BOK ratchets up warning over asset price bubble, private debt

The central bank warns against higher risk appetite, not based on economic fundamentals

By Jun 23, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The recent asset price rises in South Korea, in particular in the equities and real estate markets, have been too rapid, even considering an expected economic recovery from the global pandemic, and further widened their gaps with economic fundamentals, according to the Bank of Korea.

The price gains, driven by higher risk appetite and swelling private debts supported by the loosened fiscal and monetary policies, will likely expose the asset markets to the increased risk of undergoing a downward price correction, the central bank said in its biannual report released on Tuesday.

"It's difficult to make a clear assessment on asset values, but it is highly likely that some domestic asset prices are now at elevated levels," the central bank said in the Financial Stability Report.

"If macroeconomic policies at home and abroad make a shift after the pandemic crisis recedes, or investment sentiment turns bearish, most of the asset price gains, fueled by speculative demand, will likely be wiped out."

As of the end of March, South Korea's financial system vulnerabilities reached their highest level since the 2008 global financial crisis, according to the report.

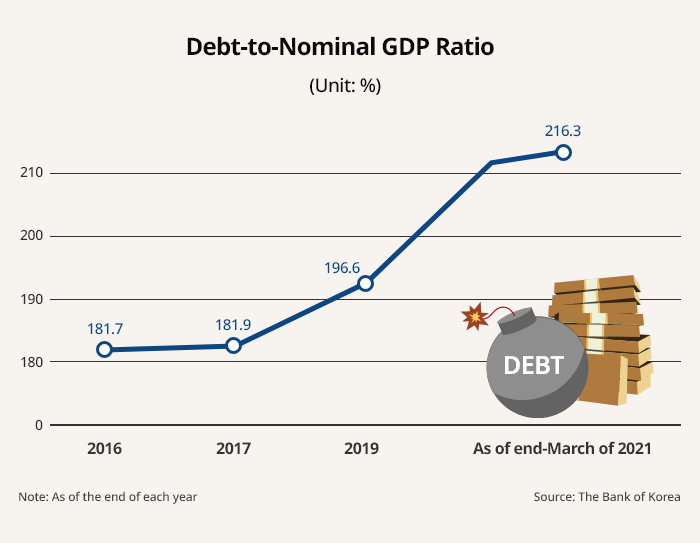

Private debts, combining both household and corporate debt, marked their highest ratio against the nominal gross domestic product (GDP), since the central bank began compiling the data in the first quarter of 2000.

It is rare for the Bank of Korea to deliver such straightforward, hawkish warnings against asset price levels. The remarks come less than two weeks after the central bank Governor Lee Ju-yeol flagged a tighter monetary policy, fueling expectations that the bank will raise its base rate earlier than expected.

South Korea ranked fifth among the countries that recently experienced the highest pace of house price rises, after Sweden, Denmark, Russia and the US, according to a Financial Times report.

The Bank of Korea also took note of rising demand for cryptocurrencies despite their lack of economic values.

"Across the asset markets, investors have increased their risk appetite for higher yields. Speculative demand for cryptocurrencies and their drastic price rises signal the prevalence of higher risk appetite, which are not based on economic fundamentals," it noted.

Household debts expanded by 11% to 2,045 trillion won ($1.8 trillion) as of the end of March this year from the year-earlier period. The balance of corporate debts increased by 8% to 2,181 trillion won during the same period.

Rising house prices resulted in a sharp increase in mortgage loans. The pandemic-induced economic slump also forced the self-employed and small business owners to increase borrowings.

Private debts are equivalent to more than twice the country's nominal GDP as of the end of March, up 15.9 percentage points year-on-year.

The Financial Vulnerability Index, compiled by the Bank of Korea, came to 58.9 at the end of the first quarter this year, the highest reading since the 60.0 in the fourth quarter of 2008 at the height of the global financial crisis.

"We need to take into consideration the accumulated financial imbalance in our decision-making process of monetary policy," Bank of Korea Deputy Governor Park Jong-seok said in a media briefing on Tuesday.

"The loosened monetary policy needs to be normalized in an orderly manner from an appropriate time."

Continued money inflows into the real estate market since last year, even in the pandemic situation, have deepened the financial imbalance, or the gap between asset prices and economic fundamentals, the central bank added.

Further, it warned that in the worst-case scenario under which central banks around the world quicken the pace of interest rate hikes, or the COVID-19 pandemic situation deteriorates, the South Korean economy could contract by 0.75% this year.

In May of this year, the central bank raised its growth outlook for this year to 4% from the February estimate of 3%.

Write to Ik-hwan Kim at lovepan@hankyung.com

Yeonhee Kim edited this article.

-

Listed firms’ earningsKorean firms emerge triumphant from pandemic with record Q1 profits

Listed firms’ earningsKorean firms emerge triumphant from pandemic with record Q1 profitsMay 21, 2021 (Gmt+09:00)

3 Min read -

Household debtHeavy household borrowing fans Korea’s asset market overheating

Household debtHeavy household borrowing fans Korea’s asset market overheatingMay 13, 2021 (Gmt+09:00)

3 Min read -

Debt-to-GDPS.Korea's public debt tops GDP for first time in 2020

Debt-to-GDPS.Korea's public debt tops GDP for first time in 2020Apr 07, 2021 (Gmt+09:00)

2 Min read