koo and Sung-Mi Shim at wonderful@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SemiconductorsSamsung, Hynix notch best day this year; metaverse to drive chip demand

SemiconductorsSamsung, Hynix notch best day this year; metaverse to drive chip demandNov 23, 2021 (Gmt+09:00)

3 Min read -

-

-

Auto chipsSamsung supplies self-driving, infotainment chips to global carmaker

Auto chipsSamsung supplies self-driving, infotainment chips to global carmakerDec 16, 2021 (Gmt+09:00)

4 Min read -

SemiconductorsSK Hynix makes industryŌĆÖs highest density 24Gb DDR5 DRAM chip

SemiconductorsSK Hynix makes industryŌĆÖs highest density 24Gb DDR5 DRAM chipDec 15, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN