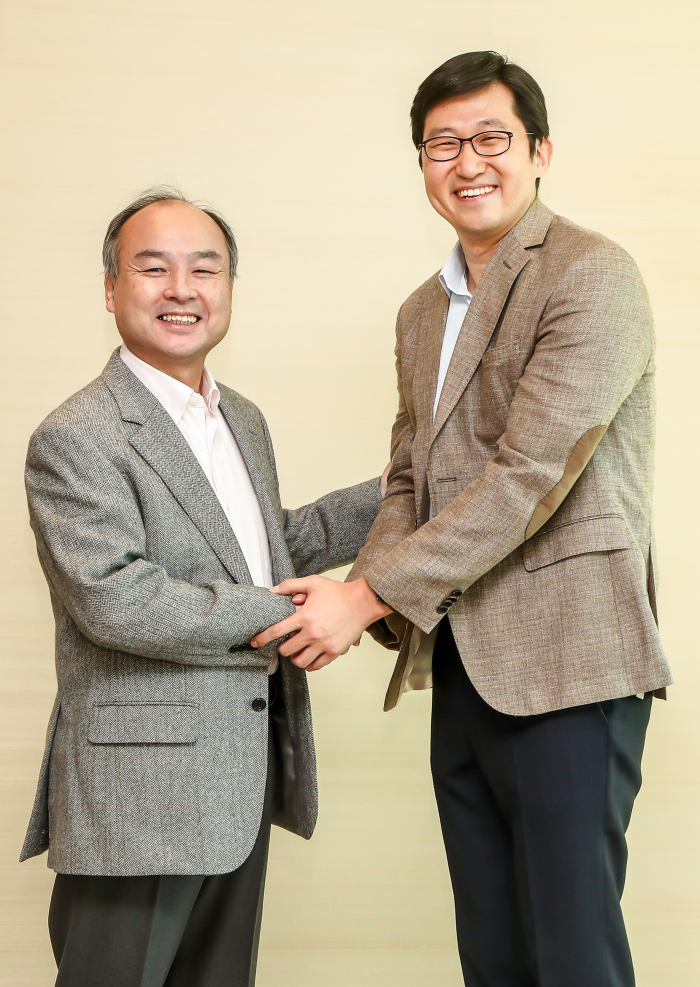

Masayoshi Son-led SoftBank to invest $2 bn in Yanolja

Japanese billionaire taps travel app as next Coupang

By May 26, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Vision Fund, led by billionaire SoftBank founder Masayoshi Son, has decided to invest around $2 billion in South Korea's largest travel platform Yanolja, double the previously reported amount, according to investment banking sources on May 26. Now, the world's largest venture capital firm is putting the finishing touches on the deal.

With the backing of Vision Fund, Yanolja will expand its business through M&As and seek a US listing as early as 2023, aiming to become the next Coupang Corp., which made a spectacular debut on the New York Stock Exchange in March this year to raise a more-than-expected $4.6 billion.

The pending investment will pave the way for the travel app's existing shareholders, including Singapore's sovereign wealth fund GIC, US online travel agency Booking Holdings Inc. and VC firms, to exit with handsome gains.

On the condition that all the previous investors sell their holdings in Yanolja to Vision Fund, the Japanese VC firm will spend $1 billion buying the existing shares and another $1 billion in subscribing to new issues.

Their assessed valuation on the travel app is in the 10 trillion won ($9 billion) range, a tenfold surge since Yanolja attained unicorn status in 2019 with a valuation of over 1 trillion won.

Upon completion of the deal, Vision Fund will hold a 25-30% stake in the Korean travel app, which offers booking services for accommodations and leisure activities, as well as transport ticketing.

Currently, GIC and Booking Holdings control a combined 35-40% stake in the travel app after they poured $180 million in aggregate into Yanolja.

Other investors include Partners Investment, Murex Partners, Aju IB Investment, SBI Investment, SL Investment and SkyLake Investment.

NEXT COUPANG?

The fresh funding will mark the largest single investment in a Korean startup since Vision Fund injected $2 billion into Coupang, the country's No. 2 e-commerce platform, in 2018.

In total, the massive VC vehicle pumped a combined $3 billion into Coupang between 2015 and 2018 when the loss-making online platform was valued just at $5 billion and $9 billion, respectively.

Vision Fund is believed to pocket heavy returns following the latter's US listing, which valued the online retailer at $63 billion, a sevenfold jump in less than three years.

Coupang's 2018 enterprise value is almost equal to the current estimation for Yanolja.

One difference between the two startups is that Coupang was in cumulative losses of close to 2 trillion won when it was valued at $9 billion in 2018. By contrast, at the same valuation, Yanolja turned to an operating profit for the first time since its inception in 2005.

Last year, Yanolja posted its first-ever operating profit, despite the pandemic-caused slump in the travel and tourism industry. Its 2020 operating income came to 16.1 billion won, versus a 6.2 billion won shortfall a year earlier. Revenue surged 43.8% year-on-year to 192 billion won on a standalone basis.

EYES ON GLOBAL MARKET

Between 2018 and 2019, Yanolja acquired Southeast Asia's No. 1 hotel chain ZENRooms and India-based eZee Technosys, the world’s No. 2 hotel housekeeping service provider.

The funding is expected to accelerate Yanolja's planned IPO. Seeking to achieve a higher valuation than the estimated 3 trillion-4 trillion won for a domestic listing, the travel app has set its sights on a US listing.

Yanolja expects its enterprise value to exceed 10 trillion won once it lists in the US, or one-tenth Airbnb's market capitalization of 131 trillion won. Yanolja's sales represent one-tenth of the US vacation home rental company's sales.

Write to Chae-yeon Kim at why29@hankyung.com

Yeonhee Kim edited this article.