IPOs

Social casino game maker DoubleDown Interactive resumes US IPO process

After a failed attempt in July 2020, the game publisher is again pushing for an IPO in a more favorable market

By Aug 26, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

DoubleDown Interactive LLC, a subsidiary of DoubleUGames Co., has resumed the process to go public on Nasdaq after more than a year has passed from its initial try in July 2020.

DoubleDown said on Aug. 26 that the company has kicked of its roadshow, which is a series of sales presentations pitched in different locations to make up an initial public offering (IPO). Roadshows typically run for more than two weeks and even up to a month.

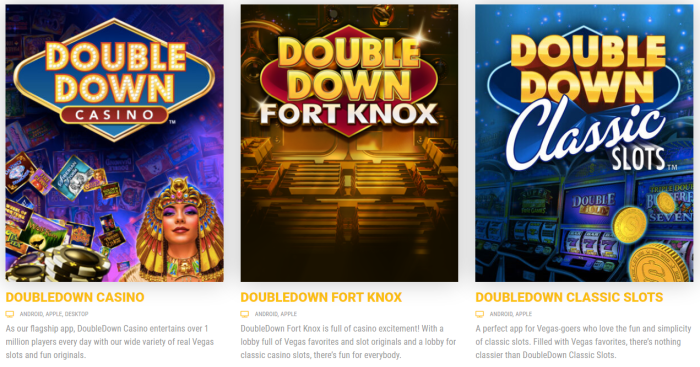

The expected unit price of the social casino game maker’s IPO shares is $18-20, a dollar higher than its first attempt last year. Its market cap will be $892-991 million depending on the final price of its IPO shares. The company is known for its mobile social casino games DoubleDown Casino, DoubleDown Fort Knox and DoubleDown Classic Slots.

DoubleDown will be raising about $95 million from the IPO. The company said that the raised funds will be used for developing next-generation games as well as M&As. The parent company DoubleUGames and another financial investor STIC Investments are also expected to be making investment returns by selling their shares in the market.

The investment banking industry is keeping a close eye on whether the casino game maker will be able to reach a valuation of 1 trillion won ($854 million) in the US market. The company’s last-year IPO attempt amid the COVID-19 pandemic failed largely as the institutions had proposed much lower price bands than DoubleDown’s asking price.

Industry watchers highlight that the stock market environment is more favorable for DoubleDown than last year, with the Nasdaq index breaking new records every day. They also note that the South Korean game company Netmarble Co. has recently acquired the world’s third-largest social casino game publisher SpinX Games for $2.2 billion.

DoubleDown and its parent company DoubeUGames currently hold a combined market share of 8.1% in social casino games. Its revenue last year was 422.9 billion won ($361.4 million), up by 32.6% versus 2019. The operating profit during the same period also grew by 44% from 45 billion won ($38.5 million) to 64.8 billion won ($55.4 million).

In case of a successful IPO, DoubleDown will be listed on Nasdaq as an American depository share (ADS), a US dollar-denominated equity share of a foreign-based company available on an American stock exchange, and will start trading from Sept. 30 under the ticker DDI.

Write to Ye-jin Jun at ace@hankyung.com

Daniel Cho edited this article.

More to Read

-

Game and entertainmentNetmarble’s new Marvel game tops App Store downloads in 117 countries

Game and entertainmentNetmarble’s new Marvel game tops App Store downloads in 117 countriesAug 25, 2021 (Gmt+09:00)

1 Min read -

-

Comment 0

LOG IN