Battery materials

POSCO Chemical, GM to launch new battery material JV in US

The JV will produce cathode materials for a high-nickel NCMA mixture from 2024 for supply to Ultium Cells

By Dec 02, 2021 (Gmt+09:00)

4

Min read

Most Read

South KoreaŌĆÖs POSCO Chemical Co. said on Thursday it is forming a new joint venture with US top automaker General Motors Co. to produce cathode materials used in electric vehicle batteries.

POSCO Chemical, already supplying both cathode and anode materials to GM, said the new large-scale cathode active material production facility to be built in the US will tighten its ties with the carmaker and strengthen a battery material supply chain in North America.

The new plant will produce high-nickel cathode materials from 2024 and supply them to Ultium Cells LLC, GM's EV battery cell manufacturing JV with KoreaŌĆÖs LG Energy Solution Ltd.

Details such as the size of the investment and the location of the plant will be disclosed later, it said.

Industry officials said POSCO Chemical will eventually supply up to 90,000 tons a year of high-nickel cathode materials worth 3 trillion won ($2.6 billion) to Ultium Cells.

POSCO Chemical, a unit of KoreaŌĆÖs steel giant POSCO, said its latest agreement with GM marks the industryŌĆÖs first such collaboration as a battery material supplier with a global automaker.

ŌĆ£We will innovate materials and lead the growth of the global eco-friendly mobility market together with GM,ŌĆØ said POSCO Chemical Chief Executive Min Kyungzoon.

Doug Parks, executive vice president for product development and purchasing at GM, said: ŌĆ£We are building a sustainable and resilient North America-focused supply chain for EVs covering the entire ecosystem from raw materials to battery cell manufacturing and recycling.ŌĆØ

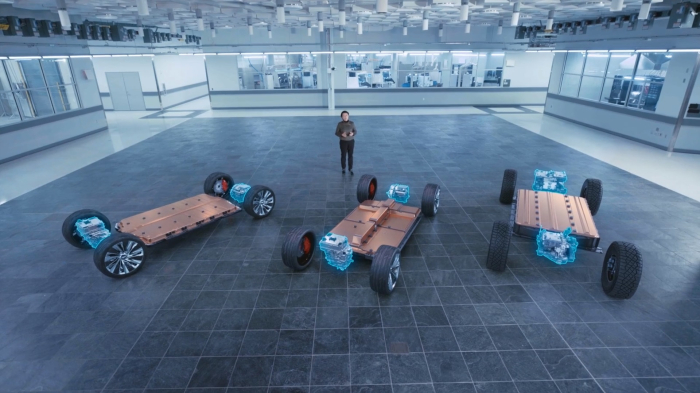

GM has announced plans for $35 billion of investment in vehicle electrification through 2025 that includes 20 new battery EVs for the North American market and 30 models globally.

STEPPING STONE

The EV battery market has been growing fast as global automakers rush to go electric and eco-friendly given tighter rules on greenhouse gas emissions, which are seen as the main culprit for global warming.

Using the JV with GM as a stepping stone, POSCO Chemical said it will continue to expand its cathode material production capacity in North America, Europe and China.

Designated as a cathode and anode material supplier for Ultium Cells in December 2020, POSCO Chemical is building a plant with an annual production capacity of 60,000 tons in Gwangyang, southwest of Seoul.

The announced new US joint venture will help the company expand its cooperative partnership with GM.

GM and its battery partner LG Energy Solution, through their Ultium Cells JV, are building a battery cell production plant with an annual capacity of 35 GWh in Ohio, and another factory with the same capacity in Tennessee. They recently unveiled a plan to build two additional battery cell factories by the mid-2020s.

The move is in line with the Biden administrationŌĆÖs push for half the new cars sold in the US to be EVs by 2030, as well as a US tariff policy to strengthen its domestic battery supply chain.

POSCO Chemical said that in time for Ultium Cells to start battery cell production, it will supply GM with cathode materials for a nickel, cobalt, manganese and aluminum (NCMA) mixture with high nickel content, and anode materials with reduced battery charging speed and improved stability for next-generation EVs.

In China, the worldŌĆÖs top electric car market, POSCO Chemical is also expanding its battery materials production capacity.

It said in August it is investing 281 billion won ($240.7 million) to expand the cathode and precursor plants jointly run with its Chinese partner Zhejiang Huayou Cobalt, the worldŌĆÖs largest cobalt producer.

The precursor is a material created by mixing nickel, cobalt and manganese, and is added to lithium to make cathodes.

Globally, POSCO Chemical aims to expand its annual production capacity of cathode active materials from 105,000 tons in 2022 to 280,000 tons in 2025 and 420,000 tons by 2030.

SYNTHETIC GRAPHITE FOR ANODE MATERIALS

Meanwhile, POSCO Chemical said on Thursday it has completed its first-phase construction of a synthetic graphite plant in Pohang.

The plant, KoreaŌĆÖs first, will initially have an annual production capacity of 8,000 tons and increase the production volume to 16,000 tons a year by 2023.

KoreaŌĆÖs EV battery makers have so far relied on imports from Japan and China for synthetic graphite, a key raw material for anodes.

POSCO Chemical expects synthetic graphite, which helps extend battery lifespan and reduce charging time, to take a bigger share of the graphite market going forward.

According to market tracker SNE Research, synthetic graphite will account for 73% of the global graphite market by 2025 from 60% in 2020.

Lithium-ion cells are composed of four main components -- cathodes, anodes, separators and electrolytes.

Cathode active materials comprise around 40% of the cost of electric vehicle batteries.

The POSCO group is pushing for the production of 220,000 tons a year of lithium and 100,000 tons of nickel by 2030, and has built a solid value chain for the battery materials business by acquiring a stake in a graphite mine in Tanzania and building a battery recycling plant.

Write to Kyung-Min Kang and Jeong-Min Nam at Kkm1026@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Battery materialsPOSCO Chem's rise from brickworks to EV materials leader

Battery materialsPOSCO Chem's rise from brickworks to EV materials leaderNov 11, 2021 (Gmt+09:00)

5 Min read -

Battery materialsPOSCO Chem to supply materials to Morrow Batteries

Battery materialsPOSCO Chem to supply materials to Morrow BatteriesOct 26, 2021 (Gmt+09:00)

2 Min read -

Battery materialsSK, POSCO in heated race for next-generation silicon battery materials

Battery materialsSK, POSCO in heated race for next-generation silicon battery materialsOct 04, 2021 (Gmt+09:00)

3 Min read -

Battery materialsPOSCO breaks ground on $101 million battery recycling plant

Battery materialsPOSCO breaks ground on $101 million battery recycling plantOct 01, 2021 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN