Foreign exchange

Record ‘Sell Korea’ knocks down stocks, won

Kospi suffers longest losing streak in near three years; won hits 11-month low

By Aug 19, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

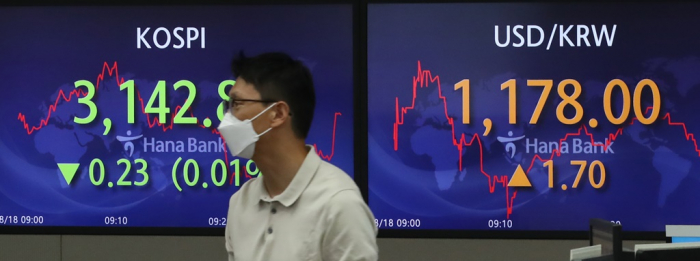

Fears are growing over ‘Sell Korea’ as foreign investors dumped the country’s stocks at a record high, pushing down the won currency to an eleven-month low. Sentiment among overseas investors weakened on the sluggish outlook on the DRAM industry, potential US monetary policy tightening and increasing COVID-19 infections.

Foreigners sold a total 28.7 trillion won ($24.5 billion) in Seoul stocks to Aug. 18 from the beginning of 2021, the largest ever for such a period, according to the Korea Exchange. Their selling for the whole year could exceed an all-time high of 33 trillion won in 2008 during the global financial crisis if the trend continues. The main Kospi on Aug. 17 slid for an eighth straight session, the longest losing streak since October 2018.

As a result, foreign holdings in South Korean stocks tumbled to 31.5% as of Aug. 17, the lowest since April 2016, from about 36% at the beginning of the year.

That compared with strong demand in other countries. Indian stock markets hit record highs with stock inflows of $7 billion, while foreign investors bought a net $1.3 billion in Indonesian shares.

The selling spree in Seoul stock markets pushed down the won. The South Korean currency on Aug. 18 skidded to as weak as 1,179.7 against the dollar, the softest since Sept. 16, 2020, before rebounding to close the local trade at 1,168, up 0.7% on the day. A finance ministry official warned against the currency’s weakness, saying the authorities were closely monitoring exchange rates.

The official said the won slumped due to foreigners’ dollar demand for repatriation after stock sell-off but the decline was an issue since it was seen as “overshooting.”

The won has lost about 7% versus the greenback so far this year, the second-worst performing unit among emerging Asian currencies, according to Reuters data.

“The won could weaken below the 1,200 level briefly depending on foreigners’ supply and demand, as well as the Fed tapering,” said HI Investment & Securities’ chief economist Park Sang-hyun.

DRAM WOES

Earlier this year, foreigners unloaded South Korean shares mainly to book profits from their healthy rises last year. But their recent selling spree was due to concerns that chip demand could peak in the fourth quarter. Foreigners sold a combined 22.5 trillion won in Samsung Electronics Co. and SK Hynix so far this year with some 15 trillion won dumped in the recent one week. Samsung fell for the ninth straight session, the longest losing streak since 1996.

Local investors are keeping an eye on when foreigners stop dumping. Selling related to worries about the DRAM industry may have been over, some analysts said. Foreigners on Aug. 18 bought a net 107.2 billion won in SK Hynix.

“Foreign brokerage houses’ forecasts of a fall in DRAM prices led foreigners’ sell-off, but the current stock prices have reflected concerns over the sector’s future business conditions,” said a Daeshin Securities analyst Lee Kyung-min.

“Foreign stock holdings in chipmakers fell below 51% to the level at the trough of the semiconductor cycle, so foreigners are unlikely to sell further.”

TAPER TANTRUM

Investors, however, remained worried as the Federal Reserve may scale back its massive asset purchase program on a healthy US labor market when the COVID-19 is predicted to hurt South Korean economy and corporate earnings. The Wall Street Journal reported on Aug. 16 the Fed may start tapering in November.The US central bank formalized the tapering discussion at the Federal Open Market Committee (FOMC) in June. The tightening is expected to strengthen the dollar and spur capital outflows from emerging countries including South Korea. The foreign selling spree in Seoul’s stock markets could accelerate if the Feb takes an action, some analysts said.

“Foreigners are likely to keep selling stocks until the tapering issue becomes full fledged,” said a KB Securities analyst Ha In-hwan. “They could sell about 5 trillion won more, compared to the 2013 taper tantrum.”

The global economy started losing steam on a resurgence in the COVID-19, putting further pressure on the local stocks. US retail sales in July fell 1.1% on the month, according to Commerce Department data on Aug. 17, missing expectations.

Write to Jae-won Park, Ik-Hwan Kim and Sulgi Lee at wonderful@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Korean chipmakersKorean chipmakers tumble, wipe out $13 billion in market capitalization

Korean chipmakersKorean chipmakers tumble, wipe out $13 billion in market capitalizationAug 12, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN