Biotech

LegoChem’s biotech platform drives 28% share price spike over last month

The firm’s antibody-drug conjugate (ADC) technology creates a platform for multiple revenue streams

By Jul 07, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The rise of the platform economy is a global phenomenon. The spread of the coronavirus pandemic has accelerated the use of contactless technology and services on online platforms in virtually all sectors of society.

In the US, big-name platform companies such as Google, Amazon and Tesla are respectively leading the internet, e-commerce and autonomous driving sectors.

Likewise in Korea, the two platform giants, Kakao Corp. and rival Naver Corp., are rapidly transforming multiple segments of the economy.

On the other hand, the biopharmaceutical industry was largely regarded as unrelated or irrelevant to the platform business model. Until recently, developing new drugs or vaccines had been the main focus of industry players and investors alike.

But now, some South Korean biotech firms are drawing huge interest from investors using platform business models.

For instance, a medical chemistry company LegoChem Biosciences Inc., saw its stock price rise by more than 28% over the last 30 days, much higher than the Kosdaq 150 biotech index that rose by 10.9% during the same period. LegoChem Bio’s stock price has already risen by 17.9% so far in July.

Those who are buying LegoChem Bio’s stocks are largely foreign investors and financial institutions. Data shows that in July, foreign investors bought 15.5 billion won ($13.6 million) worth of the company’s stocks and financial institutions have bought 24.0 billion won ($21.1 million).

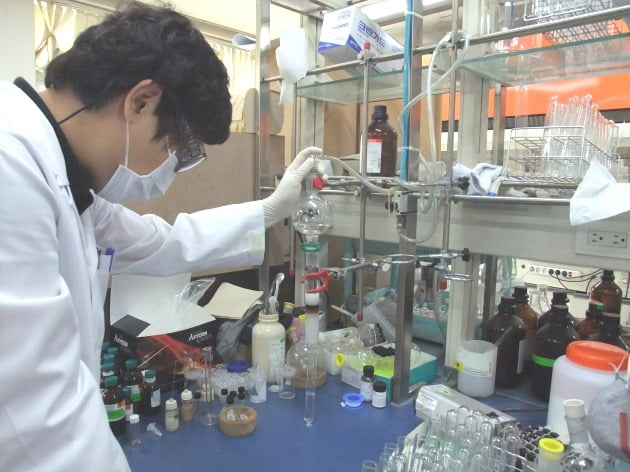

LegoChem Bio’s core competency lies in its antibody-drug conjugate (ADC) technology. ADC technology combines antibodies and drugs to eliminate only specific cells within our bodies, an ideal characteristic to treat cancer.

The ADC technology is referred to as the “platform of the bio industry” as it can create multiple revenue streams by using different drug materials to create conjugates with antibodies. The ADC technology itself can be exported overseas to generate revenue and the company can receive royalties from new drug developments.

LegoChem Bio is categorized as a second-generation ADC platform company. First-generation companies had specialized in ADC technologies that randomly combined antibodies with active ingredients in the medicine, producing less effective drugs with more side effects. But second-generation ADC technology can determine the type and the number of active ingredients that are attached to the antibody.

Experts say that there are only two or three companies in the world, including LegoChem Bio, whose ADC technology level is advanced enough to conduct clinical trials. In the third quarter of 2021, LegoChem Bio will announce the results from the phase I trial of the HER2-ADC drug material, the technology of which was transferred to China’s Fosun Pharma. LegoChem Bio so far has exported the technology to more than 10 companies overseas.

Analysts say the company’s stock has room for further growth, as two or three more cases of ADC technology exports are expected during the second half of this year.

They also note that LegoChem Bio’s global rivals have much higher market capitalization. Its main rival Seagen Inc., formerly known as Seattle Genetics, has a market cap of $27.6 billion, whereas LegoChem Bio’s is around $1.3 billion. Seagen generated a revenue of $1.1 billion in 2019 from a single ADC drug, ADCETRIS®.

The global ADC industry is expected to grow from $2.7 billion in 2019 to $24.8 billion by 2026, according to Shinhan Investment Corp.

Write to Ui-myung Park at uimyung@hankyung.com

Daniel Cho edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN