Shares of Hyosung, Kolon Industries fly high propelled by hydrogen

Hyosung and its longtime rival Kolon are performing well as their share prices more than doubled this year

By Sep 24, 2021 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

US auto parts tariffs take effect; Korea avoids heavy hit

Shares of hydrogen-related stocks such as Hyosung Advanced Materials Corp. and Kolon Industries Inc. are flying high on expectations of significant gains in quarterly earnings amid an industry shift toward the hydrogen economy.

According to financial data company FnGuide, Hyosung Advanced Materials, the carbon fiber manufacturing unit of Hyosung Group, is forecast to post a record operating profit of 137.3 billion won ($117 million) in the third quarter, up 1,053% from 11.9 billion won a year earlier.

Sales are projected to rise 46% to 932.3 billion won from 636.8 billion won.

Hyosung is the only Korean company that can produce high-intensity carbon fibers used to make hydrogen tanks. The hydrogen tank accounts for about 20% of the costs of a hydrogen vehicle.

Hyosung said it plans to expand its annual carbon fiber production volume to 24,000 tons by 2028 from the current 4,000 tons.

Hydrogen-related stocks have been outperforming other industries amid a nationwide push for one of the most promising sources of clean fuel for a net-zero emission world.

On Friday, Hyosung Advanced Materials rose as much as 9.8% to an all-time high of 877,000 won. Year to date, the stock has risen more than fivefold.

HIGHER ENTRY BARRIER

Shares of Kolon Industries, a maker of polymer electrolyte membranes (PEM), a key material for fuel cells for hydrogen cars, have also performed strongly this year.

Kolon’s stock price more than doubled year to date to trade at 111,000 won in late Friday.

Kolon Industries is expected to post an operating profit of 70.9 billion won on revenue of 1.13 trillion won in the third quarter, up 147% and 18%, respectively, from a year earlier, according to FnGuide.

Kolon is one of the leading Korean makers of PEM, which until recently was imported from overseas companies such as 3M.

Analysts say hydrogen stocks will continue to be the market darlings as hydrogen, deemed the “fuel of the future,” is primed to offer attractive opportunities for investors.

“Hydrogen-related materials such as carbon fiber and PEM require high levels of technology to produce, meaning high levels of entry barriers for newcomers, which is good for companies like Hyosung and Kolon,” said an industry official.

LONGTIME RIVALRY

Kolon and Hyosung have for decades been rivals against each other, particularly in the fiber and textile businesses.

In 1957, Kolon Group started its first enterprise Korea Nylon (Kolon) Inc., which has now become Kolon Industries and Kolon Materials.

The group heralded the creation of the nylon industry in South Korea by building the country’s first nylon yarn plant in Daegu city in 1958.

Despite its longstanding leadership in the textile industry, Kolon has relatively received little attention from analysts and investors due to rival Hyosung Group’s spectacular performance.

Hyosung Group is enjoying unprecedented growth in its market capitalization this year, spearheaded by Hyosung TNC Corp.’s strong performance in the spandex sector.

Kolon Group is striving to make a meaningful comeback this year to challenge Hyosung Group in future-growth segments including hydrogen.

Write to Jeong-Min Nam at peux@hankyung.com

In-Soo Nam edited this article.

-

Hydrogen economyHydrogen: Next big thing for stock investors in Korea

Hydrogen economyHydrogen: Next big thing for stock investors in KoreaSep 13, 2021 (Gmt+09:00)

4 Min read -

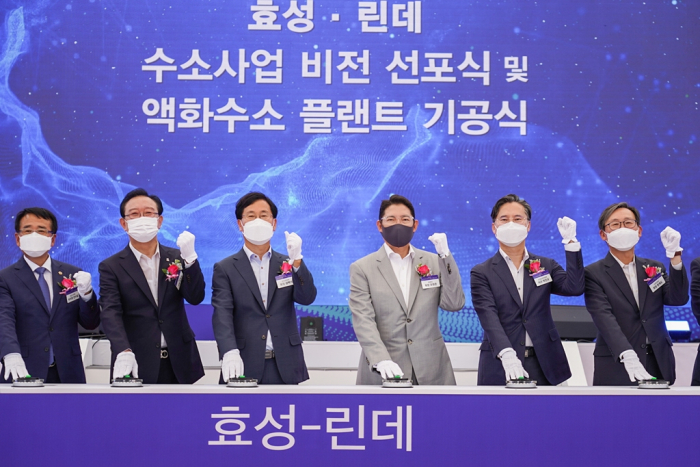

Hydrogen economyHyosung, Linde kick off building world’s largest liquid hydrogen plant

Hydrogen economyHyosung, Linde kick off building world’s largest liquid hydrogen plantJun 21, 2021 (Gmt+09:00)

2 Min read -

Fiber and textileKolon Industries to lead Kolon Group's remarkable comeback in 2021

Fiber and textileKolon Industries to lead Kolon Group's remarkable comeback in 2021Jun 18, 2021 (Gmt+09:00)

4 Min read -

Hydrogen economyHyundai, SK, POSCO, Hyosung agree to launch Korea’s hydrogen council

Hydrogen economyHyundai, SK, POSCO, Hyosung agree to launch Korea’s hydrogen councilJun 10, 2021 (Gmt+09:00)

3 Min read -

Hydrogen economyKolon Industries to mass produce key material for fuel cells

Hydrogen economyKolon Industries to mass produce key material for fuel cellsNov 19, 2020 (Gmt+09:00)

2 Min read