[Interview] Battery materials

Enchem: A Samsung hive-off that turns into an electrolyte giant

Already posted a tenfold revenue increase twice in the past decade, it wants another feat in five years, says the CEO

By Oct 15, 2021 (Gmt+09:00)

3

Min read

Most Read

When Cheil Industries, a former chemical unit of South KoreaŌĆÖs largest conglomerate Samsung Group, decided to hive off a business unit that makes electrolytes and outsource the battery material some 13 years ago, no one expected the electric vehicle age would come so soon.

Back then, CheilŌĆÖs electrolyte business posted a mere 10 billion won ($8.5 million) in annual sales as the use of batteries was limited to smaller electronic devices such as smartphones.

Batteries for electric cars have now become the talk of the town in the auto industry and EV battery makers are competing to secure enough raw materials to meet growing demand from carmakers.

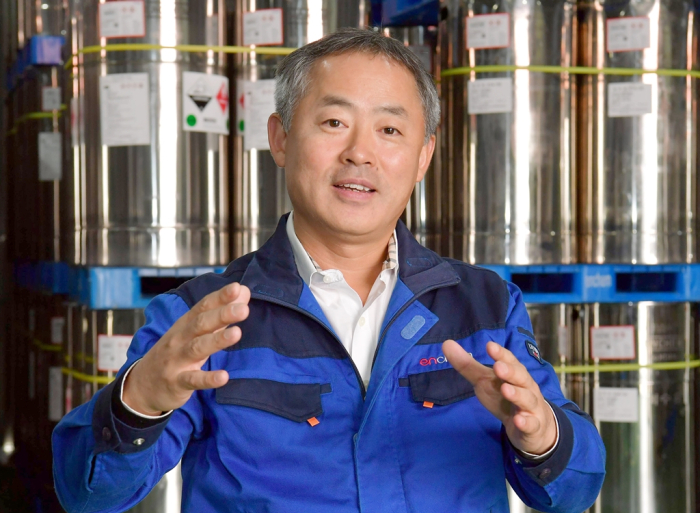

ŌĆ£Almost everyone talked about smartphones for sale of electrolytes at the time. But I thought rechargeable batteries for electric vehicles would have greater growth potential sooner rather than later,ŌĆØ said Oh Jung-Kang, chief executive of Enchem Co., in a recent interview with The Korea Economic Daily.

ŌĆ£The electric vehicle era is already here. The demand for high-power, high-density batteries will grow rapidly,ŌĆØ he said.

Oh, who worked at CheilŌĆÖs battery materials division for years, later moved to Samsung SDI Co. when it absorbed Cheil and then left the company to start his own electrolyte business, Enchem, in 2012.

Capitalized at just 1 billion won, Enchem aggressively looked for its own clients. Oh and his founding members who together worked at Cheil visited local battery makers such as Samsung SDI, LG Chem Ltd. and SK Innovation Co. to secure supply contracts, but they were all turned down.

ŌĆ£Electrolytes could be explosive. So, the big battery manufacturers wanted to get electrolytes from established companies in China and Japan. We had to supply our products only to smaller Chinese companies in the beginning,ŌĆØ said the chief executive.

EXPONENTIAL GROWTH

A business opportunity came in 2013 when LG Chem was looking for a partner to jointly develop secondary batteries for electric cars.

Oh said Enchem was successfully named the supplier of electrolytes to LG and has since secured other major clients such as ChinaŌĆÖs Contemporary Amperex Technology Co.┬Ā(CATL) and SK Innovation.

Now, EnchemŌĆÖs electrolytes are supplied to all of the worldŌĆÖs top 10 EV makers, including Volkswagen and Ford.

Enchem has grown to become the worldŌĆÖs seventh-largest electrolytes producer with its market share of about 5%.

Lithium-ion batteries for EVs consist of four key materials ŌĆō anode materials, cathode materials, separators and electrolytes. The electrolyte is the medium that provides the ion transport mechanism between the cathode and anode of a battery cell.

With the take-off of electric vehicles across the globe, EnchemŌĆÖs sales have also grown exponentially.

The companyŌĆÖs revenue increased tenfold to 20.7 billion won in 2016 from 2 billion won in 2013.

Analysts expect EnchemŌĆÖs sales to post another tenfold increase to about 242 billion won this year.

EYES GLOBAL TOP FIVE PLAYER AFTER IPO

The company is currently working to list its shares on the tech-heavy Kosdaq market by the end of October or early November to raise about 80 billion won to expand facilities.

It plans to expand its facilities in the US, China and Hungary to double its electrolyte production capacity to 125,000 tons a year.

If its initial public offering price is set at the top end of its indicative range of 30,000 won and 35,000 won a share, the companyŌĆÖs total market capitalization will reach 530 billion won.

Some market analysts expect EnchemŌĆÖs corporate value to further rise to 1 trillion won in the near future, given the strong demand for EV battery materials.

ŌĆ£Five years from now, I see our companyŌĆÖs sales at 2.5 trillion won, another tenfold increase,ŌĆØ said CEO Oh. ŌĆ£We aim to become the worldŌĆÖs top five electrolyte maker with our IPO plans.ŌĆØ

Write to Ye-Jin Jun at ace@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Battery materialsSK Nexilis, POSCO move forward with EV battery materials projects

Battery materialsSK Nexilis, POSCO move forward with EV battery materials projectsMay 27, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN