Fractional investing platforms for art to Rolex lure VCs

Korean platforms for small investors in art, music copyrights and luxury items draw domestic and foreign VC firms

By Nov 17, 2021 (Gmt+09:00)

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Infrastructure secondaries continue to rise amid inflation: Stafford

Goldman Sachs names Choi Seoul office chief

Golf equipment maker Taylormade to refinance $222 mn of debt

NPS' former key players move to law firms as its voting power increases

The growing popularity of fractional investment in celebrated artworks, music copyrights and luxury items has spurred a flurry of venture capital investments in their trading platforms in South Korea.

Fractional share trading for joint ownership has become a trend among millennial investors, mostly in their 20s and 30s, expanding the participant base in the markets once dominated by the wealthy.

Yeolmae Company, the operator of ARTnGUIDE, an online platform for joint ownership of art pieces, recently raised 9.2 billion won ($7.8 million) in Series A funding. SoftBank Ventures Asia, Korea Development Bank, Bass Investment and E&Venture Partners joined in the funding round.┬Ā

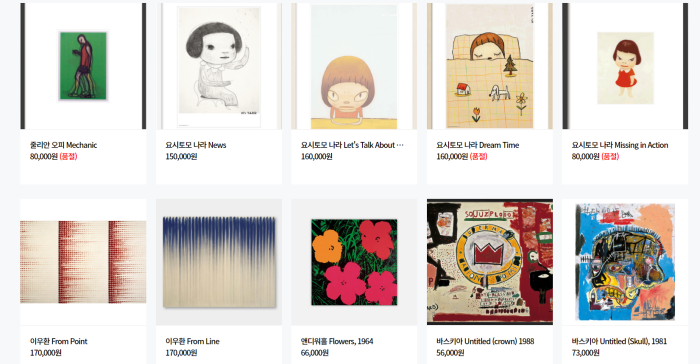

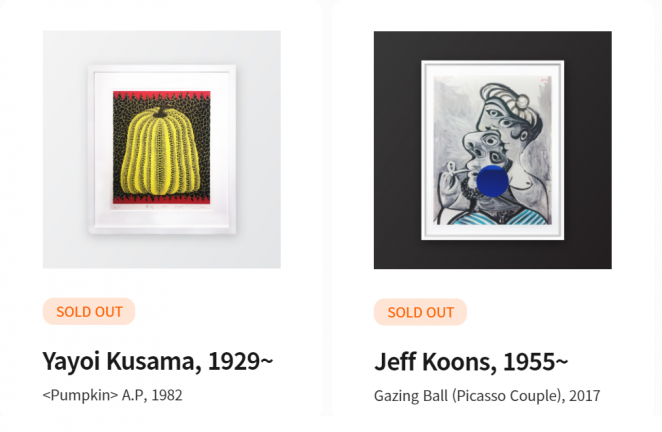

ARTnGUIDE has been selling shares in famous artworks, including pieces of Picasso's work and Yayoi Kusama, a contemporary Japanese painter, well known for her yellow and black Pumpkin sculpture. The art of Lee Ufan and Kim Whan-ki, among a few of South Korea's modern art pioneers, is also available for fractional investing on the platform.

The online platform collects art with money from a pool of small investors, shares their ownership and later distributes a profit from selling the art. Since its inception in 2016, the startup has bought a total of 16 billion won worth of art pieces and cashed out of 60% of them.

As an example, the artwork of Lee Ufan, a Korean minimalist painter and sculptor, created a 38% return for ARTnGUIDE, after it was sold for 2.2 billion won in September 2020.┬Ā

Another online artwork trading platform, Tessa, received 1.2 billion won in pre-Series A funding in the first half of this year. It is now working on additional fundraising for over 2 billion won, while its domestic rival platform Art Together is seeking to raise around 5 billion won in new funding.┬Ā

Korean fractional investing platforms backed by VC firms:

| Company name | Business | Latest funding | Major investors |

| Yeolmae Company | Fractional investment in art | 9.2 billion won (Series A) | SoftBank Ventures Asia, Korea Development Bank, Bass Investment and E&Venture Partners |

| Tessa | Fractional investment in art | 1.2 billion won (pre-Series A) | SpringCamp, Kclavis and CNTTech |

| Musicow | Music copyrights trading | 17 billion won (Series C) | Korea Development Bank, LB Investment, WYSIWYG Studios |

| Buysell Standards | Fractional investment in commodities, including luxury goods | Undisclosed (Seed) | Next Dream Angel Club, KB Investment and New Paradigm Investment |

| Source: Venture capital industry sources | |||

Musicow Inc., South Korea's first music copyright trading platform, has attracted investors with the catchphrase: "Music becomes a stable asset." It has raised a combined 32 billion won in three funding rounds from about 10 institutions since 2019, including the latest round of 24 billion won this year.

Investors are allowed to buy or sell a stake in copyrights to K-pop songs in a public auction or in an online marketplace on the platform. They receive monthly copyright royalties and take profits from an increase in the copyright price.

Recently, it embarked on the public listing process, hiring Mirae Asset Securities as its IPO manager.┬Ā

Currently, shares in copyrights to 920 K-pop songs are being traded on the Musicow platform. Its user number has more than quadrupled on-year to 71,423 users as of end-September, with the value of monthly transactions surpassing 70 billion won.

JOINT OWNERSHIP OF LUXURY ITEMS

Buysell Standards has raised an undisclosed amount of seed funding. It operates the fractional investment platform PIECE for commodities such as Rolex watches. This month, it made its name to the list of promising startups backed by the Ministry of SMEs and Startups.┬Ā

On its platform, the fractional ownership of 11 Rolex watches sold out within half an hour after it was offered at 100,000 won per piece.

Fractional investing has opened up a new investment channel for a broader range of investors, often those who missed out on an opportunity to invest in real estate or promising stocks.┬Ā

But financial experts caution against investing in a tiny fraction of works, in particular, their trading platforms because many of them are not under the supervision of financial regulators.┬Ā

Limited liquidity in the fractional investing market and the lack of appropriate valuation methods add to concerns about the burgeoning market.

"In the worst-case scenario, if the platform company goes bankrupt, its investors cannot recoup their investments," said Hong Ki-hoon, a professor of Hongik University's business school. "Moreover, they will find it difficult to value the underlying assets they are investing in."

Write to Jong-woo Kim at jongwoo@hankyung.com

Yeonhee Kim edited this article.

-

K-pop copyright trading platform Musicow prepares for IPO

K-pop copyright trading platform Musicow prepares for IPOOct 21, 2021 (Gmt+09:00)

1 Min read -

Wealth managementSongs and art: Fractional investing bedazzles millennial investors

Wealth managementSongs and art: Fractional investing bedazzles millennial investorsMay 17, 2021 (Gmt+09:00)

3 Min read -

RetailMillennials now S.KoreaŌĆÖs largest buyer of luxury goods

RetailMillennials now S.KoreaŌĆÖs largest buyer of luxury goodsSep 14, 2021 (Gmt+09:00)

3 Min read