5G races

Huawei, Ericsson or Nokia? Apple or Samsung? US or China? WhoŌĆÖs winning the 5G races?

The competition among equipment makers, countries and cellphone companies is heated. Here are the leaders in each of those races.

By The Wall Street Journal Oct 13, 2021 (Gmt+09:00)

long read

Most Read

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Infrastructure secondaries continue to rise amid inflation: Stafford

Goldman Sachs names Choi Seoul office chief

Golf equipment maker Taylormade to refinance $222 mn of debt

NPS' former key players move to law firms as its voting power increases

Equipment makers, smartphone sellers and chip designers are all vying for control of machines and services that use the fifth-generation wireless standard, which is becoming easier to find across parts of Asia, Europe and North America. Since its start as a series of plans developed by engineers and government policy makers, 5G technology has moved from a rounding error to a multibillion-dollar business for many tech companies.

Like other engineering upgrades before it, 5G has helped reshuffle the global pecking order in the markets for smartphones and cell-tower equipment. At the same time, government officials from Tokyo to Washington are a key part of the global competition, determined to support their 5G industries for economic and geopolitical reasons. Their subsidies and mandates stem from a worry that whichever country dominates the 5G economy will reap the economic rewards for decades to come.

All of which leads to this question: WhoŌĆÖs ahead? Which equipment makers are in the lead and which ones are gaining or losing? Which cellphone companies have jumped out in these early days of 5G deployment? Which countries are leading the way in terms of 5G availability? Below we offer a scorecard, a snapshot in time of some of the most competitive 5G races.

Equipment suppliers

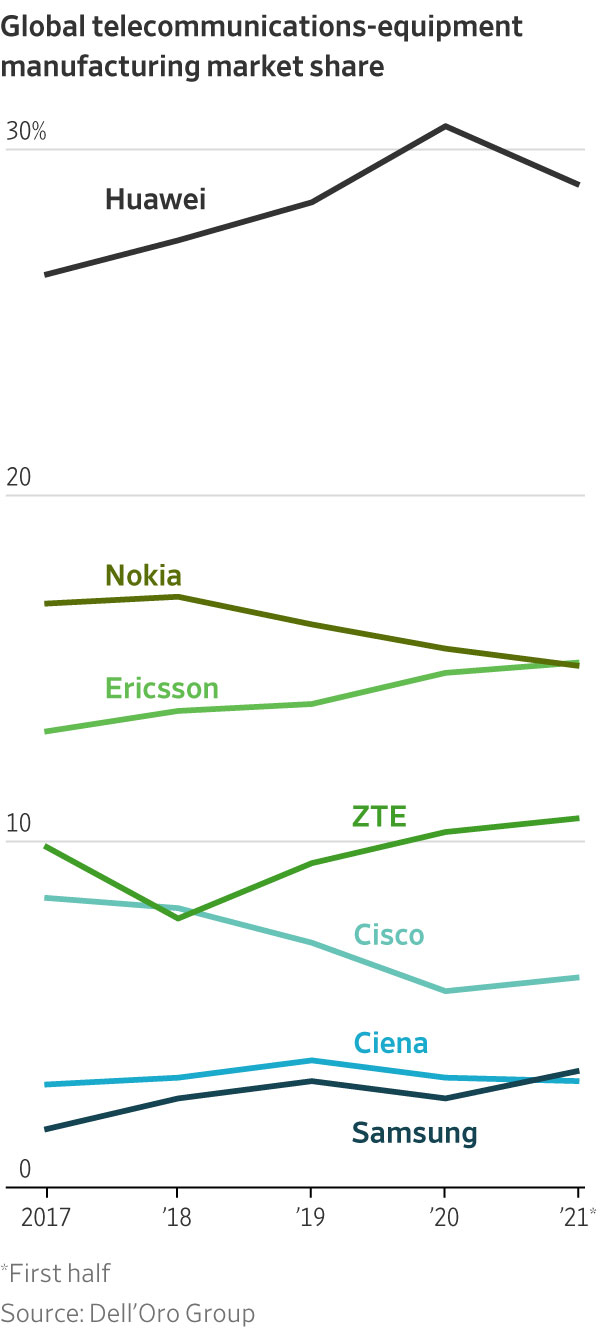

The long-held market positions of the major telecom-equipment suppliers are shifting as the worldŌĆÖs communications carriers build out their 5G networks.

ChinaŌĆÖs Huawei Technologies Co. continues to lead the $90 billion-a-year market for telecommunications equipment, as it has for the past several years. But others are gaining ground, as Huawei faces restrictions from governments around the world thanks to WashingtonŌĆÖs campaign to stifle sales of the companyŌĆÖs equipment over cybersecurity concerns.

At the end of 2020, Huawei had captured more than a 30% share of the market, according to research firm DellŌĆÖOro Group. In the first half of this year, HuaweiŌĆÖs share slipped to 28.8%.

SwedenŌĆÖs┬ĀEricsson┬ĀAB increased its market share to 15% in the first half from 14.7% last year, putting it in second place, while FinlandŌĆÖs┬ĀNokia┬ĀCorp. slipped to third place as its share declined to 14.9% from 15.4%. Ericsson and Nokia have been heading in opposite directions since 2018.

Among competitors with smaller shares, analysts note that South KoreaŌĆÖs┬ĀSamsung Electronics┬ĀCo. boosted its share to 3.2% in the first half, up from 2.4% last year and more than twice the companyŌĆÖs 1.5% share in 2017.

ŌĆ£Outside of China, we estimate that both Ericsson and Samsung are the ones that are gaining share right now,ŌĆØ says┬ĀStefan Pongratz, an analyst at DellŌĆÖOro Group.

Ericsson has made a number of 5G gains, but perhaps none bigger than the five-year, $8.3 billion deal it signed in July with┬ĀVerizon Communications┬ĀInc. Ericsson will supply Verizon with 5G radio systems and software, including a relatively new cellular-antenna technology called massive multiple-input multiple-output, an area where Ericsson has been investing heavily. In late September, the company upgraded its Massive MIMO product line with a lighter unitŌĆöcoming in at 26 pounds, about 40% less than its previous generationŌĆöwhich the company said will make it easier for carriers to deploy 5G.

But the company does face headwinds, particularly in China. Ericsson┬Āhas warned┬Āthat it could lose market share in China as a result of Swedish regulatorsŌĆÖ decision last year to ban Huawei from the Scandinavian countryŌĆÖs 5G wireless networks. Chinese officials have threatened to retaliate.

Nokia has since embraced SoC technology and has undergone a restructuring over the past couple of years, says┬ĀTommi Uitto, the head of its wireless-equipment business. It has streamlined its product portfolio and reduced costs. In one of its latest moves, the company said in March that it would┬Ācut between 5,000 and 10,000 jobs┬Āover the next two years, a move it said would enable it to cut costs and better compete in the 5G equipment market. The savings, it said, would offset additional research-and-development investment, among other things.

ŌĆ£TheyŌĆÖve done a lot of work in the past 18 months to reverse course,ŌĆØ says┬ĀPatrick Filkins, research manager for the internet of things and telecom network infrastructure at International Data Corp., or IDC.

Meanwhile, analysts agree that Samsung is a company to keep an eye on. The South Korean company┬Ādifferentiates itself┬Āwith a range of products that cover all aspects of 5G, from smartphones to base stations to chips. The breadth of products gives the company a slight advantage in that it can fully test its products and optimize their performance before offering them on the market, according to Mr. Filkins.

Samsung in 2020 signed a $6.65 billion contract with Verizon for network equipment and services that covers 5G and 4G infrastructure. The company had been winning 5G deals around that world, but nothing of that size.

ŌĆ£ThatŌĆÖs a game changer for them,ŌĆØ says IDCŌĆÖs Mr. Filkins.

The company has since signed other notable deals. In March, JapanŌĆÖs NTT Docomo Inc. agreed to buy Samsung network equipment. And in June, British telecommunications company┬ĀVodafone┬ĀPLC agreed to use the providerŌĆÖs 5G gear. The terms of the deals werenŌĆÖt announced.

Mr. Filkins thinks Samsung, along with Ericsson and Nokia, is positioned to grow its 5G businesses. ŌĆ£That is as much about HuaweiŌĆÖs challenges in certain countries as it is about technology,ŌĆØ he says. ŌĆ£I think all of them will benefit from that.ŌĆØ

The U.S. is also trying to open the way for┬Ānew 5G equipment vendors┬Ābecause of policy makersŌĆÖ concerns about the predominance of Chinese vendors such as Huawei and┬ĀZTE┬ĀCorp.. The U.S. has sought to foster an alternative by promoting Open RAN, a new technology based on open standards that promises lower-cost equipment and more flexibility.

Despite their promise, though, such vendors still control just a fraction of the market share for 5G equipment, says Mr. Pongratz of DellŌĆÖOro Group.

Smartphones

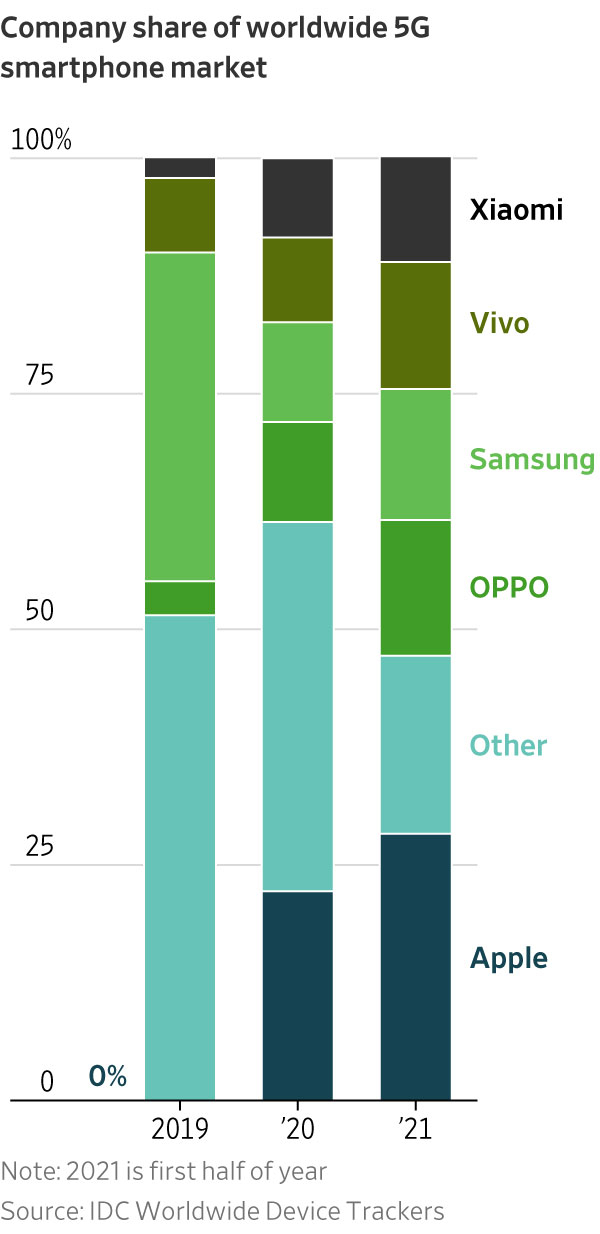

Apple┬ĀInc. has taken an early lead in the 5G smartphone race, but analysts say maintaining it may be a challenge in the ultracompetitive market.

When Apple┬Āintroduced its first 5G-capable smartphones┬Āto great fanfare a year ago, it was months behind rivals like Samsung Electronics. But by the time of this yearŌĆÖs iPhone 13 launch last month, Apple had taken the lead. It held 28.3% of the 5G phone market, as measured by shipments, in the first half of this year, according to IDC. Chinese company Guangdong Oppo Mobile Telecommunications Corp. was second with a 14.4% share, just ahead of Samsung at 13.9% and another Chinese company, Vivo Mobile Communication Co., at 13.5%. ChinaŌĆÖs┬ĀXiaomi┬Āwas next at 11.2%.

Apple has ŌĆ£completely taken the 5G world by storm,ŌĆØ says┬ĀRunar Bj├Ėrhovde, a research analyst at research firm Canalys. AppleŌĆÖs success in the 5G market, he says, has been driven partly by its introduction of several different models, and by the fact that all iPhones 12th generation and beyond are made with 5G technology, meaning consumers looking to buy the latest iPhone have no choice but to buy a 5G model.

The arrival of 5G-capable iPhones also has fueled a boom in the broader market for 5G phones. About 18% of all smartphones being shipped were 5G-capable when the iPhone 12 made its debut. Within three months, 5G devices represented 32% of total handset shipments. The market for 5G smartphones is expected to grow from $161.4 billion last year to $361.8 billion this year, IDC estimates, and reach $454.7 billion by 2025.

Production of 5G smartphones is ramping up across the industry. Mobile-phone chip giant┬ĀQualcomm┬ĀInc. said in its most recent earnings call that growing adoption of the technology could┬Āboost shipments┬Āof 5G phones to the high end of its 450 million to 550 million forecast for this year.

Demand is being driven in part by the growing availability of 5G networks. Apple says that it expects 5G networks to be available from more than 200 carriers in 60 countries and regions around the world by the end of this year.

Analysts say demand for 5G phones would be even stronger if a proverbial killer app had emergedŌĆöa feature that makes adopting the technology virtually indispensable. Demand for 4G phones was driven in part by apps like the ride-sharing and video-streaming services they enabled. ŌĆ£As of now, thereŌĆÖs nothing so unique in terms of use cases,ŌĆØ Ms. Popal says. But the continuing spread of 5G technology means that will likely change, she says.

Countries

When it comes to which country is most reaping the benefits of 5G, China continues to pull ahead, though the U.S. and some of ChinaŌĆÖs Asian neighbors are making strides.

ChinaŌĆÖs lead stems from its head start in the rollout of 5G networks. In July, ChinaŌĆÖs Ministry of Industry and Information Technology said the country had installed 961,000 5G base stations, more than any other country so far. ThatŌĆÖs about one base station for every 1,500 peopleŌĆöan impressive figure for a country as sprawling as China, says┬ĀBill Rojas, an analyst at IDC.

The sheer availability of 5G, coupled with heavy government incentives for all things 5G, has laid the groundwork for the adoption of 5G applicationsŌĆönext-generation technologies designed to reap the benefits of superfast 5G connections.

Early advances in China include 5G-supported mining, in which autonomous machines enabled by the speed and capacity of 5G networks travel deep into coal mines and other dangerous locations in place of humans. In June last year, state-backed telecom operator┬ĀChina Mobile┬Āannounced what it described as ChinaŌĆÖs first 5G coal mine at a 1,752-foot-deep mine site in the coal hub of Shanxi province. The mineŌĆÖs 5G capabilities, jointly developed by China Mobile and Huawei Technologies, allow for applications including mechanized coal mining and remote inspection, the company said. Huawei has announced plans to expand 5G mining to mines across China.

ŌĆ£By supporting this industry, we can grow our business and support more efficient and safer production in mines,ŌĆØ said┬ĀRen Zhengfei, HuaweiŌĆÖs chief executive, during a press conference in Shanxi earlier this year. ŌĆ£We can also enable coal mine workers to wear suits and ties at work.ŌĆØ

Other 5G applications that China is fostering: remote medical applications such as MRIs and surgeries, and autonomous transportation of people and goods, says┬ĀHandel Jones, chief executive of consulting firm International Business Strategies Inc.

ŌĆ£A key characteristic of ChinaŌĆÖs government and industry is to build demand for new technologies,ŌĆØ Mr. Jones says. ŌĆ£The support for building a demand base for new technologies is a key reason that China is moving ahead of the U.S. in many areas of development of new technologies such as 5G and potentially AI.ŌĆØ

To be fair, many of these applications arenŌĆÖt widespread yet, in China or anywhere else. ThatŌĆÖs because to work, they typically require super reliable, low-latency 5G networks of the type that arenŌĆÖt yet widely available. But China is moving ahead in making them available.

The U.S. is lagging behind China in 5G deployment, but not by much. The U.S. had installed roughly 100,000 5G base stations by the middle of this year, estimates Mr. Jones. Accounting for its smaller population, thatŌĆÖs one base station for every 3,300 or so people.

When it comes to 5G applications, the U.S. has taken the unsurprising approach of leaving the heavy lifting to the private sector. Many companies have come forward with similar innovations to those being developed in China.

One obstacle to their wider adoption and a greater number of 5G applications is some carriersŌĆÖ lack of access to the radio frequencies best suited for 5G coverage. Only last year did the U.S. Federal Communications Commission start to free up a significant block of ŌĆ£midbandŌĆØ spectrum, a valuable piece of digital real estate that carriers have been eager to claim for their 5G networks. Carriers are set to begin using the new airwaves later this year.

ŌĆ£The challenge in the U.S. is the carriers mostly didnŌĆÖt have access to new spectrum,ŌĆØ says┬ĀIan Fogg, vice president of analysis at Opensignal, a mobile-industry research firm.

Other countries are also dabbling with 5G applications, though in some cases they remain in their infancy.

Japan, for example, has long been behind in 5G deployment, hampering the development of 5G applications. The country developed some 5G applications for the Tokyo Olympics, including the use of drones that filmed events like sailing and golf up close, beaming the signals to spectators over 5G networks. And 5G was launched for commercial use in Japan in March 2020. By then, other countries like the U.S. and South Korea had already begun deploying 5G.

The Japanese government is now trying to catch up and promote 5G development by giving tax cuts to companies building private 5G networks for applications like smart factories and farms. They can choose either a 15% tax deduction or a 30% special depreciation for 5G-related investments.

South Korea, which enjoys some of the worldŌĆÖs fastest 5G networks and was among the first to deploy them, is also throwing its weight behind new 5G applications. In July, the countryŌĆÖs Ministry of Science and ICT announced plans to spend 49 trillion won, or about $41 billion, over the next four years to help establish specialized 5G networks designed to support new applications like smart factories.

Write to JOHN MCCORMICK at john.mccormick@wsj.com

Mr. McCormick is deputy editor of WSJ Pro Artificial Intelligence in New York. He can be reached at john.mccormick@wsj.com. Ms. Bobrowsky and Mr. Strumpf are Wall Street Journal reporters in San Francisco and Hong Kong, respectively. They can be reached at meghan.bobrowsky@wsj.com and daniel.strumpf@wsj.com. Drew FitzGerald in Washington, D.C., and Megumi Fujikawa in Tokyo contributed to this article.

┬Ā

More to Read

-

5G smartphonesSamsung unveils low-end 5G phone to rival ChinaŌĆÖs cheap models

5G smartphonesSamsung unveils low-end 5G phone to rival ChinaŌĆÖs cheap modelsJun 04, 2021 (Gmt+09:00)

2 Min read -

5G equipmentSamsung unveils mid-band 5G equipment to target $9.9 bn US market

5G equipmentSamsung unveils mid-band 5G equipment to target $9.9 bn US marketApr 20, 2021 (Gmt+09:00)

1 Min read -

Samsung 5GSamsung replaces Huawei in Canada as SaskTelŌĆÖs 5G supplier

Samsung 5GSamsung replaces Huawei in Canada as SaskTelŌĆÖs 5G supplierMar 17, 2021 (Gmt+09:00)

3 Min read -

SK Telecom tackles 5G content business

SK Telecom tackles 5G content businessOct 21, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN