Heated shopping platform M&As shake up fashion industry

By May 10, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

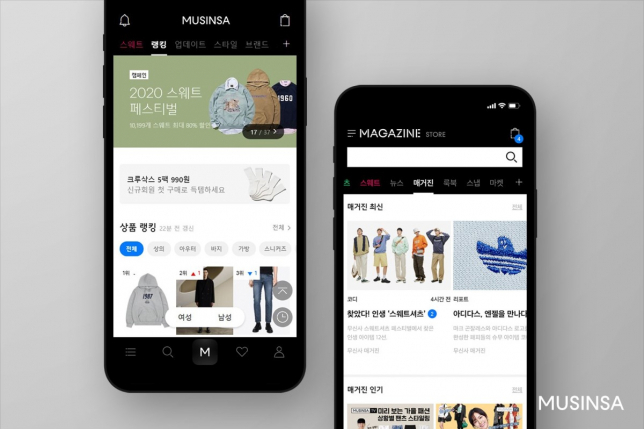

South Korea's fashion industry is all shook up following the No. 1 online fashion platform Musinsa's decision to acquire 29CM, the country’s second-largest women’s fashion platform, in a move to boost its competitiveness in women's fashion and to reinforce its lead in the market.

The deal is valued at around 300 billion won ($269 million) -- the first M&A deal to be carried out by Musinsa with a price tag of hundreds of billions of won.

The acquisition comes after retail giant Shinsegae Group's e-commerce arm SSG.COM announced plans to buy the No. 1 women's fashion platform W Concept last month to challenge Musinsa and to shake up the online fashion scene.

In fact, many platform giants have been moving to overtake Musinsa via M&A deals. In addition to Shinsegae, the country's top mobile messaging app operator Kakao Corp. dropped its bid for eBay Korea to acquire a majority stake in Zigzag, a fashion platform targeting teenagers and twentysomethings.

W CONCEPT ADDS FUEL TO FIERCE M&A COMPETITION

It was W Concept that triggered the series of M&A deals in the fashion industry. Over the past few years, the platform had been considered for sale repeatedly until it eventually found a new home in Shinsegae last month -- firing up the M&A competition.

Shinsegae acquired W Concept for 265 billion won from IMM Private Equity, which purchased an 80% stake in the fashion platform for 60 billion won ($54 million) in 2017. Four years after its investment, IMM PE made a lucrative exit -- securing over 400% in profit.

According to the M&A industry, Musinsa had been one of the finalists in the bid to acquire W Concept but lost to Shinsegae Group, which proposed a higher price.

For Shinsegae, W Concept was an extremely attractive asset since its key customers were women in their 20s and 30s with strong purchasing power. Also, the fashion platform offered a wide range of brands that would create synergy with the group's offline retail networks.

HIT OR MISS? FASHION INDUSTRY IN THE HANDS OF WOMEN IN 20s & 30s

Fashion-tech firms, such as Zigzag, Brandi and Ably, began to attract investment capital thanks to their rapid growth. Last year, fashion app Brandi secured 10 billion won from platform giant Naver Corp. while Ably received 3 billion won from Shinsegae's corporate venture capital fund, Signite Partners.

The fashion apps' forte is its rich pool of millennial and Gen Z customers -- collectively known as MZers -- especially female shoppers. Platforms that have secured female MZers as consumers are highly valued given that their spending power is likely to increase when they reach their 20s and 30s.

They also offer the latest fashion trends, affordable prices, AI-powered curation services and convenient shipping options, such as same-day delivery.

These factors prompted Musinsa to chase 29CM just a month after it lost the W Concept bid to Shinsegae.

Musinsa launched a women's clothing platform, Wusinsa, in 2016 -- but the company's customer base remained heavily tilted towards male consumers who accounted for 80% of its users.

By acquiring StyleShare and 29CM, Musinsa would be able to enhance its women's fashion operations and secure female customers.

MUSINSA ADOPTS 'BRAND PLATFORM' AS COMPANY IDENTITY

The company found it crucial to create an identity as a "brand platform," especially as it was aiding overseas expansion for brands listed on its platform. Also, Musinsa's emphasis on brand clothing stemmed from the level of contribution to sales.

“Shopping malls that focus on non-brand apparel will set the price about 1.2 times or 1.5 times higher than the production cost, but brand apparel prices are set on average three to four times higher than the production cost,” said a fashion industry official.

As of the end of March this year, there are over 6,000 brands available on Musinsa’s platform and around 8.4 million users.

ON THE HUNT FOR THE 'NEXT MUSINSA'

Musinsa became the country’s 10th unicorn company in 2019, and now, the company is looking for the "next Musinsa," to create a virtuous cycle in the fashion industry -- a company mission steered by its chief executive Cho Man-ho.

In 2018, the company set up a VC firm, Musinsa Partners, to unearth and cultivate fashion brands. So far, the company has invested in a variety of brands such as Andersson Bell, National Geographic and Covernat alongside co-investing with other investors.

In its growth stage, Musinsa also received funding from investors including Korea Investment & Securities, LB Investment and IMM Investment.

WHAT’S NEXT FOR THE FASHION INDUSTRY?

The ongoing M&A deals have drawn attention to how they will change the domestic fashion industry. All of the fashion-tech platforms have unique traits and companies acquiring them also have different reasons for seeking after them.

But the ultimate goal is the same: to gain footing in the e-commerce industry by securing loyal and precious consumers -- the trend-sensitive MZers who are active fashion platform users.

Moving forward, the fashion industry is expected to face intensified competition across various issues such as MZ customers, brand versus non-brand products and the use of big data systems. It's clear that the online shopping industry will continue to enjoy sharp growth.

According to Korea Information Society Development Institute, the domestic online shopping market was valued at around 133.1 trillion won in 2020. This year, the market is expected to stand at 159 trillion won and reach near 190 trillion won in 2022.

Write to Ji-hye Min and Chae-yeon Kim at spop@hankyung.com

Danbee Lee edited this article.

-

ShoppingFashion platforms for MZers attract investors; valuations surge

ShoppingFashion platforms for MZers attract investors; valuations surgeApr 21, 2021 (Gmt+09:00)

2 Min read -

[Exclusive] E-commerceKakao to buy fashion app, pushing aside eBay Korea

[Exclusive] E-commerceKakao to buy fashion app, pushing aside eBay KoreaApr 08, 2021 (Gmt+09:00)

3 Min read -

-

Fashion startupOnline fashion platform Musinsa raises $115 mn from VC firms

Fashion startupOnline fashion platform Musinsa raises $115 mn from VC firmsMar 16, 2021 (Gmt+09:00)

1 Min read -

Fashion platformsS.Korea's online fashion platform eyes global expansion

Fashion platformsS.Korea's online fashion platform eyes global expansionJan 21, 2021 (Gmt+09:00)

2 Min read -

Fashion appsFashion platforms Musinsa, Zigzag hit jackpot thanks to Gen Zers and millennials

Fashion appsFashion platforms Musinsa, Zigzag hit jackpot thanks to Gen Zers and millennialsDec 01, 2020 (Gmt+09:00)

3 Min read