Private debt

Monroe Capital opens first Asian outpost in Seoul

The Seoul office becomes the private credit provider's first office outside the US

Sep 14, 2021 (Gmt+09:00)

2

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

The US private credit markets-focused Monroe Capital LLC has made its foray into Asia by opening an office in South Korea, where the National Pension Service (NPS) and other retirement funds are ramping up private debt investments.

Seoul has also become the first overseas office for the Chicago-based boutique investment firm.

With the new office launch, it has appointed Alex Kim, ex-CEO of Aberdeen Standard Investments' South Korean operations, as managing director and head of Asia based in Seoul.

"The newly opened office in Seoul, South Korea, reflects MonroeŌĆÖs commitment to expanding its business in Asia ... We look forward to continued strategic growth and expansion into the Asian markets,ŌĆØ the company said in a statement on Tuesday.

ŌĆ£Over the last few years, we have seen more and more interest in the Monroe platform from Korean and Asian investors. This is a great opportunity to expand our footprint in this region,ŌĆØ said Ted Koenig, President and CEO of Monroe Capital.

With $10.3 billion in assets under management, Monroe specializes in private credit markets across strategies of direct lending, asset-based lending, specialty finance, opportunistic and structured credit and equity.

Excluding its Chicago headquarters and Seoul, it operates offices in Atlanta, Boston, Los Angeles, New York, San Francisco and Naples in Florida.

Founded in 2004, the asset manager provides credit facilities to companies in the US and Canada. Its investor base consists of public and corporate pensions, endowments and foundations, insurance companies, regional banks, family offices and high net worth individuals.

The incoming Asia head Kim had also led the Southeast Asian operations of the UK-based Aberdeen Standard Investment, which managed public-private partnership funds and separately-managed accounts for Korean institutional investors, including Korean Teachers' Credit Union and Korea Scientists and Engineers Mutual-aid Association.

Prior to Aberdeen, Kim had worked at Russell Investments, Royal Bank of Scotland and Pacific Investment Management Co. (PIMCO). He earned his bachelor's degree in political science from the University of California, Irvine.

ŌĆ£Alex is a great addition to lead our institutional efforts as well as show our commitment to the Asian community. He brings with him many great relationships across the region,ŌĆØ Monroe Capital's Managing Director and partner R. Sean Duff said in the statement.

The NPS, the world's third-largest pension fund, is planning to create a new investment team dedicated to private debt and secondaries deals as well as equity purchases of asset managers, within the Private Equity & Venture Capital Investment Division.

(Amended on Sept. 15 to clarify Naples is a city in the US state of Florida, not in Italy)

Yeonhee Kim edited this article.

More to Read

-

Pension fundsNPS to create private debt, secondaries-focused team

Pension fundsNPS to create private debt, secondaries-focused teamAug 26, 2021 (Gmt+09:00)

2 Min read -

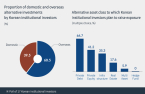

Korean investorsŌĆÖ surveyKorean LPs favor direct lending for private debt investment

Korean investorsŌĆÖ surveyKorean LPs favor direct lending for private debt investmentNov 17, 2020 (Gmt+09:00)

2 Min read -

Korean investors' surveyKorean investors pick private debt as preferred asset class

Korean investors' surveyKorean investors pick private debt as preferred asset classOct 27, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN