BTS label HYBE shares at highest close: Too late to chase it now?

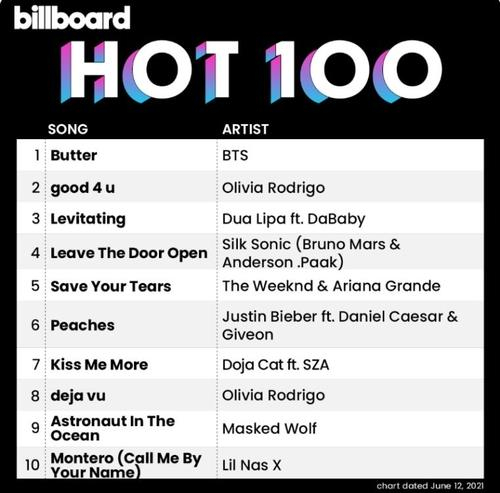

HYBE soared 5.36% to close at a session high, with BTS' Butter topping Billboard for 4th straight week

By Jun 22, 2021 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

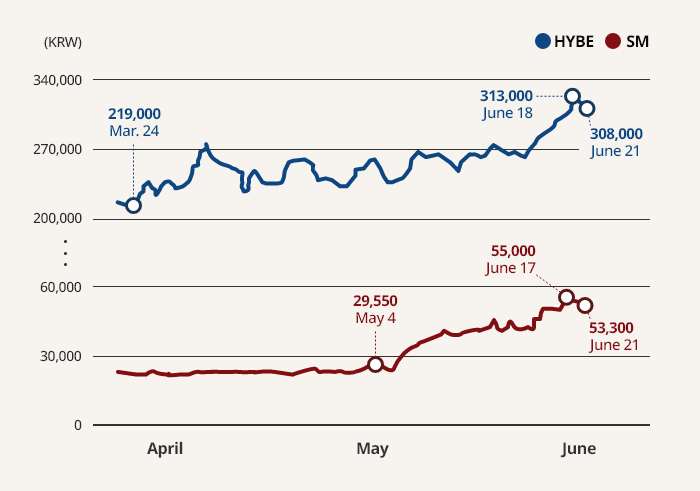

HYBE soared 5.36% to finish at 324,500 won ($286), its highest level on the day, outperforming a 0.71% rise in the broader Kospi market. The stock has advanced in eight sessions of the past nine trading days, gaining 22.5% since the start of the month, versus a mere 2% addition in the Kospi index.

Along with the huge success of the "Butter," expectations about resumption of offline concerts later this year and brisk sales of albums and idol goods on HYBE's online fandom community Weverse have prompted several analysts to raise their target price for HYBE.

Among Korean securities firms, eBEST Investment & Securities Co. is the most bullish about the BTS label, suggesting the highest 12-month target price of 502,000 won, or 54% higher than Tuesday's closing level.

Last Friday, HYBE ended above the 300,000 won mark for the first time since its stock market debut on Oct. 15, 2020, in its heaviest trade in two months. Its recent rally catapulted the entertainment powerhouse to the group of the country's 30 largest stocks, with a market capitalization of 12.3 trillion won as of Tuesday's close.

FOREIGN NET BUYING

Since the start of the year, the share price of HYBE has almost doubled, digesting concerns about its new share offers worth 445.5 billion won conducted earlier this month.┬ĀForeign investors purchased a net 212.7 billion won worth of HYBE shares between June 1 and 18. On the contrary, both individual and institutional investors turned net sellers during the same period.

Mirae Asset Securities Co. and Hyundai Motor Securities Co. have recently revised higher their target price for HYBE by 15% and 23% to 390,000 won and 350,000 won, respectively, compared with their previous target prices.┬Ā

Now the market consensus for HYBE's 12-month stock price was hiked to 338,000 won, versus the 298,000 won three months before.┬Ā

Hyundai Motor Securities analyst Kim Hyun-yong forecast HYBE's operating profit and revenue to exceed the market consensus in the current quarter, posting year-on-year growth of 54.2% and 69.3%, respectively.

"Even considering one-off expenses like those related to the acquisition of Ithaca Holdings, HYBE will continue to post robust earnings thanks to soaring sales, as well as revenue from online concerts," he said.

In March, HYBE announced the┬Ā$1 billion acquisition of full ownership of Ithaca Holdings, a US-based integrated media company behind artists including Justin Bieber and Ariana Grande.

Mirae Asset is upbeat about HYBE's second-half earnings, citing the rise of the online fan community and enhanced fandom loyalty, as well as on-site performances expected to resume later this year or next year.

The fandom community Weverse is expected to boost HYBE's earnings further. The online platform is set to become a joint venture with the country's online giant Naver Corp., which is now the second-largest shareholder in the operator of Weverse. Additionally, YG Entertainment, the label behind the K-pop girl group Blackpink, will be joining the community platform.

"From the fourth quarter of this year, offline concerts will resume both at home and abroad, further highlighting its business fundamentals," said Mirae Asset Securities analyst Park Jeong-yeob.

Other entertainment shares also went up so far this month, outshining the broader Kospi market. SM Entertainment Co. and YG have advanced 25% and 8% this month, respectively. With the accelerated pace of COVID-19 vaccinations, JYP Entertainment Corp. climbed over 8% this month on expectations that on-site performances would resume.

VALUATION CONCERNS

Offering a contrarian view, however, Meritz Securities in early June maintained a hold recommendation on HYBE. It also stuck to its target price of 260,000 won proposed in April this year when the brokerage house downgraded its buy recommendation to hold.┬Ā┬Ā

Meritz Securities analyst Lee Hyo-jin said in a recent note that HYBE's outperformance so far this year was attributable in large part to the announcement of the Ithaca Holdings purchase and foreign investors' buying triggered by expectations of the country's possible inclusion into the MSCI developed-market index.''

"Its current valuation is high compared to its rivals in the same industry," she said, adding that HYBE is now trading at its proper valuation, or 50 times its 2022 projected earnings.

"Rival SM Entertainment's stake sale will provide an opportunity to review the corporate value of the country's three other leading entertainment companies, trading at lower valuations than HYBE's," she said, referring to SM, JYP and YG.

"Now is the time to wait and see until those rivals' valuations play catch-up."┬Ā ┬Ā

Lee Soo-man, founder and the largest shareholder of SM Entertainment, is seeking to sell his 18.73% stake in the label behind the K-pop phenomenon.

Write to Ji-yeon Sul at sjy@hankyung.com

Yeonhee Kim edited this article.

-

Music and entertainmentHYBE raises $400 mn in a move to diversify BTS-dependent portfolio

Music and entertainmentHYBE raises $400 mn in a move to diversify BTS-dependent portfolioJun 03, 2021 (Gmt+09:00)

1 Min read -

K-popBTS smooths Butter at Billboard Music Awards; scoops up 4 awards

K-popBTS smooths Butter at Billboard Music Awards; scoops up 4 awardsMay 25, 2021 (Gmt+09:00)

1 Min read -

Korean music labelsEntertainment shares to soar in Q2 following BTS, Blackpink comeback

Korean music labelsEntertainment shares to soar in Q2 following BTS, Blackpink comebackApr 16, 2021 (Gmt+09:00)

3 Min read -

BTS label Big Hit prices IPO at top end of range at $115

BTS label Big Hit prices IPO at top end of range at $115Sep 28, 2020 (Gmt+09:00)

3 Min read