Lifted short sale ban blamed for Korea ETF redemption

May 07, 2021 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

S.Korea's LS Materials set to boost earnings ahead of IPO process

HYBE to fire NewJeans agency CEO; Min refutes accusation

Louis Vuitton, Chanel, Dior post weak profits in Korea post-pandemic

Microsoft CEO to meet with Samsung, SK Hynix, LG, SK Telecom chiefs

The lifting of South Korea's short-selling ban on large-cap stocks on Monday could be blamed for the recent heavy outflows from US-listed exchange-traded funds (ETFs) focused on Korean equities, analysts said.

Following the 14-month ban, in effect since March 2020 when the global pandemic sent stock markets tumbling, South Korea has now allowed the resumption of short selling, or selling borrowed shares betting on a price drop, on stocks on the benchmark Kospi 200 Index and the junior Kosdaq 150 Index from May 3.

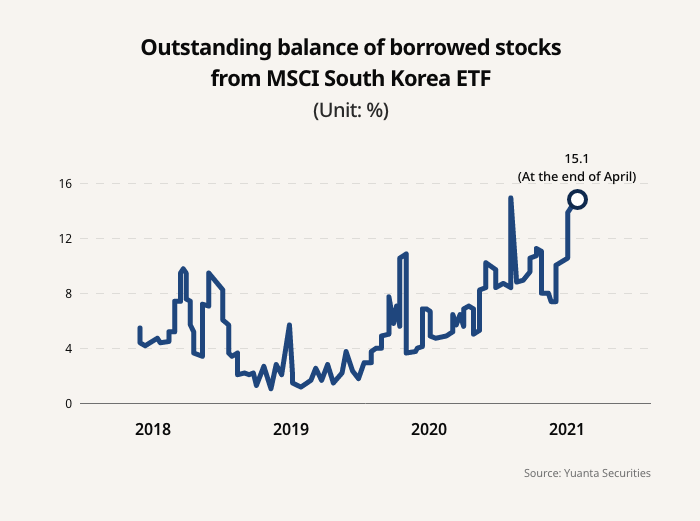

During the short sale prohibition, foreign investors were believed to have used South Korea-focused ETFs traded in the US to short Korean stocks, according to Yuanta Securities analyst Koh Gyeong-bum. Now that the short sale ban has been lifted, they no longer need to depend on the ETFs for short selling.

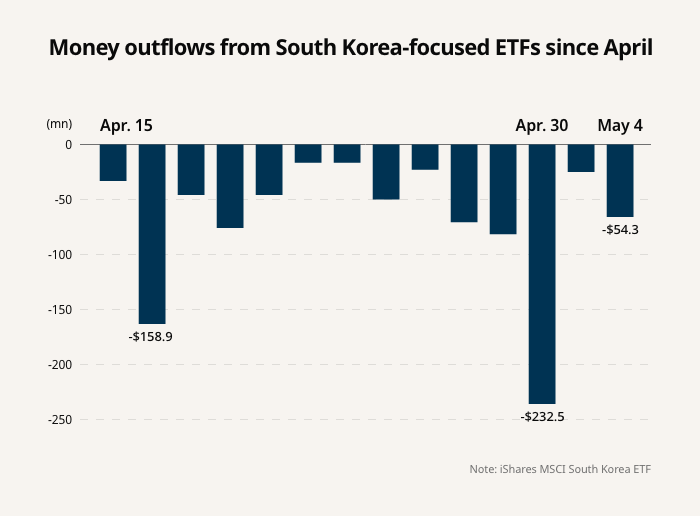

The iShares MSCI South Korea ETF, the largest among three South Korea stock market-tracking ETFs, suffered net outflows totalling $935.3 million from the third week of April through May 4, according to Yuanta Securities. In April alone, the ETF saw the highest per-month outflow of 960 billion won ($856 million) since its launch.

Their withdrawals from the largest Korea-focused ETF contrasted with over 700 billion won inflows into the ETF between November and December 2020, helping the benchmark Kospi break through the 3,000 points for the first time.

In January and February of this year, over 100 billion won had been funneled into the South Korea ETF.┬Ā

"Foreign institutional investors' selling of (South Korea) ETFs reached an unprecedented level," said Koh of Yuanta. "Their redemptions seem to reflect subdued demand for the ETFs as a means of short selling, along with the lifted short-selling ban."

Since short selling on Korean stocks was banned in March 2020, foreign institutional investors borrowed stocks included in the Korea-focused ETFs, according to Koh. Unlike individual investors, institutional investors are allowed to borrow a basket of stocks from an ETF, short some of them and buy them back to return to the fund.

On the first trading day following the lifting of the short sale ban, foreign investors shorted 1 trillion won worth of Korean stocks, centering on biotech, rechargeable batteries and transportation companies, all stocks individual investors had bought into heavily. Celltrion Inc., LG Display Co. and the Kosdaq-lised Seegene Inc. topped the list of foreign short selling on May 3 alone.

By Ji-Yeon Sul

┬Āsjy@hankyung.comYeonhee Kim edited this article.

-

Foreign investorsForeigners return to Korean market; Kosdaq at near 21-year high

Foreign investorsForeigners return to Korean market; Kosdaq at near 21-year highApr 12, 2021 (Gmt+09:00)

2 Min read -

Short-selling resumptionKorea to lift short-selling ban on large stocks; retail investors resist

Short-selling resumptionKorea to lift short-selling ban on large stocks; retail investors resistFeb 04, 2021 (Gmt+09:00)

2 Min read -

Korean govt extends ban on short selling to appease retail investors

Korean govt extends ban on short selling to appease retail investorsAug 27, 2020 (Gmt+09:00)

3 Min read