China, S.Korea top BofA's emerging markets list

Fast digitization of the economy and high resilience to capital outflows may outweigh high valuation

By Jul 23, 2021 (Gmt+09:00)

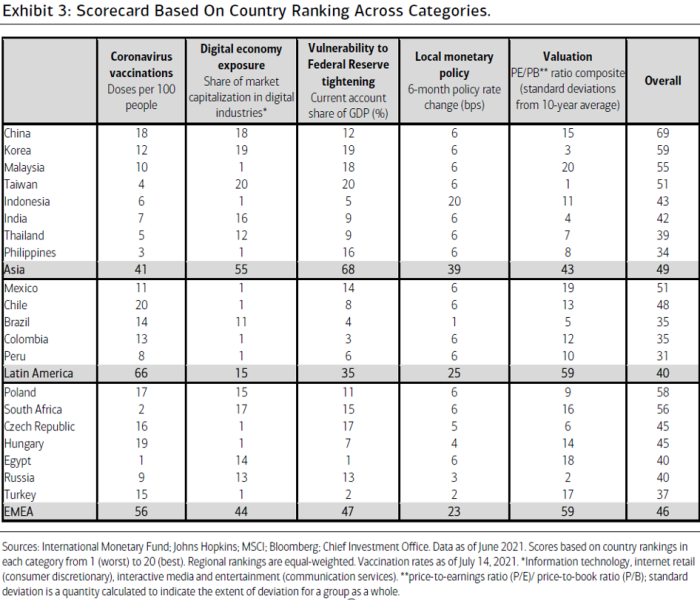

South Korea was picked as one of the two most attractive emerging markets along with China thanks to the country's fast digitization and low vulnerability to capital outflows, the Bank of America's (BofA) recent study shows.

South Korea ranked in second place after China on the list of 20 emerging markets. It received an almost perfect score in terms of resilience to capital outflows with 19 on a scale of 20, and won 18 scores in the degree of digitization of the economy.

But in terms of valuation, BofA rated South Korea as the third most expensive market. The world's 12th-largest economy was placed third from the bottom on the list of assessing how much overvalued the market is. It scored just three out of 20.

Taiwan was rated the most expensive market among the 20 countries, and Russia came next, according to the BofA report released on July 19.

The US securities firm analyzed 20 emerging markets in terms of five aspects: vaccination rate; degree of digitization of the economy; vulnerability to the US Federal Reserve's shift to a tightening stance, or current account surplus against the gross domestic product; monetary policy; and valuation.

The five items were evenly weighted for a maximum score of 100 in total. On a scale of 100,┬Ā South Korea got a score of 59, only after China with 69.

In comparison, China got higher scores for both the vaccination rate and valuation, while winning the same score in the digitization as South Korea.

The 20 countries on the list include China, South Korea, Taiwan and five other Asian countries; five nations in Central and South America; and seven countries in Europe, Middle East and Africa including Poland and Turkey.

NH Investment & Securities analyst Pyeon Deuk-hyeon agreed that Chinese stock market valuations are low enough to attract new investors after the recent tensions between the US and China sent Chinese stocks lower.

Pyeon added that Chinese stock markets have strong upside potential as the economy recovers from the global pandemic, supported by the country's low inflationary pressure and low asset valuations.

Write to Sul-gi Lee at surugi@hankyung.com

Yeonhee Kim edited this article.

-

-

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate view

Foreign exchangeKorean won at 17-month low on Middle East woes, Fed rate viewApr 16, 2024 (Gmt+09:00)

-

-

-

EconomyAs many as one in 10 residents in South Korea likely to be foreign by 2042

EconomyAs many as one in 10 residents in South Korea likely to be foreign by 2042Apr 11, 2024 (Gmt+09:00)