Moody's urges Korean banks to beef up online platforms

With the upcoming IPO, KakaoBank is making inroads into traditional banks' core businesses

By Jul 12, 2021 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

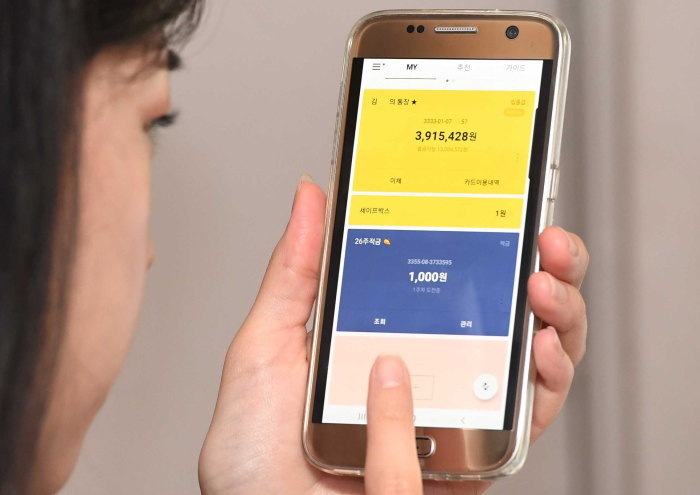

South Korea's traditional banks, led by KB, Shinhan, Hana and Woori, will need to strengthen their online platforms as KakaoBank, the country's leading mobile banking app, is now venturing into their core markets of mortgage and merchant loans, according to Moody's Investors Service.

The rapid growth of KakaoBank, launched in 2017, underscores a Big Tech company's successful penetration into the highly regulated banking industry, while heralding worsening profitability at the traditional lenders, the rating agency said in a report released on Monday.

"KakaoBank's assets rose rapidly in unsecured personal lending by attracting the largest number of users among Korea's mobile banking apps through a seamless digital banking experience," Moody's Vice President and senior analyst Tae Jong Ok said in the report.

Without physical branches, the mobile banking platform's profitability matched that of nationwide banks' in 2020.

Moody's rated KakaoBank at Aa2, on a par with South Korea's sovereign rating. The virtual bank, under the country's dominant online messaging app Kakao Corp., is now ranked South Korea's eighth-largest retail bank.┬Ā┬Ā

The rating agency warned that the planned capital raising by KakaoBank via an initial public offering later this month could help pull its share in the country's won-denominated loans market from the current 14% to 65% over the next one and a half years. The IPO could increase its capital by around 76%-90% from the level at the end of March 2021, Moody's said.

For smaller Korean banks, KakaoBank's rise means a further reduction in their already limited presence in the household loans markets, it added.

For the IPO, KakaoBank will price its shares at between 33,000 and 39,000 won to raise as much as 2.55 trillion won.

Its price band is close to the share price of the country's second-largest banking group Shinhan Financial Group, which ended up 2.49% at 39,150 won on Monday.

KakaoBank's market capitalization, based on the top of the indicative range, is estimated at 18.5 trillion won, slightly below Shinhan's 20 trillion won, but far above the third-ranked Hanan FInancial Group's 13 trillion won.

Ok noted that the traditional Korean lenders are at a competitive disadvantage against Big Tech firms due to the lack of a platform to attract customers and collect data from nonfinancial services, as well as their costs required to maintain physical branches.

Further, their efforts to strengthen their platforms could increase costs and operational risks.

"The burden has shifted to the incumbent banks to strengthen their platforms and make the customer experience similar to virtual banks'," Ok said.

Kookmin Bank of KB Financial Group runs about 1,000 branches nationwide as of the end of 2020, followed by Shinhan at about 900 and Woori at 800.

Adding another blow to the established lenders, the country's three Big Tech players -- Naver Corp. Kakao and Toss -- are preparing to jump into the personal loan refinancing market.

Meanwhile, Toss, a fintech startup offering payment and settlement services as well as stock trading, was valued at 8.2 trillion won in its latest funding round. It matched the market value of the fourth-largest lending group Woori Financial Group.

Write to Geun-ho Im at eigen@hankyung.com

Yeonhee Kim edited this article.

-

IPOsKakaoBankŌĆÖs $2.3 bn IPO set to alter KoreaŌĆÖs banking landscape

IPOsKakaoBankŌĆÖs $2.3 bn IPO set to alter KoreaŌĆÖs banking landscapeJun 28, 2021 (Gmt+09:00)

4 Min read -

TechfinNaver, techfins poised to spark Korean loan market's Big Bang

TechfinNaver, techfins poised to spark Korean loan market's Big BangJun 16, 2021 (Gmt+09:00)

3 Min read -

Future bankingKakaoBankŌĆÖs skyrocketing valuation fuels debate on financial reform

Future bankingKakaoBankŌĆÖs skyrocketing valuation fuels debate on financial reformMay 25, 2021 (Gmt+09:00)

5 Min read