Batteries

SK IE Technology throned as top battery materials stock on Korean bourse

Its decent stock performance in recent weeks quells concerns over its valuation

By Jul 09, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

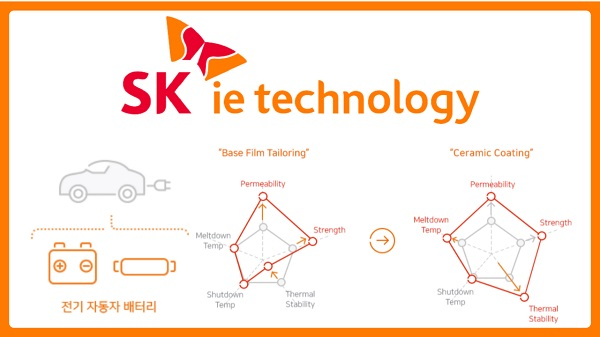

SK IE Technology Co. (SKIET), a unit of SK Innovation Co., has climbed to the top ranking among battery materials makers in terms of market capitalization on South Korea’s main bourse amid investor optimism over electric vehicles.

Given the strong demand from battery makers and SKIET’s aggressive capacity expansion to solidify its market leadership, the stock will offer further upside potential in coming years, analysts say.

Shares of the Korean EV battery separator maker finished up 3% at 205,000 won on Thursday, bringing its total market capitalization to 14.62 trillion won ($12.7 billion), overtaking the top post from crosstown rival POSCO Chemical Co. with its valuation at 12.32 trillion won.

SKIET has risen nearly 38% since the start of June as foreign investors and domestic institutions snapped up the stock.

Institutional investors bought 334.1 billion won worth of SKIET, while foreigners purchased 169.4 billion won of the stock during the cited period. Individual investors, meanwhile, sold the stock amounting to 495.4 billion won on profit-taking.

If the upward trend continues, SKIET’s corporate value could rise to 30 trillion won by 2025, analysts said.

When the company went public in mid-May, its shares initially doubled the IPO price before giving up a chunk of their earlier gains.

The stock price jumped at the opening bell, reaching a high of 222,500 won before falling back by 26.5% from the starting price of 210,000 won to close at 154,500 won on May 11. The debut sent SKIET's market cap to 11 trillion won.

QUELLING CONCERNS ABOUT OVERVALUATION

Analysts said SKIET’s decent performance in recent weeks is quelling concerns over the stock’s valuation.

“The battery separator business has a high entry barrier, meaning SKIET could be free from an intense competition with smaller rivals. That justifies its relatively high valuation compared to other materials stocks,” said Jung Won-seok, a HI Investment & Securities analyst.

Based on SKIET’s suggested 2023 earnings before interest, taxes, depreciation and amortization (EBITDA) of 700 billion won, analysts estimate the company’s valuation at 15 trillion won, with a price-earnings multiple of 30.

SK Innovation Chief Executive Kim Jun, while unveiling its long-term goal to turn the petroleum and battery parent into an eco-friendly company, said last week he expects affiliate SKIET’s EBITDA to rise to 1.4 trillion won by 2025.

Based on his growth forecast, SKIET’s market value will rise to 30 trillion won by then, according to analysts.

CAPACITY EXPANSION

SKIET, which makes lithium-ion battery separators (LiBS), has said it will build two additional battery separator plants in Poland to meet the rising demand for electric car batteries. The project, valued at around 1.2 trillion won, marks SKIET’s single largest investment.

The SK Innovation CEO said last week SKIET’s LiBS production capacity will likely rise to 4 billion square meters by 2025 from an estimated 1.36 billion square meters at the end of this year.

SKIET was the first South Korean company to develop lithium-ion battery separators in 2004, and the first in the world to develop the sequential stretching process technology in 2007.

As of the end of 2020, the company was the world’s top player in the high-quality tier-one separator market with a market share of 26.5%, followed by Japan’s Toray Industries Inc. (23.7%), Asahi Kasei (23.6%) and China’s Yunnan Chuangxin New Material Co. (15%).

Write to Yun-Sang Ko at kys@hankyung.com

In-Soo Nam edited this article.

More to Read

-

IPOsSK IE Tech IPO draws record-high demand; brokerage servers down briefly

IPOsSK IE Tech IPO draws record-high demand; brokerage servers down brieflyApr 29, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN