Foldable devices

Kolon to supply CPI film for XiaomiŌĆÖs foldable phone

By May 03, 2021 (Gmt+09:00)

2

Min read

Most Read

South KoreaŌĆÖs chemical and textile company Kolon Industries Inc. will supply its patented colorless polyimide (CPI┬«) film for XiaomiŌĆÖs first ever foldable smartphone, Mi Mix Fold.

The Chinese makerŌĆÖs foldable smartphone will be equipped with KolonŌĆÖs trademarked film, according to the South Korean company on May 3.

Xiaomi targets producing 30,000 devices of Mi Mix Fold as the first batch, with a total annual volume of 500,000 devices. Mi Mix Fold is priced at 9,999 Chinese yuan ($1,500), deemed a reasonable price for a foldable smartphone.

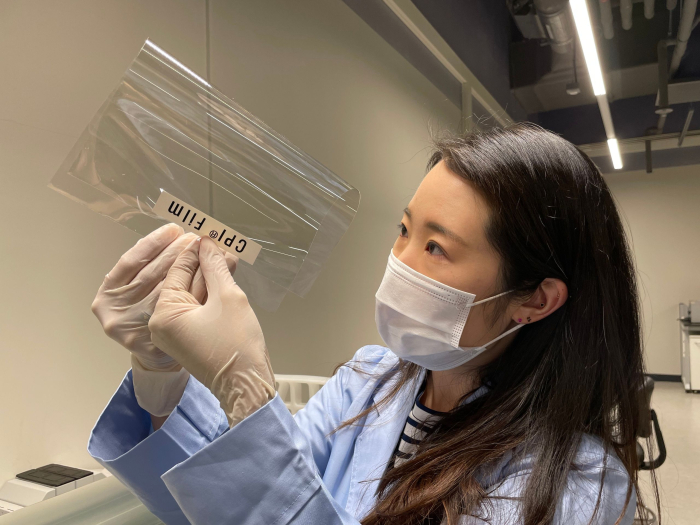

The CPI® film is a thin, transparent plastic film used as the display cover window of the electronic device for protection.

Kolon Industries succeeded in mass production of CPI® film, specialized for use in foldable devices, in 2019 and currently holds around 90% share of the global film market for cover devices on electronic devices.

Most of the leading Chinese high-tech brands such as Xiaomi and Lenovo are clients of its CPI® film, due to higher durability and a cheaper price versus glass-based cover windows.

Demand for KolonŌĆÖs CPI┬« film is expected to rise further with Chinese manufacturers competitively launching foldable devices one after another.

Huawei has already launched its Mate X series, while Oppo and Vivo are also planning to join the competition. Lenovo, which is using KolonŌĆÖs CPI┬« film on its first foldable PC, will soon develop a next model in its lineup. ┬Ā

According to the market research firm Display Supply Chain Consultants (DSCC), the market size for foldable displays will grow from 3.3 million devices this year to 41.1 million devices in 2024.

Kolon Industries said sales of its CPI® film are projected to grow at an average annual rate of 60% until 2024.

On May 3, the company also posted its first-quarter earnings, with operating profit growing by 160.3% from the same period last year to 69.1 billion won ($61.5 million), and its revenue growing by 10.2% to 1.09 trillion won ($970 million).

Kolon said the earnings surprise was largely due to performance improvements in its film and electronic materials segments.

Its tire cord business is also thriving, having received more orders than its maximum production capacity due to the rising demand. The company has technical expertise in making nylon tire cords that contain aramid, often referred to as the ŌĆ£super fabricŌĆØ for its strength and insolubility even in high-temperature environments. ┬Ā

The company also said that its fashion business, hard hit by the pandemic in 2020, is showing signs of recovery.

ŌĆ£Our golf apparel brands like WACC are showing sharp growth in sales. Our online channel is also rebounding. We expect a positive turnaround in our fashion segment this year,ŌĆØ said a Kolon Industries official.

Write to Jae-kwang Ahn at ahnjk@hankyung.com

Daniel Cho edited this article.

More to Read

-

BiodegradablesSK, Kolon tie up on biodegradable plastic production

BiodegradablesSK, Kolon tie up on biodegradable plastic productionApr 07, 2021 (Gmt+09:00)

2 Min read -

Foldable devicesKolon to supply display film for world's first foldable PC

Foldable devicesKolon to supply display film for world's first foldable PCApr 05, 2021 (Gmt+09:00)

2 Min read -

Hydrogen economyKolon Industries to mass produce key material for fuel cells

Hydrogen economyKolon Industries to mass produce key material for fuel cellsNov 19, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN