Battery materials

SK Nexilis, POSCO move forward with EV battery materials projects

KoreaŌĆÖs major firms are expanding facilities as EV makers race to increase range per charge

By May 27, 2021 (Gmt+09:00)

3

Min read

Most Read

With competition heating up in the global race for more eco-friendly cars, South KoreaŌĆÖs major companies are moving forward with their plans to expand facilities for raw materials used in EV batteries.

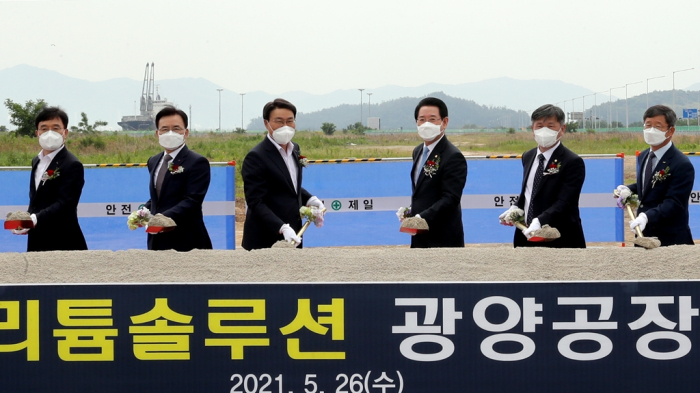

POSCO, the countryŌĆÖs top steelmaker, on Wednesday broke ground on a 760 billion won ($680 million) plant to extract lithium hydroxide, a key material for rechargeable batteries.

The construction of the plant in Gwangyang, home to POSCOŌĆÖs second steel factory, will be completed in 2023, it said.

Once completed, the plant will have an annual production capacity of 43,000 tons of lithium hydroxide, enough for one million electric cars. The company will import ore from AustraliaŌĆÖs lithium mining firm Pilbara Minerals to make lithium hydroxide.

Lithium hydroxide is one of the most common lithium compounds used as a chemical base for anode materials, which assist in the flow of electricity within battery cells.

POSCO approved the construction project at its board meeting in April.

ŌĆ£Stable procurement of lithium will be laying the groundwork for POSCO to become a battery materials company over the next century,ŌĆØ POSCO Chairman Choi Jeong-woo said at the groundbreaking ceremony.

ŌĆ£Our efforts will also contribute to advancing the domestic battery industryŌĆÖs competitiveness.ŌĆØ

DEMAND GROWS AS CARMAKERS RACE FOR LONGER RANGE PER CHARGE

Demand for lithium hydroxide is increasing as automakers race to increase their battery's mileage range per charge. Anode materials with high nickel content above 80%, which use lithium hydroxide as a chemical base, are becoming more prevalent.

POSCO said it will also break ground on the construction of a lithium plant in Argentina before the end of this year.

The company said last October that the Salar del Hombre Muerto salt flat in northern Argentina it purchased from an Australian mining firm in 2018 proved to contain 13 million tons of lithium deposits, six times more than its initial estimate.

With the completion of the Argentinian plant, POSCOŌĆÖs total lithium production capacity in Korea and abroad will reach 220,000 tons a year in 2030, it said.

In December 2020, POSCO unveiled its goal of becoming the worldŌĆÖs top player in the EV battery materials market by 2030, by establishing a supply chain from raw materials procurement to production of battery materials.

SK, LOTTE, ECOPRO ALSO EXPAND CAPACITY

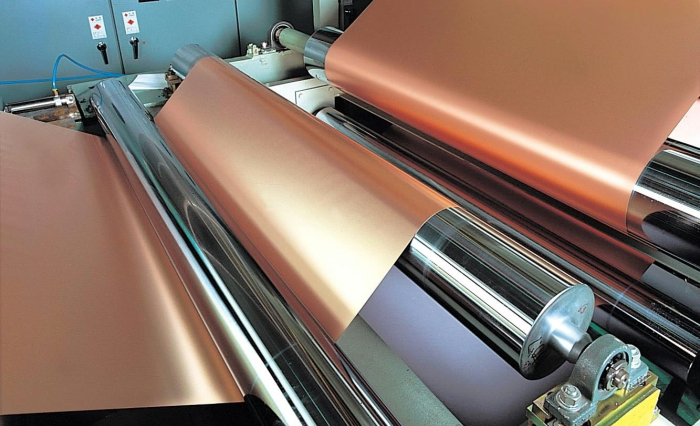

Meanwhile, SK Nexilis Co., the battery copper foil making unit of SK Group, said on Wednesday it is building a new plant in Europe to meet growing demand globally.

Poland is the likely candidate for the site given its geographical proximity to major battery makers, the company said.

The European plant comes in addition to SKŌĆÖs announcement in March that it will build its first overseas copper foil plant in Malaysia to boost the companyŌĆÖs capacity for the EV battery component by nearly fivefold to over 200,000 tons in 2025.

EcoPro BM Co., a domestic battery materials maker, said in a regulatory filing on May 26 that it will spend 134 billion won to build a new factory to manufacture anodes, close to its first plant in Pohang, North Gyeongsang Province.

When the new plant with an annual production capacity of 28,800 tons comes on line, EcoProŌĆÖs capacity is set expand to 180,000 tons by 2024 from 61,400 tons a year now.

Lotte Chemical Corp. also said it will invest 210 billion won to build new facilities for battery materials.

Write to Jae-Kwang Ahn at ahnjk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Listed firmsŌĆÖ earningsKorean firms emerge triumphant from pandemic with record Q1 profits

Listed firmsŌĆÖ earningsKorean firms emerge triumphant from pandemic with record Q1 profitsMay 21, 2021 (Gmt+09:00)

3 Min read -

EarningsPOSCO revises up sales target after Q1 profit rises to 10-year high

EarningsPOSCO revises up sales target after Q1 profit rises to 10-year highApr 26, 2021 (Gmt+09:00)

3 Min read -

EV battery materialsPOSCO's lithium reserves in Argentina soar to $31 bn

EV battery materialsPOSCO's lithium reserves in Argentina soar to $31 bnMar 04, 2021 (Gmt+09:00)

2 Min read -

M&AsSK E&S to sell 49% stake in city gas businesses; valued over $900 mn

M&AsSK E&S to sell 49% stake in city gas businesses; valued over $900 mnFeb 03, 2021 (Gmt+09:00)

3 Min read -

Battery materialsPOSCO aims for top spot in EV battery materials market

Battery materialsPOSCO aims for top spot in EV battery materials marketDec 03, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN