Venture capital

Korea Venture Investment creates global fund worth $2 billion

Funding from overseas VCs exceeds estimate, thanks to growing appetite for K-startups

By Dec 02, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Korea’s government-backed fund of funds (FOF) management institution announced its latest selection of funds late last month, which would benefit from the second around of this year’s global funding program.

Through the second round, Korea Venture Investment Corp. plans to inject 69 billion won ($58.2 million) to 10 funds around the globe. A total of 23 venture capital firms across the globe have applied for the fund, a 3:1 competition rate, requesting around 200 billion won.

The total amount, which will be a combination of the funding from KVIC and the selected venture capital firms' contributions, is expected to hover above 1.04 trillion won.

The purpose of the global fund program is directing foreign investment to specific types of startups that benefit the country's business climate.

In this regard, the selected VCs must invest more than the amount it received from KVIC to Korean startups, overseas affiliates of Korean companies, joint ventures created in conjunction with Korean companies or startups founded by foreign nationals of Korean heritage. This condition is in line with the corporation's catchphrase, "Making Virtuous Cycle of Venture Ecosystem."

BULLISH SENTIMENT ON K-STARTUPS

In this round, the combined total of the minimum amount from the venture capital firms will reach $869 million.

By region, there are four funds located in the United States, two in China and Southeast Asia respectively; and the rest two in other regions.

Four venture capital firms in the US, California-based Big Basin Capital and Goodwin Ventures, Collaborative Fund, and Northgate Capital will receive $21.5 million together.

In China, Legend Capital and Fosun International will receive $11.5 million.

In Southeast Asia, $13 million will go to Altara Ventures and a joint venture by Korea's KB Investment and RHL Ventures; leaving $12.2 million to France-based Eurazeo and Singapore's Antler, which were categorised as being located in the "other" regions.

Together with the first round conducted back in June, the total funding for this year's overseas investment program would surpass 2.3 trillion won.

Initially, KVIC expected its original funding to makeup some 40% of the raised target of 400 billion won. The investment amount at present is almost a six fold jump from the target.

The higer than expected investment reflects foreign venture capital firms' rising appetite for startups here.

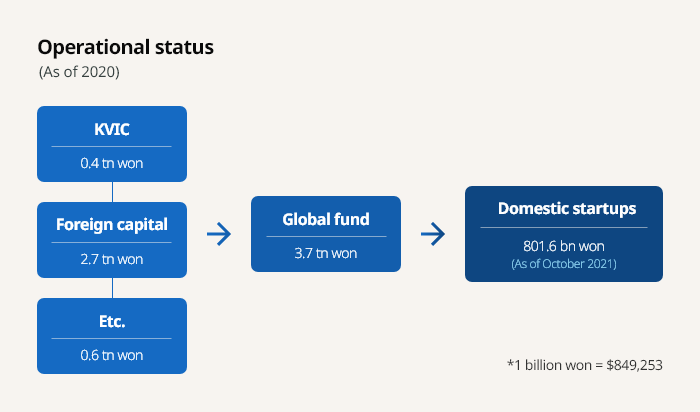

The KVIC has been running the Foreign VC Investment Fund since 2013, infusing 412 billion won to create a total investment amount of 3.67 trillion won. Of that amount, 2.73 trillion won are foreign capital, a whopping 74.4%.

Until now, some 380 Korean startups received a total of 801.6 billion won through the Foreign VC Investment Fund; of which 51 were able to score follow up investments from top tier investors such as New York-based Goldman Sachs and Beijing's Legend Capital.

Korea's recent unicorns, namely IT service management company Viva Republica which owns mobile banking provider Toss; grocery shopping app Kurly; and real estate app Zigbang, are all beneficiaries of such infusion of capital through the global fund.

Apart from the obvious financial perks, the broadened network has also expanded the Korean startups' potential.

Healing Paper Corp., a medical beauty startup that received funding from Legend Capital, said it is working on entering the Chinese market through the VC's support.

Other companies like Woowa Brothers Corp. and Hyperconnect Inc., for their parts, have been acquired by overseas VCs at 4 trillion and 2 trillion won respectively.

A high level KVIC official said he hopes the cycle of fresh infusion of foreign capital energizing the domestic startup scene will continue to benefit the overall economy.

Write to Jee Abbey Lee at jal@hankyung.com

Jee Abbey Lee edited this article

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN