Semiconductors

Energy-saving chips emerge as new battleground

ESG criteria and big data expected to drive data center operators' shift to higher-priced, low-power chips

By Dec 20, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Environmental, social and governance (ESG) requirements are expected to drive high-performance chip demand higher, in particular from data center operators looking for energy-saving chips to offset surging power consumption.

Data centers consume vast amounts of energy to run servers that store and process data, while cooling down computers. And the global data volume to be processed has been growing exponentially, driven by artificial intelligence-assisted automated data.

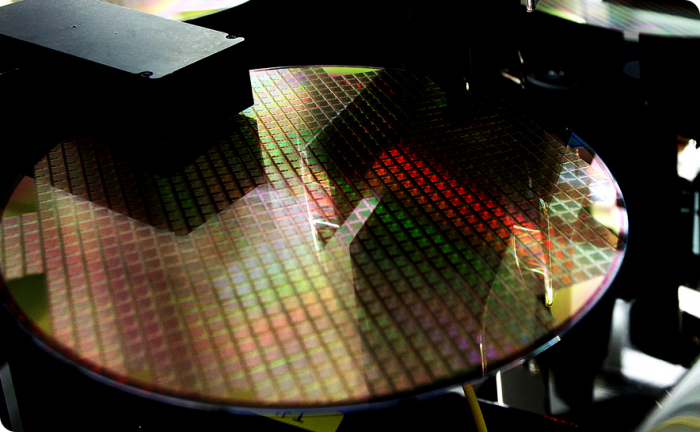

Chips used in data centers are expected to prop up demand for DRAMs and NAND flash memory as a whole, outweighing oversupply concerns triggered after the spot price of DRAM chips tumbled in the second half of this year.

Further, ESG requirements force global Big Tech firms such as Google Inc. and Amazon.com to adopt costly renewable energy such as solar and wind power.

To compensate for the soaring costs of renewable energy and growing data volume, Big Tech firms are expected to accelerate their shift into energy-saving, high-performance chips -- emerging as a new battleground for chipmakers.

"Big Tech firms would be willing to pay for low-power chips, despite their slightly higher price," said a semiconductor industry source. "If low-power chips become the industry standard, they will be a measure of competitiveness for chipmakers."

Samsung Electronics Co. recently shared an energy-saving scenario for data centers. They may replace the hard disk drives released in 2020 for use in data centers with solid-state drives (SSDs) made with NAND flash memory, alongside the latest server memory of DDR5.

That would result in cutting down each data center's energy consumption by 7 terawatt-hour (TWh) per year, enough to power households in the state of New York for four months, according to the world's largest memory chipmaker.

Hyundai Motor Securities in a recent research note forecast the global memory chip market at $173.2 billion in 2022. That is based on the assumption that the memory chip market for data centers would expand by 8% on-year, led by demand for high-performance and energy-efficient chips.

HIGH-PERFORMANCE CHIPS

To lead the era of next-generation memory, Samsung is throwing its weight behind the SSD used in data centers, unveiled in February of this year. The new drive reduces power by about 50%, compared with the SSD based on the fifth-generation V-NAND.

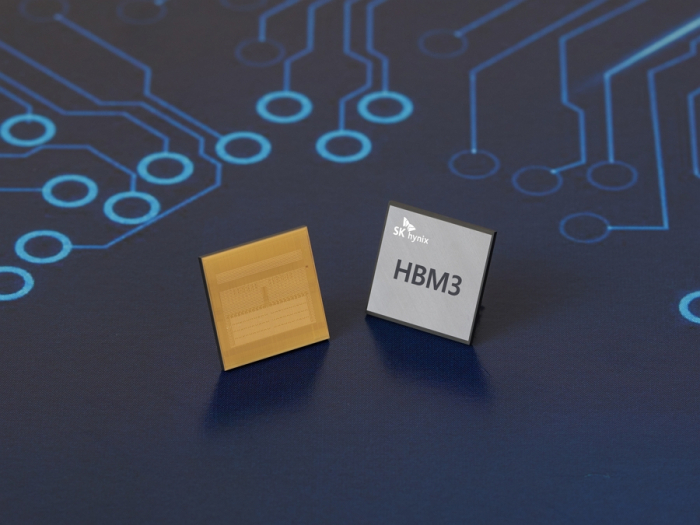

SK Hynix Inc., the world’s second-largest memory chipmaker, is pinning hopes on High Bandwidth Memory 3 (HBM3) used in high-performance data centers. The latest DRAM, released this October, cuts energy consumption by about 50%.

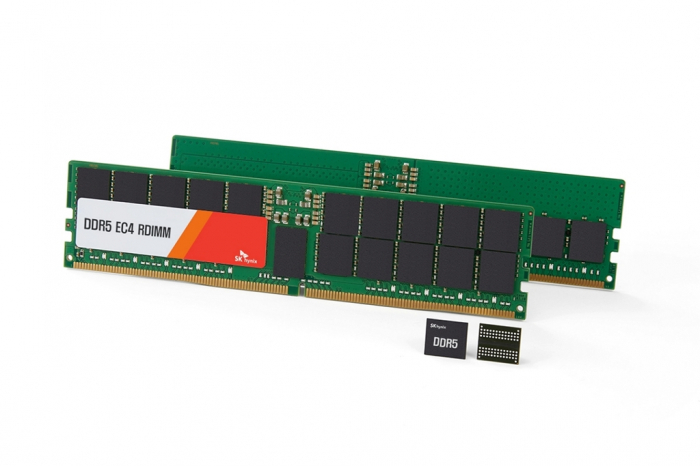

The double data rate 5 (DDR5) DRAM is another type of high-performance chip. Its mass production is scheduled for next February, when Intel Corp. is set to roll out central processing units equipped with the DDR5 DRAM.

The DDR5 chip increases data speed by about 30%, compared with its previous- generation DDR4, while slashing power consumption by 25%.

Global data center electricity use in 2020 reached 200-250 terawatt-hour (TWh), or around 1% of global final electricity demand, according to the International Energy Agency on Dec. 19.

This year, electricity consumption is estimated to increase sharply with the rise of contactless services.

The amount of accumulated digital data reached 33 zetabytes (ZB), or 33 trillion gigabytes, as of 2018, according to IDC IGIS, a market tracker. Global digital data to be created annually is forecast to reach 175ZB in 2025.

Write to Hyung-suk Song at click@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

SemiconductorsWinter is over? Samsung's Q3 chip sales beat Intel's

SemiconductorsWinter is over? Samsung's Q3 chip sales beat Intel'sDec 13, 2021 (Gmt+09:00)

3 Min read -

SemiconductorsSK Hynix makes industry’s highest density 24Gb DDR5 DRAM chip

SemiconductorsSK Hynix makes industry’s highest density 24Gb DDR5 DRAM chipDec 15, 2021 (Gmt+09:00)

2 Min read -

SemiconductorsSamsung makes industry’s smallest 14 nm DDR5 chip with EUV technology

SemiconductorsSamsung makes industry’s smallest 14 nm DDR5 chip with EUV technologyOct 12, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN