Corporate investment

Investors give warm welcome to Korean firms' capex hike for future growth

Listed firms’ first-half investment more than doubled to 7 trillion won, sending their shares higher

By Jul 16, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Capital raising through new share sales and debt to expand facilities wasn’t good news for investors as the move often led to a fall in share prices on concerns it could hurt companies’ financial health.

Now, they have changed their mind. Investors are snapping up shares of promising manufacturers, big and small companies alike, as soon as they announce major investment plans.

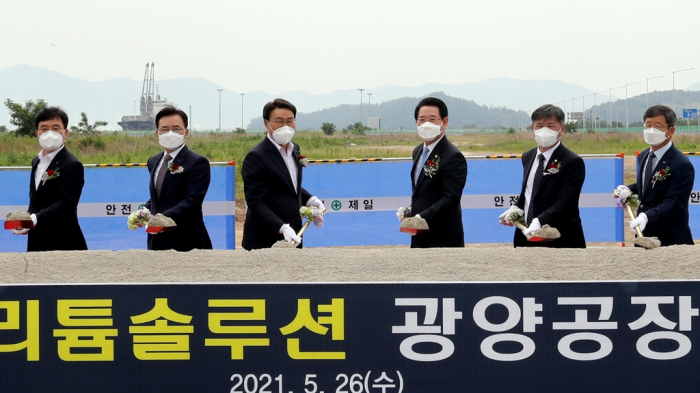

In mid-May, EcoPro BM Co., a South Korean battery materials maker, said in a regulatory filing that it is spending 134 billion won ($117 million) to build a new factory to manufacture cathode materials. Its stock surged 56% in one and a half months following the announcement.

When Lotte Chemical Corp. said earlier this week it is investing 4.4 trillion won in hydrogen projects by 2030 to move away from its mainstay petrochemicals and foster hydrogen as its new growth driver, its shares rose 5.5% on the day.

“In the past, investors didn’t like companies’ aggressive investments after raising capital through a rights offering or a bond sale. But apparently, they now think an active investment is a good thing, believing that it can strengthen companies’ competitiveness,” said a stock analyst.

According to the Financial Supervisory Service on Thursday, companies’ facilities investment totaled about 7 trillion won in the first six months of this year, up 161% from a year ago.

Smaller companies listed on the junior Kosdaq market reported that their announced investments more than trebled to 1.34 trillion won in the cite period.

GROWTH OPPORTUNITIES

Back in the early 2000s, Japan’s Sony Corp. was the dominant leader in the Braun TV market, with Korea’s Samsung Electronics Co. a distant follower.

As the industry was increasingly adopting LCD panels for large-screen TVs, Samsung took a bold and risky initiative to heavily invest in LCD panels – a move that made the company the world’s top TV manufacturer.

Analysts said Korean companies have become emboldened with their investments to not miss out on growth opportunities, particularly in sectors like rechargeable batteries, electric vehicle components and chip equipment.

Hyundai Mobis Co., an auto parts affiliate of Hyundai Motor Co., recently said it is considering ramping up hydrogen fuel cell facilities.

SK Group affiliate SK Siltron Co. said earlier this month it plans to expand wafer production facilities amid growing demand from the global chip manufacturers.

In late June, industrial materials maker Kolon Industries Inc. said in a public filing that it is investing 236.9 billion won to expand facilities for aramid fibers used in cables and tire cords. Its shares have risen 15.2% since then.

Hyosung TNC Corp. saw its stock surge more than sevenfold in the past year after announcing its spandex factory expansion plans to solidify its market leadership.

PI Advanced Materials Co. is ramping up its factories for polyimide (PI) film used in various applications including smartphones, EVs and displays with its 70 billion won investment announced in November last year, sending its shares 80% higher since then.

To raise capital for factory expansion, the companies offered a combined 17.39 trillion won in rights to existing shareholders in the first half, up 350% from the year-earlier period, amid ample liquidity in the capital market.

Write to Jin-Seong Kim and Yun-Sang Ko at Jskim1028@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Hydrogen economyLotte Chemical goes green with $3.8 bn investment in hydrogen business

Hydrogen economyLotte Chemical goes green with $3.8 bn investment in hydrogen businessJul 13, 2021 (Gmt+09:00)

2 Min read -

-

ChemicalsKolon expands hydrocarbon resins production, becomes global No.2 maker

ChemicalsKolon expands hydrocarbon resins production, becomes global No.2 makerJun 21, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN