Batteries

Race heats up in solid-state battery development

SES to unveil Li-Metal battery; SK Innovation, Solid Power to jointly develop, produce solid-state batteries

By Oct 28, 2021 (Gmt+09:00)

5

Min read

Most Read

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

Korea's Lotte Insurance put on market for around $1.5 bn

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Global automakers and battery producers are accelerating the development of a next-generation electric vehicle battery, called an all-solid-state battery. Massive investments are being made to begin mass production of the batteries ŌĆō reportedly safer and more durable than existing ones ŌĆō from as early as 2025.

Solid-state technology has been in the spotlight since lithium-ion batteries,┬Ā which most EVs are currently using, have some issues such as the risk of catching fire, analysts said. The technology has the potential to deliver faster charging times and make the packs safer by eliminating the flammable electrolyte solution used in lithium-ion batteries, the Wall Street Journal quoted auto executives and analysts as saying last month.

"Solid-state technology is the game-changer,"┬ĀFrank Blome, who leads battery development at Volkswagen AG, said in March, according to the newspaper.

But there are hurdles to the technology's development. When the electrolyte is completely converted to a solid from a liquid, the ion conductivity decreases and the interfacial resistance increases. The battery can often be charged at high temperatures above 60 degrees Celsius, while the addition of lithium metal into the anode materials damages battery separators, generating a dendrite.

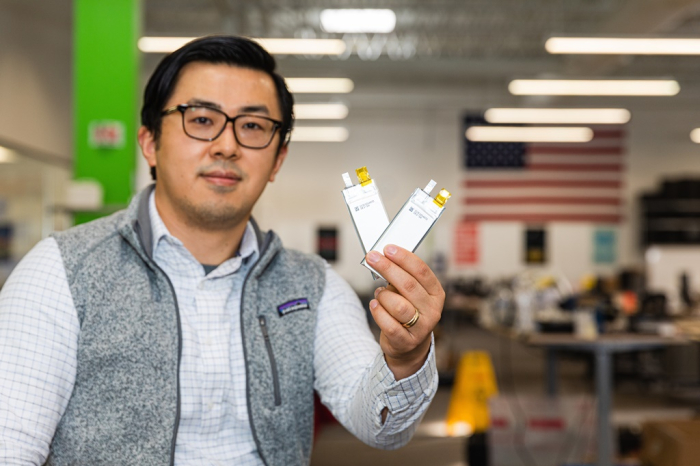

SES TO UNVEIL LITHIUM-METAL BATTERY

SES Holdings Pte. Ltd. (SES), one of the worldŌĆÖs top three all-solid-state battery makers, is set to unveil a lithium-metal (Li-Metal) rechargeable battery that tackles most of the above issues at its inaugural Battery World virtual livestream event, taking place in the US on Nov. 3, and in South Korea and China on Nov. 4, according to industry sources on Oct. 28. SES prevented the ion conductivity from decreasing by mixing about in about 10% liquid instead of allowing the electrolyte to turn completely solid.

The company significantly improved battery performance. Its energy density stood at 417Wh, much higher than the 250-300Wh of existing lithium-ion batteriesŌĆÖ density, increasing mileage of batteries of the same size by 30%.

It also takes 12 minutes to charge the battery to 90% from 10%, faster than the previous record of 18 minutes to charge a battery to 80% from 10%.

The batteryŌĆÖs durability was evaluated as strong. Its performance remained at 80% after charging and discharging was repeated 800 times, equivalent to driving for 300,000 miles, or 480 kilometers. It was also understood to have passed other evaluations such as a thermal stability test.

ŌĆ£The company is differentiated from existing firms since it developed an actual product rather than a laboratory theory,ŌĆØ said an investment banking industry source.

SES, formerly known as SolidEnergy Systems, is scheduled to list on the New York Stock Exchange next month. The US startup plans to build a lithium-metal battery plant in Shanghai, China with an annual capacity of 1GWh by 2023 with the proceeds. It aims to supply samples to its key investors such as General Motors Co. and Hyundai Motor Co., while targeting commercialization in 2025.

SES is not the only player that develops solid-state batteries. Ford Motor-backed solid-state battery developer Solid Power Inc. of the US is another industry leader.

SK INNOVATION, SOLID POWER TO JOINTLY DEVELOP, PRODUCE

South KoreaŌĆÖs SK Innovation Co. signed an agreement with Solid Power on Oct. 28 to develop an all-solid-state battery applied with silicon anode materials. The battery will increase mileage to 930 kilometers from 700 kilometers.

The two companies are set to develop technology to allow existing facilities for lithium-ion batteries to manufacture solid-state batteries. That will help cut initial capital expenditures and bring the batteriesŌĆÖ mass production forward. Solid Power will supply batteries for tests to its investors, including Ford and BMW, by next year. SK Innovation and Ford last month officially┬Ākicked off a joint venture BlueOvalSK, which plans to invest $11.4 billion to build an assembly and battery complex and two additional battery factories in the US.

Cooperation between automakers and battery producers is growing. QuantumScape Corp., a US major solid-state battery maker, joined forces with Volkswagen earlier. Volkswagen poured $100 million into the partner in March, raising its total investment to $300 million. Global investment in battery startups has reached about $2 billion so far with half injected to QuantumScape, according to consulting firm AlixPartners.

Toyota Motor Corp. is developing its own solid-state batteries as it is investing 1.5 trillion yen ($13.2 billion) in EV batteries by 2030.

The Japanese carmaker aims to halve automobile production costs by developing cars and batteries together. It targets a rollout of EVs equipped with solid-state batteries by the first half of the 2020s as previously planned.

PROBLEMS TO SOLVE

Despite growing hopes for solid-state batteries, the battery industry needs to solve various issues ahead of mass production.

Investors doubt if QuantumScape has enough technologies to resolve the issues. Its share prices on Oct. 27 closed at $23.44, a mere one-fifth of its peak of $131 hit in December last year, due to short-selling.

ŌĆ£Solid-state batteries are more stable with higher energy density than lithium-ion batteries. However, it is still unclear whether mass production will be successful. It is also doubtful if mass production will enhance price competitiveness,ŌĆØ said an industry source.

To begin mass production, the industry needs to solve technical issues such as charging in a low-temperature environment and improving the electrical conductivity of electrolytes. It is also key to lower the prices of solid electrolytes.

South KoreaŌĆÖs battery makers ŌĆō LG Energy Solution Ltd., SK On and Samsung SDI Co. ŌĆō aim to start mass production of solid-state batteries around 2030. They are trying to bring it forward, but analysts say that might not be easy.

BMW CEO Oliver Zipse said he was skeptical about how fast mass production of the batteries can take place.

Lithium-ion batteriesŌĆÖ performance and price competitiveness are expected to improve further when solid-state batteries are mass produced. The use of other energy sources such as hydrogen is also predicted to increase. Automakers may not need as many solid-state batteries.

Solid-state batteries may be used only for high-performance cars or personal air vehicles (PAVs) even after mass production, some experts said.

ŌĆ£Solid-state batteries will have to fiercely compete with other energy sources,ŌĆØ said SNE Research CEO Kim Kwang-joo.

Write to Il-Gue Kim and Byung-Uk Do at black0419@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EV BatteriesTeslaŌĆÖs shift to LFP cells to shake global battery industry

EV BatteriesTeslaŌĆÖs shift to LFP cells to shake global battery industryOct 22, 2021 (Gmt+09:00)

3 Min read -

EV batteriesLG Energy, Stellantis to launch $3.4 billion EV battery JV in US

EV batteriesLG Energy, Stellantis to launch $3.4 billion EV battery JV in USOct 18, 2021 (Gmt+09:00)

4 Min read -

-

LG Group joins investment in EV battery startup SES

LG Group joins investment in EV battery startup SESJul 14, 2021 (Gmt+09:00)

1 Min read -

EV batteriesHyundai Motor invests $100 mn in US battery startup SES

EV batteriesHyundai Motor invests $100 mn in US battery startup SESJul 04, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN