Quantum computing

Korean telecom firms expand commercial use of quantum cryptography

The imminent security threat from quantum computers creates an opportunity for Korea's telecom industry

By Jun 09, 2021 (Gmt+09:00)

5

Min read

Most Read

The imminent advent of quantum computers is posing an online security risk.

Quantum computers, unlike the binary computers in common use today, can deal with immense amounts of data by running innumerable computations in parallel.┬Ā

This capacity allows hackers to carry out cryptanalytic attacks to steal data from the devices previously considered safe. ┬Ā┬Ā

ŌĆ£When the quantum computers become prevalent, our current cybersecurity system will quickly become ineffective. It is like using the classical computing system of the 1950s in the 21st century,ŌĆØ said the Boston Consulting Group (BCG).

With the growing demand for tighter security, South KoreaŌĆÖs three telecom companies, SK Telecom Co., KT Corp. and LG Uplus Corp., are quickly expanding the application of quantum cryptography technologies into more industries to provide protection against quantum cyberattacks.

Quantum cryptography, currently used mainly to protect smartphone devices and mobile apps, is projected to be more widely used in financial transactions, medical data protection, smart cities as well as smart factories. ┬Ā

The global quantum cryptography market is still regarded as nascent. But the data security industry projects that it will grow rapidly over the next five to 10 years.

The French market research firm Yole D├®veloppement has forecast that the global industry size of quantum cryptography will grow from $121.9 million in 2019 to $1.46 billion in 2027.

Another global research firm BCC Research estimates that the market will grow at an average annual rate of 30.7% from 2019 to 2024.

CURRENT CYBERSECURITY SYSTEM VS. QUANTUM CRYPTOGRAPHY

The encryption system widely used at the moment is public key cryptography (PKC). Encryption is the process of transforming plain data into an unreadable format, called cipher text, to protect the confidentiality of the digital data.

The PKC system uses pairs of keys, public keys that may be known to others and private keys that only the owner can know. BCG says about $3 trillion worth of e-commerce transactions are made annually in the world using the PKC system.

The system is commonly used together with the two encryption techniques, Advanced Encryption Standard (AES) and Rivest-Shamir-Adleman (RSA). ┬Ā

The AES is a symmetric-key algorithm, meaning the same key is used for both encrypting and decrypting the data, while the RSA is an asymmetric technique that uses two different keys as separate public and private keys to perform the encryption and decryption.

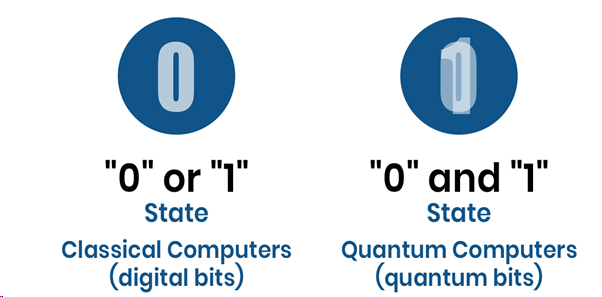

The AES and the RSA techniques use the classical bit (binary digit) -- the most basic unit of information in computing -- that can represent either 0 or 1 but not both.

On the other hand, the qubit (quantum bit) used in quantum cryptography can be in a 0 or 1 state, or even in a superposition of the 0 and 1 states.

When a third party such as a hacker interrupts the transmission of a qubit, the qubit changes the information it carries, showing broken information to the interrupter, unlike in the case for the classical bit where the information remains unchanged even after the interruption. ┬Ā

KOREAŌĆÖS MOVE IN THE SEGMENT

South KoreaŌĆÖs presence in the quantum cryptography sector is led by the three telecom companies, SK Telcom, KT and LG Uplus.

SK Telecom, the countryŌĆÖs largest mobile carrier, has been the most aggressive. The company started investing in quantum cryptography technologies from 2011 and in 2018 acquired the Swiss-based world leader in quantum safe-security solutions, ID Quantique (IDQ).

In April, SK Telecom and IDQ jointly developed a quantum virtual private network (VPN) technology to be used by corporate clients in setting up protected networks using quantum cryptography.

The company also won a number of pilot projects from the South Korean government in May to establish and operate quantum cryptography infrastructure in the country.

KT is also developing a quantum cryptography service in-house. Its quantum key distribution (QKD) model in February was chosen by the South Korean Telecommunications Technology Association (TTA) as the countryŌĆÖs national standard.

KT in April also developed Quantum Hybrid technology that can implement quantum cryptography communication through smartphone apps. KT said the Quantum Hybrid technology will be applied on a range of 5G network services including those for connected cars.

LG Uplus has been focusing on the development of post-quantum cryptography (PQC) technologies. The PQC, also called the quantum-resistant cryptography, uses mathematical algorithms that are secure against cryptanalytic attacks by quantum computers.

LG Uplus applied the PQC technology last year on its optical communication networks for customers. It aims to expand the range of PQC applications in both the private and public sectors.

The company has also recently won a pilot project from a government agency, National Information Society Agency (NIA), to build dedicated circuit lines in the South Chungcheong Province over a distance of 137 km using the PQC technology.

TELECOM INDUSTRYŌĆÖS STOCK MARKET PERFORMANCE IN 2021

South KoreaŌĆÖs three telecom companies have far outperformed the countryŌĆÖs representative stock market KospiŌĆÖs year-to-date growth at 10.3%.

As of June 8, SK TelecomŌĆÖs stock price grew by 38.4% this year, whereas KTŌĆÖs grew by 40.97% and LG UplusŌĆÖ was up by 29.96%.

Not only is the market outlook positive on the industryŌĆÖs new technological endeavors such as quantum cryptography, but the companiesŌĆÖ stock buyback and cancellation programs have also heightened investor confidence in telecoms.

SK Telecom last month has retired 8.69 million treasury shares worth 2.6 trillion won ($2.3 billion) in a move to boost its shareholder value.

KT has kicked off a year-long stock buyback program last November with plans to put 300 billion won ($269 billion) into the stock market to purchase its own shares. The program is KTŌĆÖs first large-scale buyback since 2009.

LG Uplus also announced on June 8 that it will spend 100 billion won ($89.7 billion) to buy the companyŌĆÖs shares back from the market. The action marks LG UplusŌĆÖ first stock buyback program since its establishment in 1996.

The company has also adopted an interim dividend payments policy, allowing the shareholders to receive dividend payments twice a year.

ŌĆ£The buyback will raise our corporate value and strengthen our shareholder return policy. We will be paying out more cash dividends to shareholders, and we expect our market valuation per share to rise as well,ŌĆØ said an LG Uplus official.

Write to Han-Gyeol Seon at always@hankyung.com

Daniel Cho edited this article.

More to Read

-

Telecom industryKT stock value likely to double by 2022, analysts say

Telecom industryKT stock value likely to double by 2022, analysts sayMay 21, 2021 (Gmt+09:00)

2 Min read -

Shareholder valueSK Telecom to retire $2.3 bn treasury shares amid corporate split-off

Shareholder valueSK Telecom to retire $2.3 bn treasury shares amid corporate split-offMay 04, 2021 (Gmt+09:00)

3 Min read -

Business diversificationSKT strengthens foothold outside mobile biz

Business diversificationSKT strengthens foothold outside mobile bizApr 18, 2021 (Gmt+09:00)

3 Min read -

Group restructuringSK Telecom to split into mobile and non-mobile units

Group restructuringSK Telecom to split into mobile and non-mobile unitsApr 14, 2021 (Gmt+09:00)

5 Min read -

K-conentKT to bolster content creation with $350 mn investment by 2023

K-conentKT to bolster content creation with $350 mn investment by 2023Mar 24, 2021 (Gmt+09:00)

3 Min read -

Company restructuringSK Telecom creates dedicated IPO team to boost valuation

Company restructuringSK Telecom creates dedicated IPO team to boost valuationFeb 07, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN