Startups

SK Square injects $29.5 million into agriculture startup

Korean conglomerates continue to bet on sustainability businesses

By Dec 27, 2021 (Gmt+09:00)

1

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

MondayŌĆÖs announcement comes a month after the SK Telecom Co., Ltd. spin-off announced a 100 billion won investment into a blockchain and metaverse firm.

SK Square focuses on investment into companies in the information and communication technology sector.

The company said it hopes the latest investment will open the door for collaborations between SK affiliates and Greenlabs in the agtech industry.

GreenlabsŌĆÖ valuation is estimated to be between 700 and 800 billion won, meaning SK Square now has a four to five percent stake in the startup.┬Ā

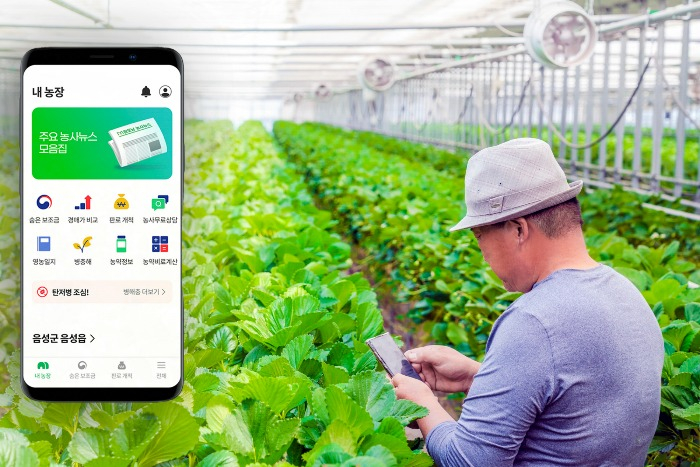

Founded in 2017, Greenlabs provides data-driven information to farmers with the aim of maximizing usersŌĆÖ margins. This yearŌĆÖs revenue stands at around 100 billion won. GreenlabsŌĆÖ main product, Farm Morning, is an app that enables crop growth monitoring, remote control of the farm environment, and more.

Some 450,000 farming households use the app, approximately half of all such households in Korea.┬Ā

In terms of collaborations, SK SquareŌĆÖs affiliate Eleven Street Co., Ltd. an e-commerce platform, will utilize GreenlabŌĆÖs distribution network. The conglomerate also plans to grow its ESG businesses by tapping into the startupŌĆÖs certified emissions reduction service.┬Ā

SK Square said Greenlabs is on the verge of becoming a unicorn. As the agtech companyŌĆÖs revenue, trade volume, and the number of subscribers directly reflect its valuation, the conglomerate forecasts an increasing stake with the startup's expansion.

Write to Seon Han-gyeol at always@hankyung.com

Jee Abbey Lee edited this article.

More to Read

Comment 0

LOG IN