Alternative investments

KB Fin, Shinhan invest in Sweden's wind farm via joint fund

S.Korea's two top banking groups to develop the vehicle into global co-investment platform

By Sep 17, 2021 (Gmt+09:00)

2

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Money pours in for technology to reshape Korean restaurants

South Korea's two banking giants -- KB Financial Group and Shinhan Financial Group -- have invested a combined 80 billion won ($68 million) in a wind farm project in Sweden through their joint global energy fund launched this year.

The fund has acquired a 45% stake in Gubbaberget Wind Farm which will have an electricity generation capacity of 74.4 megawatts (MW), Shinhan said on Thursday.

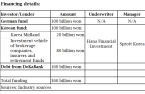

Kookmin Bank, Shinhan Bank, KB Insurance Co. and Shinhan Life Insurance Co. each injected 20 billion won into the Global Green Energy Partnership Fund for its first investment.

Korea Midland Power Co., wholly owned by power utility KEPCO Co., will take the remaining 55% stake and oversee the project.

Other than KB, Shinhan and Korea Midland Power, KEPCO-owned Korea Hydro & Nuclear Power Co. and Sprott Korea Investment participated in the renewable energy fund.

Sprott Korea, part of Canada-based Sprott Asset Management, is in charge of the joint fund, together with Shinhan Asset Management Co.

In addition to the investment, the banking arms of KB and Shinhan -- Kookmin Bank and Shinhan Bank -- have issued letters of credit to finance the construction equipment purchase by Gubbaberget Wind Farm. They are also considering providing loans, or additional payment guarantees for the project, according to Shinhan.

CO-INVESTMENT PLATFORM

KB and Shinhan plan to increase their capital commitments to the investment vehicle, mobilizing their units ranging from banks to insurers to brokerage firms, to expand their portfolio.

"Going forward, Shinhan Financial and KB Financial will develop the Global Green Energy Partnership Fund into a renewable energy co-investment platform in close cooperation with Korea Midland Power, Korea Hydro & Nuclear Power and Sprott Korea Investment. We will expand our investment not only in Europe and North America, but also in other parts of the world," Shinhan said in a statement.┬Ā┬Ā

The wind farm investment also aligns with their efforts to comply with the environmental, social and governance standards. KB Financial is aiming to expand ESG-themed products launch, investment and lending to as much as 50 trillion won by 2030 under its Green Wave 2030 initiative.

Shinhan Financial set a goal of achieving zero emissions for its loan portfolio under its Zero Carbon Drive, meaning its corporate borrowers must become carbon neutral by the government-set timeline of 2050.

Back in 2019, Korea Midland Power acquired Stavro Wind Farm in Sweden in a consortium with a German pension fund and domestic financial investors for 360 billion won. Stavro, with a capacity of 254.2MW, is set to begin commercial operation later this year. Sprott Korea was involved in the investment as well.

Write to Dae-hun Kim at daepun@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

EnergyKorean companiesŌĆÖ race heats up in $2.8 tn global wind farm markets

EnergyKorean companiesŌĆÖ race heats up in $2.8 tn global wind farm marketsAug 05, 2021 (Gmt+09:00)

2 Min read -

-

KEPCO unit-German fund buys SwedenŌĆÖs wind project for $300 mn

KEPCO unit-German fund buys SwedenŌĆÖs wind project for $300 mnAug 31, 2019 (Gmt+09:00)

2 Min read

Comment 0

LOG IN