Pre-IPOs

Masayoshi Son's top pick Yanolja eyes 2023 Nasdaq listing

The travel platform hopes to become the next Coupang via US listing

Jul 15, 2021 (Gmt+09:00)

4

Min read

Most Read

CarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Infrastructure secondaries continue to rise amid inflation: Stafford

Goldman Sachs names Choi Seoul office chief

Golf equipment maker Taylormade to refinance $222 mn of debt

NPS' former key players move to law firms as its voting power increases

South Korea's largest travel platform Yanolja has raised 2 trillion won ($1.7 billion) from the Masayoshi Son-led SoftBank Vision Fund II, marking the fund's second-largest investment into a Korean startup. The company is currently preparing to go public on the Nasdaq as early as 2023.

Vision Fund will become Yanolja's second-biggest shareholder with a 25% stake, according to the travel platform on July 15. The fund will spend around 1 trillion won to acquire existing shares and another 1 trillion won to subscribe to new issues.

The latest funding from SoftBank has solidified Yanolja's decision to go public in the US, despite having considered dual-listing at home and abroad. Investment industry sources expect the company's valuation to top 10 trillion won in the US, compared to the expected 3 trillion won to 4 trillion won if it were to be listed in Korea.

Yanolja will be following in the footsteps of Coupang Corp., which made a tremendously successful trading debut in the US, raising $4.6 billion from its initial public offering. CEO Son had bet on Coupang, investing around $3 billion in total, despite the e-commerce company logging operating losses that amounted to 2 trillion won at the time of investment. Unlike Coupang, the Korean travel startup swung to a profit last year, posting an operating profit of 6.2 billion won.

Industry watchers say CEO Son took note of not only Yanolja's growth but also its potential as an IT company.

Last year, many people expected the travel startup to crumble from the COVID-19 crisis, but instead, it kept busy transitioning into a comprehensive cloud-based IT firm, expanding its businesses to encompass data, cloud and artificial intelligence -- which is why the billionaire SoftBank founder Son chose Yanolja as its fourth Korean startup to invest in.

SoftBank's Son has invested in four Korean startups so far. He invested around $3 billion in e-commerce giant Coupang; $160 million in content localization company Iyuno-SDI Group┬Āand $175 million in the AI startup Riiid Inc. In terms of investment volume, Yanolja comes second to Coupang.┬Ā

Through the investment, Yanolja will be crowned the country's newest decacorn, or a company valued at over $10 billion. Its valuation surged tenfold since achieving unicorn status in 2019 when it raised $180 million from investors including Singapore's sovereign wealth fund GIC.

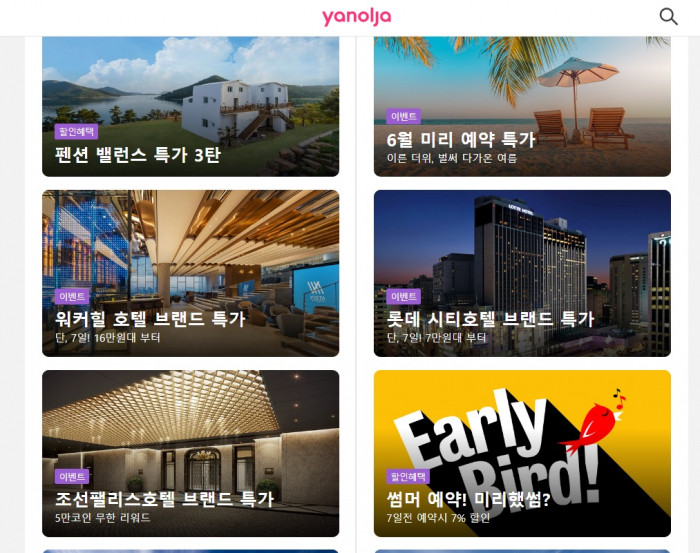

The travel app plans to use the proceeds to diversify its business portfolio via M&As and to boost its technologies. The company will focus on improving its existing app services and big data-powered personalized services such as search and recommendation features.┬Ā

NO. 1 TRAVEL PLATFORM GETS ITS START FROM A MOTEL

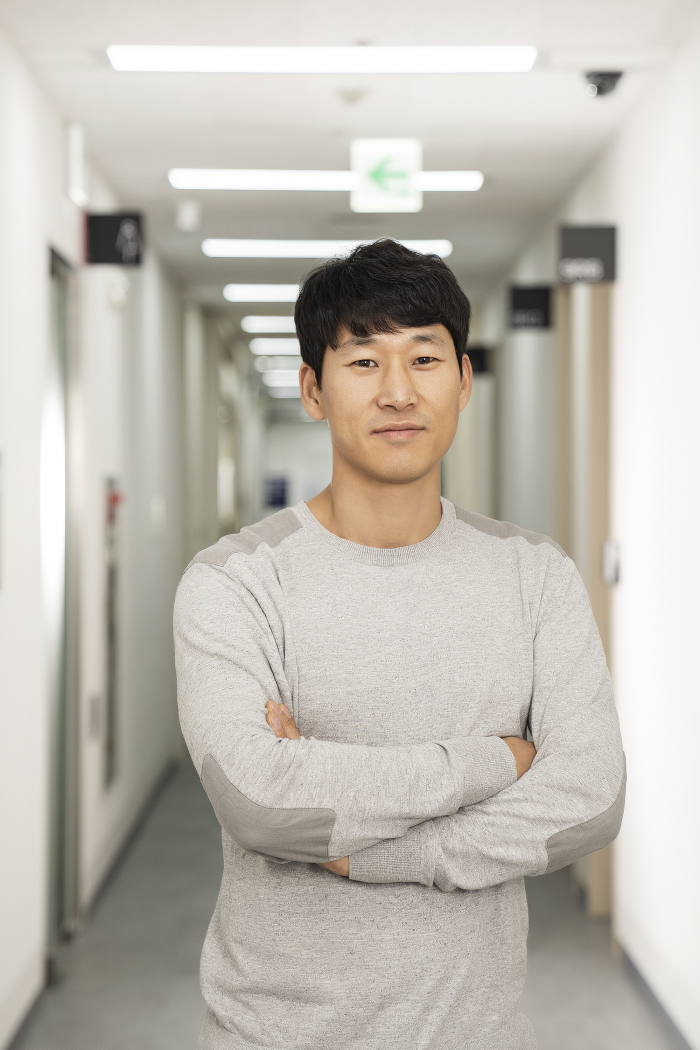

Yanolja's Chief Executive Lee Su-jin comes from humble beginnings. Lee was raised by his grandmother who made her living through farming. His father passed away when Lee was four years old and his mother left him when he turned six.

After graduating from a community college, Lee, with empty pockets, looked for jobs that provided room and board, which led him to find work at a motel.

In 2004, CEO Lee created an online community, Motel Stories, and uploaded posts to share his experiences of working at a motel. The community went viral and attracted over 10,000 users in a year, serving as an online hub for motel industry workers.

Lee spotted a business opportunity from the thriving community and in 2005, he acquired a bigger online community, Motel Tour, which had around 200,000 users. Lee began to offer matching services for users and motels, which expanded into Yanolja in 2011.

Yanolja reshaped the industry landscape by positioning motels as a place to have fun -- a departure from the seedy reputation of motels in Korea. The travel platform shared photos of motel rooms and facilities alongside reviews to increase transparency and credibility.

It also launched a franchise business in 2011 and evolved into a smartphone-based app service in 2015. Now the company has grown into an all-inclusive leisure platform that offers digital services for transportation, restaurants, shopping and accommodation by utilizing AI, big data and blockchain technologies.

But Yanolja's true value lies in the business-to-business (B2B) segment. In 2017, the company adopted the software as a service (SaaS) business model, including a cloud-based hotel property management system (PMS) system that manages day-to-day hotel operations such as reservations, housekeeping, food delivery and billing.

The PMS system served as an opportunity to highlight YanoljaŌĆÖs forte as a travel platform. Currently, Yanolja is the worldŌĆÖs No. 2 PMS provider with 23,000 partners worldwide -- following closely behind industry frontrunner Oracle, which has around 38,000 partners.

"It's only a matter of time before Yanolja overtakes Oracle," said an industry official, explaining that the domestic travel app's technology is more advanced due to its cloud technology.┬Ā

By Chae-yeon Kim, Min-ki Koo, Joo-wan Kim, Han-gyeol Seon┬Ā

why29@hankyung.com

Danbee Lee edited this article.

More to Read

-

-

Enterprise valueTravel platform YanoljaŌĆÖs enterprise value seen at $11 bn if listed on Nasdaq

Enterprise valueTravel platform YanoljaŌĆÖs enterprise value seen at $11 bn if listed on NasdaqMar 02, 2021 (Gmt+09:00)

3 Min read -

IPOsTop travel platform Yanolja eyes Q2 IPO review, listing by year-end

IPOsTop travel platform Yanolja eyes Q2 IPO review, listing by year-endMar 01, 2021 (Gmt+09:00)

3 Min read -

-

Comment 0

LOG IN