S.Korea plans to tighten ability-to-repay rules

Financial regulators to tighten assessment of borrower's ability to pay back loans

By Sep 27, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

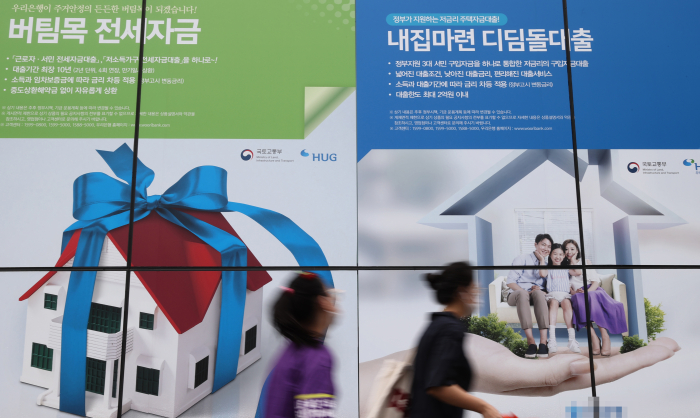

South Korea's new household lending rules, set to be unveiled next month, will center on tightening the assessment of borrowers' repayment capability as the government is determined to step up curbs on household lending, the country's top financial regulator said on Monday.

"The most important lending standards are whether the borrower is capable of repaying the loan in whatever situation on a stable basis," Financial Services Commission (FSC) Chairman Koh Seung-beom said in a meeting with the country's economic and financial market experts on Sept. 27.

"The new measures on household lending, to be announced early or in the middle of next month, will focus on tightening the review of the borrower's repayment capability ... We will implement new measures in stages on a continual basis to clamp down on snowballing household debt," he noted.

The FSC, South Korea's top financial watchdog, will keep in place the total quantity control on household loans, under which annual lending growth is capped at 5-6% based on the lender's outstanding household loan balance, until next year.

The regulator plans to further lower the limit to 4% from next year.

DEBT SERVICE RATIO

Since July of this year, South Korea has been restricting mortgages on houses priced over 600 million won ($510 million) each in areas under close monitoring by the government to 40% of the borrower's annual salary. Under the new debt service ratio (DSR), credit loans of over 100 million won should not exceed 40% of the borrower's annual income, regardless of their salary.

The government plans to expand the DSR-related rules to all consumer loans of over 200 million won from July 2022 and to all individual borrowers of over 100 million won from July 2023.

The regulatory body might bring forward the toughening DSR-related lending rules, according to industry sources, which FSC's Koh did not deny.

"The upcoming lending rules could be related to the DSR," he told reporters after the meeting. "We will push for various measures to introduce the practice of restricting lending to the borrower's repayment capacity."

Last week, financial industry sources said the regulators were considering curbing margin loans offered by brokerage companies to stock investors, as part of new measures aimed at reining in soaring household debt.

Specifically, margins loans could be included in the calculation of the DSR, or the debt principal against the borrower's annual income, according to the sources. Currently, the DSR is based mainly on mortgage and credit loans

With housing prices showing no signs of easing, household debt last month grew by 9.5% from a year earlier.

Meanwhile, the top regulator was cautious about clamping down on lending in relation to the jeonse system, a traditional Korean rent system in which tenants pay a lump-sum deposit to lease the home because the jeonse loans are made to renters as well as speculative investors.

Write to Ho-Gi Lee at hglee@hankyung.com

Yeonhee Kim edited this article.

-

Retail investorsSeoul may curb margin loans to rein in household debt

Retail investorsSeoul may curb margin loans to rein in household debtSep 23, 2021 (Gmt+09:00)

3 Min read -

-

EconomyNew FSC chief nominee tough on household debt, against cryptocurrencies

EconomyNew FSC chief nominee tough on household debt, against cryptocurrenciesAug 06, 2021 (Gmt+09:00)

2 Min read