Healthcare

IsraelŌĆÖs Nanox begins production of digital X-ray components in Korea

SK Telecom is the second-largest shareholder of the Israel-based, Nasdaq-listed healthcare unicorn

By Jun 22, 2021 (Gmt+09:00)

2

Min read

Most Read

Nano-X Imaging Ltd. (Nanox), an Israeli startup listed on the Nasdaq last August, has started manufacturing digital X-ray components in South Korea.

Nanox recently kicked off the operation of its manufacturing facility in Cheongju city, about 100 km southeast of Seoul, where the Korea Economic Daily made a visit on June 21. The company said it is the first time that its facility in Korea has been open to an external visitor.

Nanox is a unicorn company that possesses exclusive digital x-ray imaging technology. The startup has received investments from Fujifilm Corp., Foxconn Technology Group, SK Telecom Co., and Yozma Group Korea. SK Telecom is currently Nanox's second-largest shareholder.

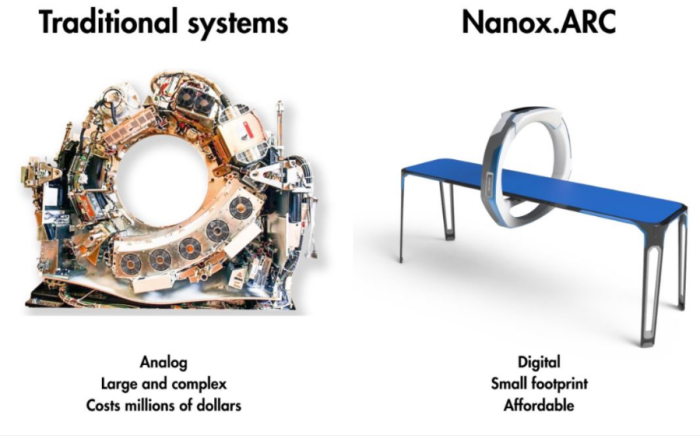

The X-ray devices currently in widespread use require a process to heat up the tube that emits light for taking the images. These devices thus need a cooling system to prevent the tube from overheating and have difficulty in shooting images continuously.┬Ā

In contrast, Nanox uses micro-electromechanical system (MEMS) semiconductor chips to enable the image-taking in an instant, like a photoshoot using a camera flashlight, without heating up the tube.

As the cooling system is unnecessary for NanoxŌĆÖs devices, they also take up much less space than traditional medical scanning and imaging equipment.

Nanox said it will be manufacturing in Korea the MEMS chips and tubes used in its devices. The companyŌĆÖs current facility in Cheongju is only operating temporarily; operations will later be moved to Yongin city, just outside the capital, where Nanox has bought a 12,000 square-meter site to build a full-scale plant by September of this year.

Earlier this month, the Cheongju facility started working on the photolithography part of the chip manufacturing, which is the front-end process of putting extremely small patterns on the wafer.┬Ā

Nanox says that its imaging system, Nanox.ARC, developed in-house using its core radiographic technologies, can cut the costs of computed tomography (CT) scans by around 90%.

NanoxŌĆÖs single-source Nanox.ARC digital X-ray technology received clearance from the US Food and Drug Administration (FDA) in April of this year. The company added that it has also applied for FDA clearance on June 17 for its multi-source Nanox.ARC 3D system, which can be applied for wider uses.

Nanox said that its Yongin plant will be producing 220,000 MEMS chips annually, enough to make 50,000 Nanox.ARC devices.

The company added that the semiconductor cleanroom at the new Yongin plant will be more than three times the size of the one at the Cheongju facility.

ŌĆ£Our immediate target is to manufacture 1,000 digital X-ray devices in 2022 as the first batch. We will apply our digital X-ray technology on medical devices as well as on the devices used for customs, immigration quarantines and product quality inspection,ŌĆØ said a Nanox official.

Write to Ju-hyun Lee at deep@hankyung.com

Daniel Cho edited this article.

More to Read

Comment 1

LOG IN