Semiconductors

Chipmakers eye shorter memory downturn

There are increasing signs of an earlier-than-expected end to the chip industry winter

By Dec 21, 2021 (Gmt+09:00)

4

Min read

Most Read

Global memory chipmakers, including market leader Samsung Electronics Co., expect the current industry downcycle to be shorter than expected, with views that a recovery will come as early as the third quarter of next year.

Since the start of this year, the semiconductor industry has been plagued by talk that high chip inventories at corporate clients and a protracted supply-demand bottleneck will keep the market depressed well into 2022.

However, signs are growing that inventories are dwindling and corporate investment in cloud servers and other chip-guzzling devices will increase, signaling the winter in the chip industry is coming to a close.

Micron Technologies Inc., a leading US memory chip supplier, on Monday delivered stronger quarterly results than Wall Street expected as data centers and electric vehicle manufacturers drove demand for its chips.

The company said its fiscal first-quarter revenue came in at $7.69 billion, beating the market consensus of $7.67 billion. The September-November quarter net profit was $2.47 billion, it said.

The company forecast its second-quarter sales and profits will also beat market estimates, with chip shortages, which have been stifling shipments of cars and personal computers, starting to ease in 2022.

Industry watchers say MicronŌĆÖs better-than-expected results are a precursor to decent earnings to be reported next month by its global peers such as Samsung and SK Hynix Inc., and bode well for the entire industry, which has been struggling with falling chip prices.

SHARES ALREADY RISING

ŌĆ£MicronŌĆÖs market outlook is positive. It expects a low single-digit fall in DRAM prices in the coming quarter, meaning the memory downcycle in the first half will not be as bad as many analysts earlier forecast,ŌĆØ said NH Investment & Securities analyst Doh Hyun-woo.

Chip shares are already rising as investors bet on better earnings into next year.

On Tuesday, Samsung, the worldŌĆÖs top memory chipmaker, rose 1.3% to finish at 78,100 won, while SK Hynix, the worldŌĆÖs No. 2 memory company, closed up 3.3% at 124,500 won.

Samsung has gained 14.3% from a 52-week low on Oct. 13, while SK Hynix has risen 38% over the same period.

The significant share gains were led by foreign investors, signaling their return to the Korean markets.

Foreigners have been selling the two Korean chip stocks worth over 35 trillion won ($29 billion) since the start of this year on pessimistic market views that the memory chip industry is doomed for a protracted downcycle.

Over the past month, however, foreign investors bought 2.87 trillion won in Samsung shares and 863 billion won of SK Hynix shares.

ŌĆ£Any further DRAM chip price declines will be limited in the coming months. We expect DRAM prices to enter an upcycle in the third quarter of 2022,ŌĆØ Daishin Securities said in a recent research note.

The local brokerage on Monday raised its target price for Samsung to 120,000 won, up 20% from its earlier target, while also raising SK HynixŌĆÖs target price by 18.5% to 160,000 won.

Daishin Securities now expects SamsungŌĆÖs 2022 operating profit to be 58.47 trillion won, up from its November forecast for 55.18 trillion won. SK Hynix is expected to earn 14.85 trillion won next year, compared to an earlier forecast for 12.58 trillion won, it said.

SAMSUNG SET TO WIDEN LEAD OVER RIVALS

According to market tracker Omdia on Tuesday, Samsung Electronics retained its top position in the global DRAM market with its market share rising to 43.9% in the third quarter from 43.2% in the second quarter. The third-quarter figure shows the company has expanded its market share for three consecutive quarters.

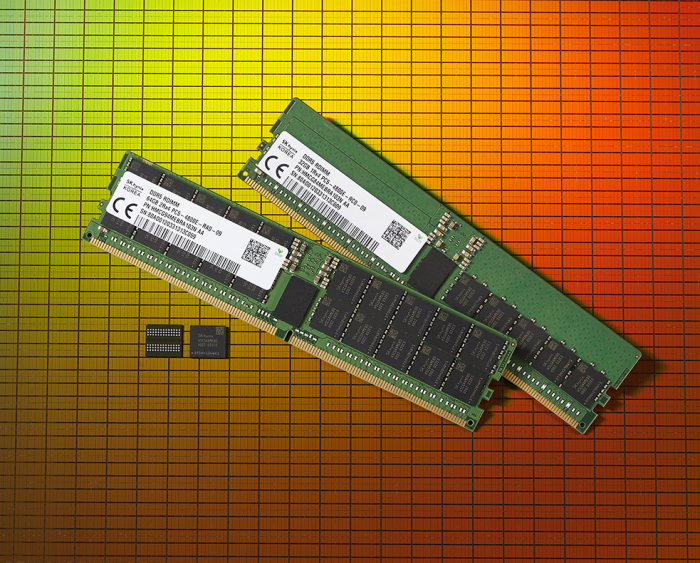

SK Hynix came in second with a 27.6% market share, followed by Micron at 22.7%.

Omdia data also showed Samsung overtook Intel Corp. as the top player in the overall memory market, including NAND flash memory, putting the US chipmaker to second place for the first time in 12 quarters in terms of revenue.

In the third quarter, Samsung posted $20.96 billion in memory sales, beating IntelŌĆÖs $18.79 billion.

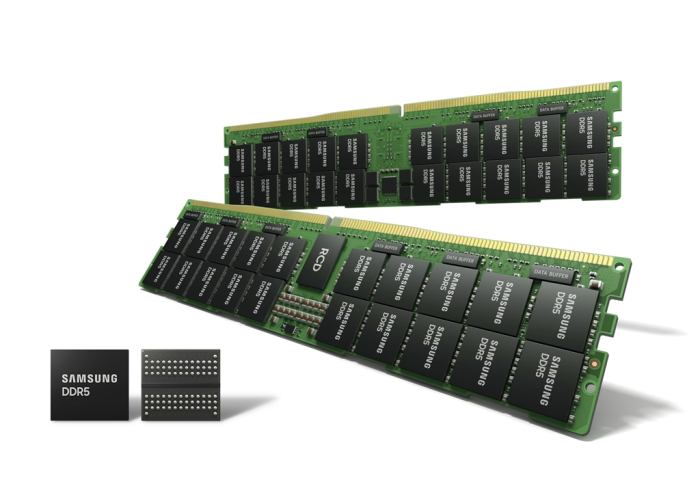

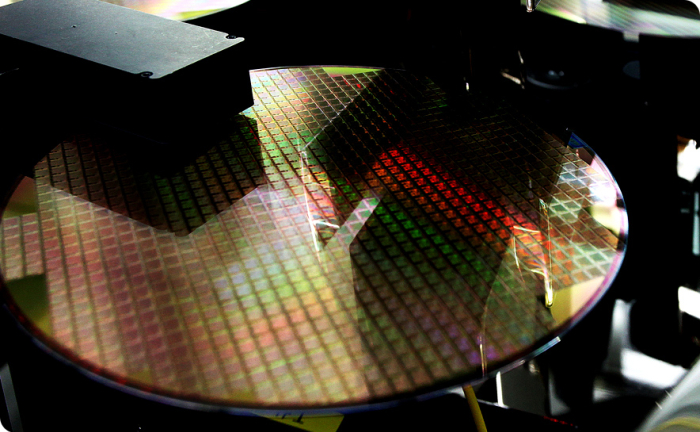

Samsung said in October it began mass production of the industryŌĆÖs smallest 14-nanometer next-generation double data rate 5 (DDR5) DRAM chips using extreme ultraviolet (EUV) technology.

If the latest chip becomes mainstream in the DRAM market, it will also provide support for falling DRAM prices, industry watchers said.

Write to Su-Bin Lee and Hyung-gyo Seo at lsb@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Semiconductor rivalryMemory leader Samsung aims to strengthen system chips, foundry

Semiconductor rivalryMemory leader Samsung aims to strengthen system chips, foundryJun 08, 2021 (Gmt+09:00)

3 Min read -

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrend

DRAM supercycleSigns of upcoming DRAM boom cycle loom large amid price uptrendFeb 25, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN