Earnings

Samsung Elec's Q2 operating profit beats forecast on strong chip business

The chipmaker's April-June profit is estimated at $11 billion, up 53.4% from a year earlier and 33.3% from the previous quarter

By Jul 07, 2021 (Gmt+09:00)

1

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

Samsung Electronics Co. said its operating profit in the second quarter likely surged more than 50%, beating market expectations, thanks to its healthy chip business.

The worldŌĆÖs largest memory chip and smartphone maker said the profit during the April-June period was estimated at 12.5 trillion won ($11 billion), up 53.4% from a year earlier and 33.3% from the previous quarter. The latest profit was higher than the market consensus forecast of 11 trillion won.

Revenue was estimated to have increased 18.9% on-year to 63 trillion won, according to its preliminary earnings statement released on July 7.

AUSTIN IS BACK

Strong chip business improved the companyŌĆÖs earnings. Its foundry plant in Austin, US, normalized operations in the second quarter after a shutdown in the previous three months due to a cold snap, helping its chip division double operating profit in the latest quarter from a 3.4 trillion in the January-March period, analysts had predicted. The preliminary earnings suggested the divisionŌĆÖs profit may have topped such forecasts.

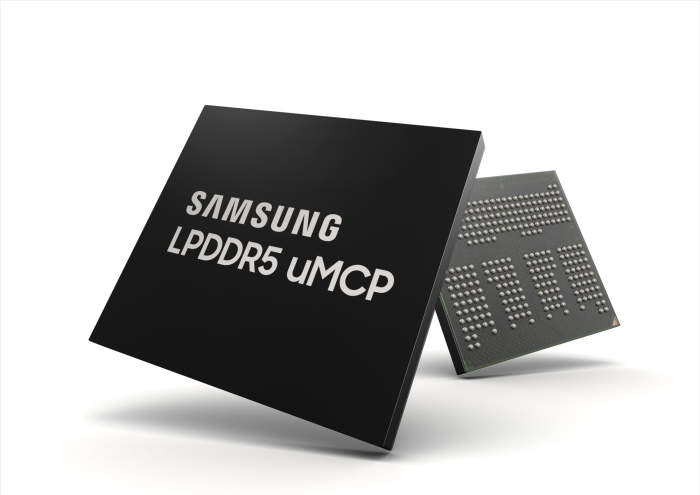

DRAM prices in April increased more than 26% to $3.8 compared to a month earlier and NAND flash memory chip prices rose 8.5% in the same period on growing demand from home appliances amid the COVID-19 and increased use of corporate servers.

Its display division was estimated to post operating profit around the low-1 trillion-won level as the pandemic supported liquid crystal display (LCD) panel prices.

On the other hand, SamsungŌĆÖs IT & Mobile Communications Division likely suffered a drop in operating profit to around 3 trillion won from 4.4 trillion won in the previous quarter, while the Consumer Electronics DivisionŌĆÖs profit probably stagnated due to a decrease in TV shipments.

Samsung will release detailed quarterly earnings on July 29, according to its filing to a financial regulator.

Write to Sin-Young Park at nyusos@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Foundry competitionSamsung, TSMC up ante in US foundry competition

Foundry competitionSamsung, TSMC up ante in US foundry competitionMay 24, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN