Refineries

Korea refiners' recovery accelerates on strong margins

Q4 profits to improve on slowing Chinese petroleum product exports, increasing Indian fuel demand

By Sep 13, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Margins are predicted to remain strong thanks to increasing rollouts of COVID-19 vaccinations around the globe, supporting refiners’ earnings in the second half.

MARGINS AT TWO-YEAR PEAK

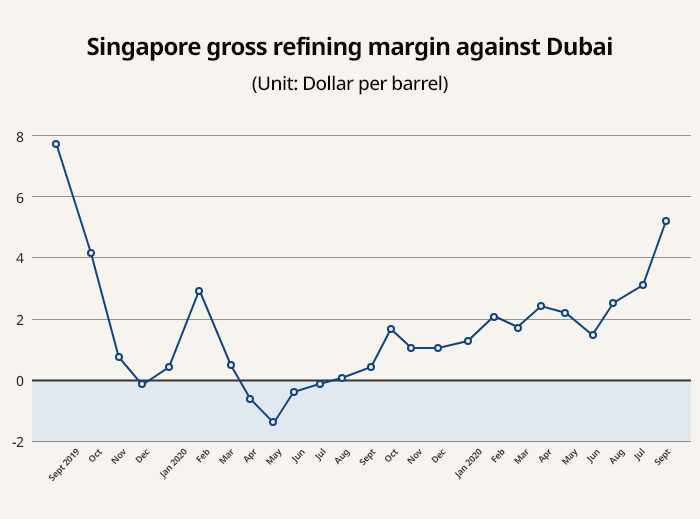

The benchmark Singapore gross refining margin against Dubai surged 37% on-week to $5.2 a barrel in the second week of this month, the highest since September 2019, according to refining industry sources on Sept. 13. The margin fell to minus $1.5 per barrel in May 2020 when the pandemic hit global fuel demand.

Margins need to be around $4 for the industry to break even, but domestic refiners were able to take profit even with margins below that level given their healthy fundamentals, the industry sources said.

The margin was boosted this month as Chinese refiners cut refined product exports and Indian fuel demand increased.

China is reducing crude oil import quotas for independent refiners, also known as teapots, while cutting petroleum oil export quotas for state-run refiners in a move to meet President Xi Jinping’s goal of achieving carbon neutrality by 2060, according to industry sources. West Pacific Petrochemical Corp. (WEPEC) slashed runs of its export-oriented 200,000 barrel-per-day refinery in Dalian to 85% in August from 96% in June.

REVIVING INDIA

Petroleum consumption in India, the world’s third-largest crude importer, is also growing. Increasing vaccinations and the upcoming harvest season are raising demand for gasoline and diesel, according to industry sources.

“Petrol sales volume has already crossed pre-Covid levels, with diesel likely to get there in the next two to three months,” Shrikant Madhav Vaidya, chairman of Indian Oil Corp., the country’s biggest refiner, said on Aug. 27 during the state-run company’s annual general meeting.

“With the recovery in the overall demand, refining and other related operational parameters have demonstrated an even more pronounced turnaround compared to the previous year.”

Crude oil prices are also rising, ramping up inventory gains, amid tight supply after Hurricane Ida last month hit the US Gulf coast -- where about 45% of the country’s crude production facilities are located.

About three-quarters of the US Gulf's offshore oil production, or about 1.4 million barrels per day, has remained halted since late August, according to a Reuters report. That is roughly equal to what OPEC member Nigeria produces, the report said.

BUT HOW LONG CAN IT LAST?

South Korea’s four refiners reported a total 4 trillion won ($3.4 billion) in operating profit in the first half as strong performance of non-refining sectors including petrochemicals and lubricants offset weak refining margins during the period.

Margins are expected to improve further as increasing vaccinations are predicted to raise mobility and fuel demand, industry sources said. Some predicted fuel demand would recover to pre-pandemic levels in 2022.

However, local refiners are unlikely to report as strong earnings in the third quarter as they did in the second given smaller gains in crude prices and concerns over a spread in the Delta variant of COVID-19, industry sources said.

“Oil prices are keeping at stable levels, which will help improve the industry’s earnings as we move into the fourth quarter. What is key is how long refining margins can stay as strong as they are now,” said one source.

Write to Jeong Min Nam at peux@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN