Foundry business

Korean foundry firm DB HiTek sets new Q1 sales record

By May 17, 2021 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

South KoreaŌĆÖs foundry company DB HiTek Co. has reported the highest quarterly revenue since its establishment in 1997.

The companyŌĆÖs regulatory filing on May 14 posted this year's first-quarter revenue at 243.7 billion won ($215 million). While its quarterly operating profit was down by 6% from the same period last year to 60.6 billion won ($53.5 million), the market is retaining a positive outlook as the decline was due to a technical adjustment in depreciation. ┬Ā

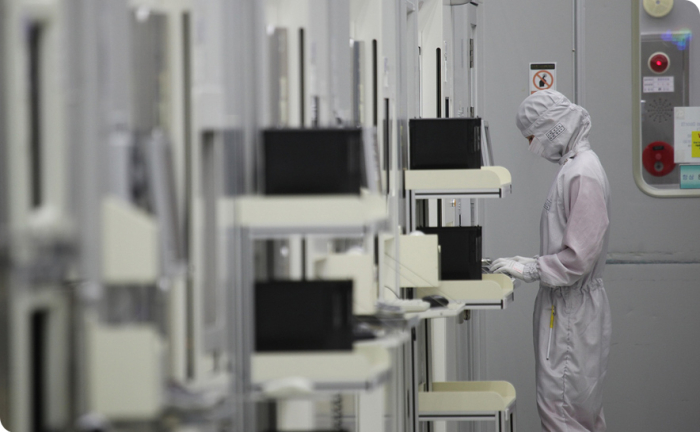

ŌĆ£The demands for our display driver IC, power management IC and image sensor products are constantly rising. We are operating our plants at full capacity,ŌĆØ said a DB HiTek representative.

Market analysts say that DB HiTekŌĆÖs strong performance is likely to continue for at least three more years, as automobiles and electronic devices with more advanced technology must use a greater number of non-memory chips produced by the foundry companies. ┬Ā┬Ā

DB HiTek, the countryŌĆÖs first foundry company, is currently regarded as one of the ŌĆ£game changersŌĆØ amid the ongoing global chip shortage, after successfully coming out of a long period of losses from 1997 to 2013. The company also faced a serious liquidity crisis in 2014 and tapped external parties for acquisition without success. ┬Ā

ŌĆ£It was a big mistake that we decided not to acquire DB HiTek back in 2014, when the asking price was only around 200 billion won ($177 million),ŌĆØ said an executive of a leading Korean semiconductor company.

DB HiTekŌĆÖs market capitalization in May has stayed around 2.5 trillion won ($2.2 billion), more than 12 times the asking price in the middle of the companyŌĆÖs liquidity crisis in 2014.

The company says its painful efforts in streamlining the business as well as its continued R&D investment of around 100 billion won ($88 million) every year proved fruitful. ┬Ā

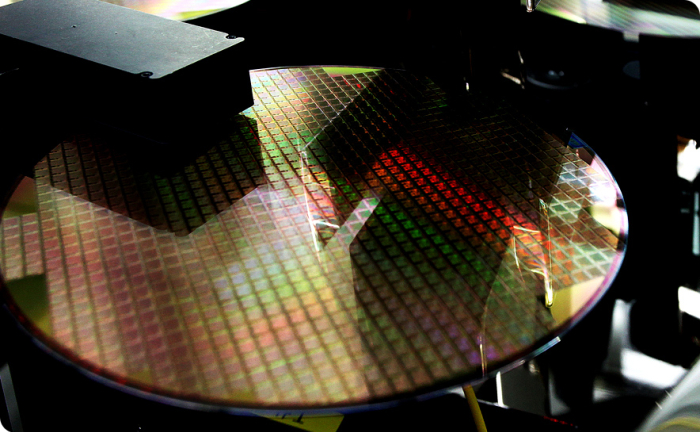

Industry insiders add that DB HiTekŌĆÖs representative 200 mm wafer products mainly drove the companyŌĆÖs long-awaited turnaround.

The 200 mm wafers, which were commonly used starting from the 2000s into the early 2010s, are smaller and cheaper to make than the 300 mm wafers used for more technologically advanced manufacturing processes. The worldŌĆÖs leading companies such as Samsung Electronics Co. and TaiwanŌĆÖs TSMC focus on manufacturing the 300 mm wafers. ┬Ā┬Ā

On the other hand, the 200 mm wafers are used to make products that do not require such an advanced, nano-level manufacturing process. For instance, low-definition image sensors, power management integrated circuits (PMICs) and display driver integrated circuits (DDIs) mainly use 200 mm wafers in their production.

Working together with small and medium-sized fabless companies, DB HiTek has been producing a wide range of image sensors, PMICs and DDIs. DB HiTekŌĆÖs range of products has seen a rapid rise in demand as multiple industries that use a large number of semiconductor chips, including the global auto segment, are showing signs of recovery.

ŌĆ£We will continue to expand the portfolio of more technologically advanced products that can outperform the competition. Existing products will also strengthen their competitive edge,ŌĆØ said DB HiTek CEO and Vice Chairman Choi Chang-sik.

Write to Hyung-suk Song at click@hankyung.com

Daniel Cho edited this article.

More to Read

-

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial plan

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial planMay 13, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix co-vice chairman hints at expanding foundry business

Foundry expansionSK Hynix co-vice chairman hints at expanding foundry businessApr 22, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN